TABLE OF CONTENTS

The deals you can get from lenders depend on your credit score: the better your score, the cheaper it is to borrow.

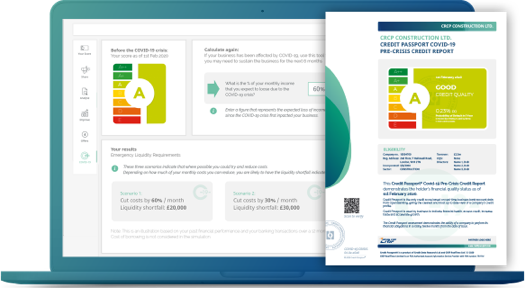

Swoop has joined forces with South Africa’s leading credit bureaus to rate your business’ credit. The service is free and does not affect credit scores, unlike credit checks and failed loan applications which can harm your reputation.

Register with Swoop and enter your business’ details. Already registered? Great, we’ll have all the information we need, and you’ll get an answer in just a few clicks.

You’ll get a quick overview of your business’ credit health using the traffic light system – green, amber, and red, as well as a ‘probability of default’ as a percentage.

Need more information? Purchase a detailed detailed credit report, including tangible actions you can take right now to improve your business’ credit .

Applying doesn’t affect your credit score

You are in complete control of your data

No credit card required

A word from Andrea

"A good credit score will get you a better deal on financial products, saving you money and helping to build your reputation as a business. If your business credit score needs improving, we can offer guidance on the best way to build this, to solidify your position in the industry and help set you up for growth."

Business credit scores provide a snapshot out of 100 of the financial health and creditworthiness of an organisation - calculated by measuring payment and default history, levels of debt, legal problems, riskiness of the customer base and even the type of industry the company operates in. Banks, major suppliers, and commercial lenders will check a business’s credit score to understand the financial position of the company and its level of risk. Typically, higher scores increase an organisation’s borrowing options and reduce the rates they pay. Lower scores reduce the business’s loan options and increase the costs they pay.

Every registered business in South Africa, from SME’s to sole traders has a credit score – but few business owners have checked their score and many have no idea what goes into it. They may only become aware of their credit score when they apply for a business loan or other form of credit, and then they may be disappointed with the results. It is important to know your business’s credit rating before applying for any type of borrowing. You can do this without paying a fee by obtaining your free business credit health check now by registering with your business with Swoop.

Everyone knows their personal credit score can affect their ability to secure a mortgage, lease a car, secure lending, open a mobile phone account, or even buy electricity and gas on credit. Business credit scores carry the same type of weight. They can decide if a business can borrow, if it can obtain supplier credit, if it can lease premises, even if it can secure a major contract. A business’s credit score is central to its success. Good scores may help it flourish, whilst bad scores may see it struggle.

Banks and credit rating agencies model their scores on a business’s behavioural and financial situation. Behavioural factors will include things like does the company pay its bills on time, does it have past or ongoing legal issues, and are there any tax or regulatory problems. Financial factors will include the company’s level of debt compared to assets, any late payment history, the quality of its customer base and how long it takes to collect receivables. Scores may be shown on a numerical scale ranging from 0 to 100, (with 0 being very bad credit and 100 being excellent), or across an alphabetical scale, (with E being very bad credit and A+++ being excellent).

They are primarily used by banks and commercial lenders to support the provision of loans. The lenders’ willingness to supply credit and the rates they charge for those funds will be largely determined by a company’s credit score. Score high and you may see an array of borrowing options at very attractive rates. Score low and you may see few or no funding offers and high costs for whatever credit you can find. Additionally, major suppliers, landlords, utility providers and even large customers may also refer to a company’s credit score before choosing to do business with them.

Business credit scores are measured on a numerical scale, (0 to 100), or on an alphabetical scale, (E to A+++). The latter closely mirrors the economic scoring systems used by global rating agencies such as Moody’s and S&P. A ‘good’ score, which means the business is a good to excellent financial risk, would typically be above 75 on the numerical scale and from A to A+++ on the alphabetical scale.

Banks and rating agencies base their business credit scores on available information – and the more information there is and the more positive it is, the better it is. Having low or no credit history, minimal operating data and hidden activities will always have a negative impact on your business’s score. Follow these steps to build a positive result:

A damaged credit rating can damage your business so it is essential to repair the flaws in your business’s credit score as soon as possible. Unfortunately, as with personal credit scores, the most significant healer of a bad business credit score is time – as negative events fade into history, so they have less impact on your score. However, even if complete repair is a long-term activity, there are still actions you can take today to speed up the process:

More importantly, what score do you need to obtain an economical business loan? Such loans typically enjoy low interest rates and fees. However, they are usually only available for good to excellent risk applicants. This means companies with a credit score over 75, or between A and A+++ on the alphabetical scale. Note that many business loans are still available for organisations with lower scores, (or that have even been rejected on previous loan applications), but they may come at a higher cost to reflect the greater risk involved.

Essentially, business scores and personal scores do the same thing – they reveal the financial health of the borrower. However, anyone trying to directly compare a personal credit score to a business credit score will find themselves frustrated. Unlike the personal scoring system, where a standard risk value is assessed on individuals, business credit scores are assessed on companies by a range of credit agencies, banks, and other lenders. Each assessor will have its own calculation models and their scores are not so freely available for review. Sole traders may also find that their personal credit score is entwined with their business credit score to further complicate the subject. Additionally, while there are government rules to protect individuals from false credit reporting, there are no such rules for companies. This means UK business should regularly check their report is free of errors. Failure to do so could see their credit score mistakenly reduced.

Yes and no. When your business applies for credit, it does so in the name of the company and the application will generate a business credit score that is independent of your personal score. However, many lenders also wish to see the credit worthiness of the company principal and for that, they check your personal credit score. If that score is too low, it could adversely impact your business loan application. Additionally, if you are providing a personal guarantee, or supplying collateral in your name, (such as your home), the lender will certainly review your personal credit report. Lastly, many sole traders merge their business operations with their personal finances. To uncouple this unwelcome combination, lenders will usually seek both business and personal credit scores.

Some organisations charge a fee for providing your business credit score. However, you can check your business' credit health without for free by registering with Swoop. See your business credit score the way lender’s see it. Always free and up to date.

Alastair is South African and has a depth of experience in small business financing and strategy. He has led the launch and development of several successful ventures related to fintech, biotech and agriculture. Alastair studied economics and finance at the University of Cape Town, and then went on to complete his Masters at the University of Edinburgh.

Swoop promise

At Swoop we want to make it easy for SMEs to understand the sometimes overwhelming world of business finance and insurance. Our goal is simple – to distill complex topics, unravel jargon, offer transparent and impartial information, and empower businesses to make smart financial decisions with confidence.

Find out more about Swoop’s editorial principles by reading our editorial policy.

Join the 95,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

Suite 42, 4th Floor, Oriel Chambers, 14 Water Street, Liverpool, L2 8TD

View in Google MapsKingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google Maps35 Bull Street, Lewis Building, Birmingham B4 6AF, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google MapsClever finance tips and the latest news

Delivered to your inbox monthly

Join the 95,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.