We get it, you’re a time-poor business owner with limited understanding of your options when it comes to funding. Swoop takes the hassle out of finding funds to grow your business, allowing you to search tailored options including cash advances and grants. We’ll also help you save on your business costs like energy, banking, and more.

Think of us as your virtual CFO

Global customers (and counting!)

Funding completed

Savings for our businesses

Ever felt like you’re paying too much for your business bank account, credit card, or energy bills? We’ll help you find some of the best deals on the market – we’ve helped customers save over R140m (and counting)!

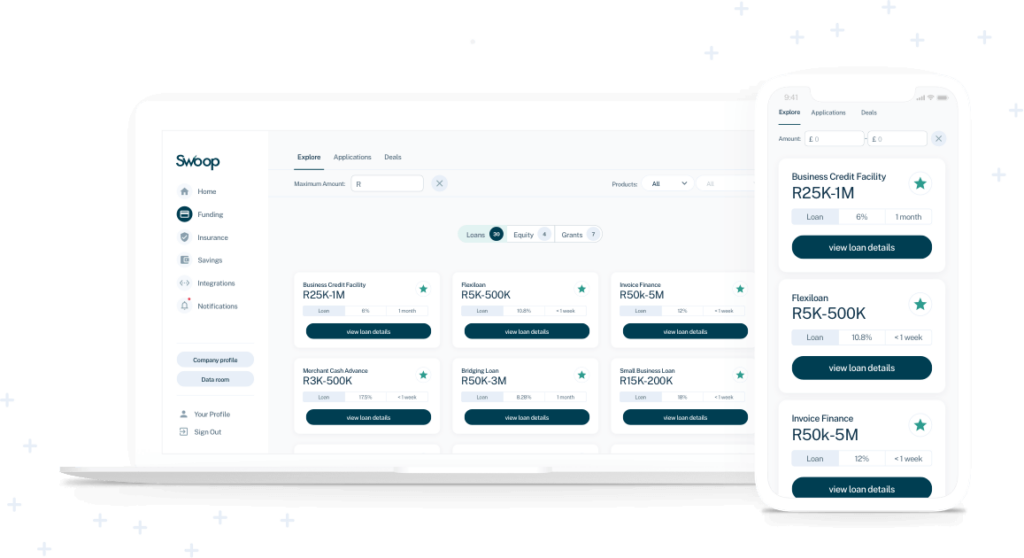

Simply register to access your personal dashboard where you can view your funding and savings options and manage applications.

Watch as our technology matches you with the most relevant solutions across business financing and grants.

Integrate your bank account with Swoop and instantly access your bespoke expenditure and savings report. Start to cut costs immediately.

Keep track of your options as your circumstances change, easily submit your applications, and get updates on your performance and metrics.

Simplicity and security are at the heart of all we do here at Swoop. That’s why we’ve made joining and working with us as safe, simple and friendly as possible. We’ve created smart matching technology (which you can access via our easy-to-use dashboard) and we combine this with real people at the end of the phone. They want to share their financial knowledge and insights with you, and they’ll always put you – and your security – first.

Trusted. We’re a chosen partner to multiple banks and financing partners in South Africa.

Bank-grade security. Your important personal and business information is encrypted and protected with the same industry leading technologies that are used by banks.

Protected. We use measures like double-factor authentication designed to protect access to your account and personal information.

Top marks. We have been chosen to help businesses like yours find the best funding and savings solutions.

We’re recognised globally as a one-stop shop for SMEs. Swoop operates with integrity and works to give SMEs complete and unbiased access to the best management tools and funding providers for their needs.

Founder & CEO, Novus Altair Ltd

APAP

Sknhead

Nimble Babies

Co-founder & Director, Sons

Bua Fit