By Granted Consultancy, partners of Swoop. Granted Consultancy specialises in unlocking non- dilutive funding for ambitious innovative companies who are looking to accelerate the commercialisation and development of new products, services and technologies.

What are the benefits of grant funding?

Grant funding has the ability to unlock projects and significantly accelerate project timeframes. There are two main types of grants – Capital/Business Growth grants and R&D grants.

Using Business Growth grants enables bigger, more impactful projects to be realised by covering capital expenditure e.g. buildings or machinery, with project success often being predicated on job growth.

Research and Development (R&D) grants allow a significant reduction in an innovative product’s time to market, beating the competition and establishing first-to-market status. This can have a pronounced impact on your business through the increase of commercial returns and subsequent business growth.

Grants are typically provided in arrears (i.e. you have to spend the money first and then reclaim, normally quarterly) and have varying “intervention rates”. An intervention rate is the amount of funding a grant will provide. For Business Growth grants this is normally 20-50% of the total project costs and for higher risk R&D grants normally 50-100%.

Other benefits of grant funding include:

- No Debt – ensuring you don’t have to provide security for the funding received

- No Equity Requirements – ensuring you retain control

- Access to Partners – funding may cover the costs of academic and commercial experts and attract renowned organisations

- Transformative Impact – with amounts typically between £50k and £4m and at an intervention rate of 30-100%

- Attractive to Investors – acting as validation and reducing risk

- External Validation – via a competitive process that has been scrutinised

Are there any downsides to consider?

Although grant funding can facilitate significant company growth, it is also important to consider the downside. Grant funding is high-risk high-reward so it is important to consider if this style of funding is suitable for your company.

Other downsides to grant funding to consider:

- Competitive

- Time consuming

- Paid in arrears

- Bureaucratic

- Match funding often required

What type of businesses are eligible for grant funding?

Business Growth grants are highly location dependent and typically aimed at sectors such as manufacturing, where investment in machinery has a straightforward correlation to job growth.

The main focus when applying for R&D grant funding should be on the outputs of a defined project. Of course elements of wider business suitability play a part (such as sector, size and age of company), but the project has to be innovative. You could be the most innovative company but if your project is seen as simply iterative development with no market disruption it will decrease the likelihood of R&D grant funding success.

There are typically four categories for assessing project eligibility:

Innovation

- Are you undertaking research and development?

- Is your project novel, disruptive and innovative?

- Does your project have wider economic, social and environmental impacts?

Scalable

- Does your project have high growth potential?

- Does your project have export potential?

- Does your project have a strong commercial case?

Funding

- Are you seeking feasibility funding (typically £100k-325k), or prototyping and testing (typically £100k-£5m)?

- Are you looking to access UK or EU grants?

- Does the funding you are seeking align with the project outputs?

Business

- Does the project team meet the eligibility criteria (i.e. often projects must be led by an SME)?

- Will the work be carried out in the eligible territory (typically aligned to the funder, i.e. UK, EU)?

- Have you proved the concept and protected the IP to date?

How do I know when is the right time to apply for grant funding?

It is important to keep in mind that grants are not a quick fix, which is why you need to assess whether the timing is right for your company.

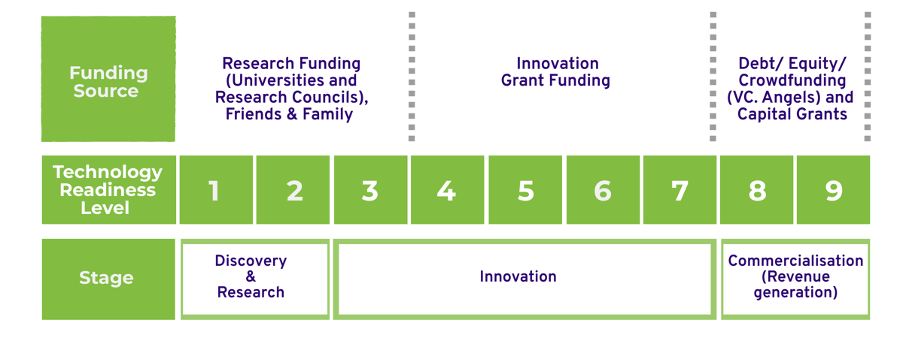

Technology Readiness Levels (TRLs) are a method for estimating the maturity of technologies during the acquisition phase of a program, developed at NASA during the 1970s. The TRL can help you to assess what stage your project is at and therefore the type of funding that will be most suitable, helping you to work out the “right” time to apply for funding.

One thing that is certain is that the worst time to apply for a grant is 2 days before the deadline! We would recommend to start drafting at least 6 weeks before the deadline.

What does the application process typically look like?

As a guide, it typically takes between 9-12 months from engaging with Granted Consultancy to first drawdown of grant funds, taking into account finding the right funding competition, developing the application, waiting during the assessment window, progressing through due diligence and then completing project kick off.

We advise our clients to leave 6 weeks to develop a full grant funding application to allow plenty of time for reviews and edits to make sure the application is at the highest possible standard by deadline day. Post-submission it typically takes 1.5-3 months, depending on which funding competition you are applying for, to find out whether or not you were successful, due to the rigorous assessment process. Once you have received the outcome of your application you will still not receive funds just yet; R&D grants funds are paid in arrears so typically you won’t receive any money until the end of the first quarter.

Looking ahead to 2021, what are the grant competitions to be aware of?

Capital Investment Funding for Business Growth

With the recent announcement of the spending review, the Government has committed to £100 billion of capital investment with the aim to kick start growth and support job creation. This suggests an increase in Business Growth funding competitions for businesses who have suffered the effects of COVID-19 or are critical to economic recovery.

Typically Business Growth grants subsidise the cost of capital items such as buildings, extensions, equipment, machines, etc. They can also support operational costs such as recruitment and business planning. Typical intervention rates (i.e. the amount of a project cost that is grant funded) are between 20-50%.

Research and Development Funding for Innovation

Innovate UK is the main funding body for commercial innovation projects in the UK, funding numerous projects in a variety of industry sectors. Typically Innovate UK release their funding competitions 2-3 months before the competition deadline, so try to fit regular grant funding landscape scanning into your workload or find a reliable expert to do it for you.

Innovate UK Smart Grants

One competition to look out for is Innovate UK Smart Grants. The Smart Grant is Innovate UK’s ‘Open’ grant funding programme seeking the best game-changing and commercially viable innovative or disruptive ideas from almost any industry. This competition typically runs 3-4 times a year with projects costs ranging from £25,000 to £2 million. However competition can be fierce (public success rates show that typically only around 5% of all submissions are successful), so be sure to get the right advice to give you the best chance of winning.

Why use a Grant Funding Consultancy?

There are many different factors that will improve your chance of grant funding success; a grant funding consultancy will know where to find suitable funding, how to access it successfully and how to use it to best effect. We allow you to focus on your business, saving your time, while we write the grant application for you.

A good consultancy will have pertinent sector expertise, the ability to upskill at pace in new technologies, and experience of working with companies of all sizes, from startups to multinationals. We are delighted to have launched a strategic partnership with Swoop, utilising our grant writing expertise to maximize your chances of grant funding success.

yet? Register here!

yet? Register here!