TABLE OF CONTENTS

Finance the purchase of solar energy to spread the cost over a period, reduce the strain on your cashflow, and beat loadshedding!

South African small businesses can significantly reduce their electricity bills by adopting solar power, as they can generate their own electricity and reduce their reliance on Eskom, leading to long-term cost savings and improved financial stability.

South Africa is especially well-suited to solar energy given the abundance of sunshine and increasing options for low-cost solar energy. In addition to cheaper and more reliable power, solar energy also has environmental benefits, significantly reducing your business’ carbon footprint and contributing to a cleaner and more sustainable future.

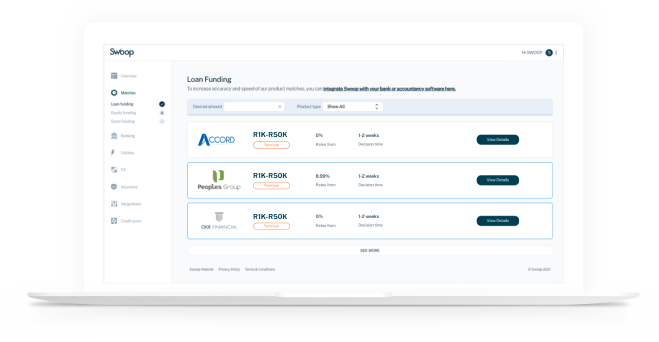

Making the switch to solar can be a challenge for small businesses given the upfront cost. That’s where government incentives and Swoop’s funding providers come in. The Department of Energy offers tax incentives and rebates for businesses that invest in renewable energy, and Swoop can help you secure financial support to cover the upfront costs of installing solar panels and other renewable energy equipment.

Purchasing solar power outright can put a substantial strain on your cash flow. Spread the cost of the solar installation over the useful life of the asset in order to make it more accessible and retain your working capital for other expenses.

Eskom, South Africa’s national grid electricity supplier is facing major capacity issues, which has meant that loadshedding quintupled in 2022 compared to 2021. Furthermore, the CSIR has projected that loadshedding will contine for the next 10 years in South Africa.

From 1 March 2023, businesses will be able to reduce their taxable income by 125 percent of the cost of an investment in renewables. Furthermore, there may also be tax rebates available under specific circumstances.

Related pages

Join the 95,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google Maps35 Bull Street, Lewis Building, Birmingham B4 6AF, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google MapsClever finance tips and the latest news

Delivered to your inbox monthly

Join the 95,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.