In partnership with

Suddenly, finding funding is straightforward and hassle free.

Sage has partnered with Swoop to take the hassle out of finding funds to grow your business, allowing you to search tailored options across loans, equity finance and grants. Whether you’re after an SBA loan, funding to grow a franchise, need heavy machinery, or even want to acquire a business, Swoop’s got you covered.

Advisors

As accountants and advisors are called on to help their clients grow – Swoop will work with you to discover the right funding solutions across debt, equity finance and grants.

Businesses

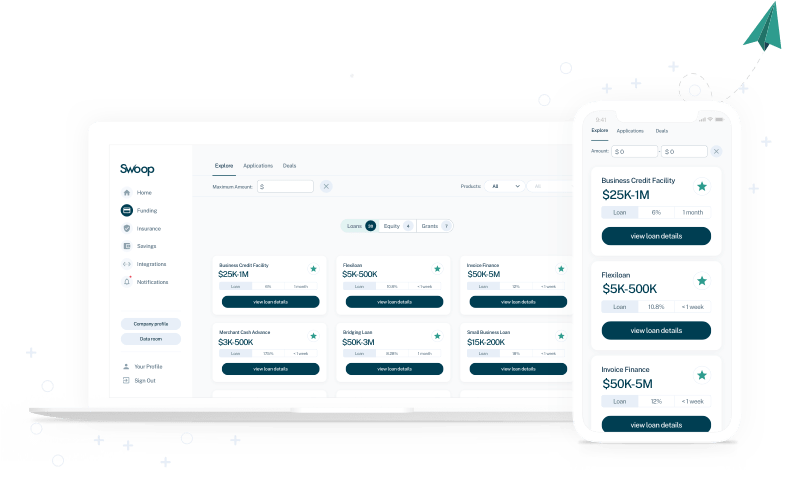

Simply register to access your personal dashboard where you can view your funding and savings options and manage applications.

Sole traders

The Sage partnership does not cover sole traders. You can progress to create a Swoop account as a sole trader, this will not be associated with Sage.

Simple, secure and speedy

Compare, access and secure tailored funding and savings opportunities for your business, all in one place. A team of experts is readily available to support and guide you throughout your journey.

Simply create your free account today to get started.

How Swoop Works

Apply for funding and savings solutions quickly and easily

Get started

Tell us a bit more about your business and funding requirements

Get matched

We’ll fetch you tailored funding, across loans, equity finance and grants, as well as find savings opportunities from our providers

Get funding and savings

Review your options and apply for a product online in minutes

What finance solutions would you like to explore?

Start discovering some of the funding and savings opportunities available on Swoop

Commercial mortgages

Funding to help you expand your business or investment property portfolio

Get started

International payments (FX)

US businesses are overcharged by approximately $4bn per year on foreign currency exchange rates. On average our customers save up to $8,000 a year by using our FX savings analysis tools. You can too.

Get started

Simple, secure and speedy

Access the money and services you need to grow your business

© Swoop 2021