In partnership with

The hassle-free way to serve your clients with funding

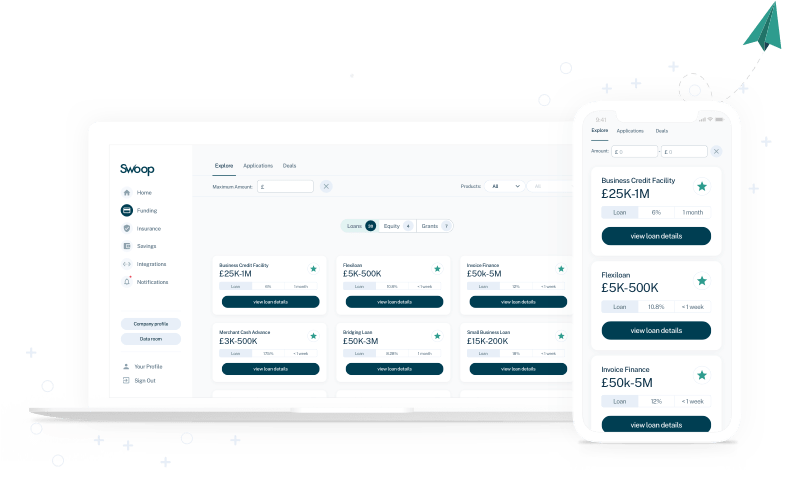

OmniPro’s partnership with Swoop makes it fast and easy to find funds for your clients’ businesses.

Search bespoke options across loans, equity finance and grants; you can even save your clients on business costs including FX, energy, banking and more.

Advisors

Businesses

Simple, secure and speedy

Compare, access and secure tailored funding and savings opportunities for your clients all in one place. A team of experts is readily available to support and guide you throughout your journey.

Book a demo and see how much extra value you could unlock for your clients today.

How Swoop Works

Apply for funding and savings solutions quickly and easily

Get started

Tell us a bit more about your business and funding requirements.

Get matched

We’ll fetch you tailored funding across loans, equity finance and grants, as well as savings opportunities.

Get funding and savings

Review your options and apply for a product online in minutes.

What finance solutions would you like to explore?

Start discovering some of the funding and savings opportunities available on Swoop

Commercial mortgages

Funding to help you expand your business or investment property portfolio

Get started

Innovation grants

Provided by a variety of funding bodied such as Innovate UK to support innovative ideas and business growth, including those from the UK’s world-class research base

Get started

Local Enterprise Partnerships (LEPs)

Voluntary partnerships between local authorities and businesses that provide business funding, support and guidance to their local areas

Get started

R&D tax credits

Cash payments from the government to encourage companies to carry out research and development projects that relate to science or technology

Get started

Business Current Accounts

Tired of being overcharged and underserved on your business bank account? Ensure you’re getting the best deal with our quick and simple comparison tool.

Get started

International payments (FX)

UK businesses are overcharged by approximately £4bn per year on foreign currency exchange rates. On average our customers save up to £8,000 a year by using our FX savings analysis tools. You can too.

Get started

Business Insurance

Most business owners don’t realise they can be liable for a whole range of accidents and issues, even if they seem unfair. With tailored insurance you can build a level of cover to protect against the specific risks your business faces.

Get started