What is Debt Service Coverage Ratio

Debt Service Coverage Ratio (DSCR) is one of the biggest financial ratios that loan providers use to analyse your loan application. The ratio is highly useful because it offers a good indication on whether you’ll be able to pay back the loan facility with interest.

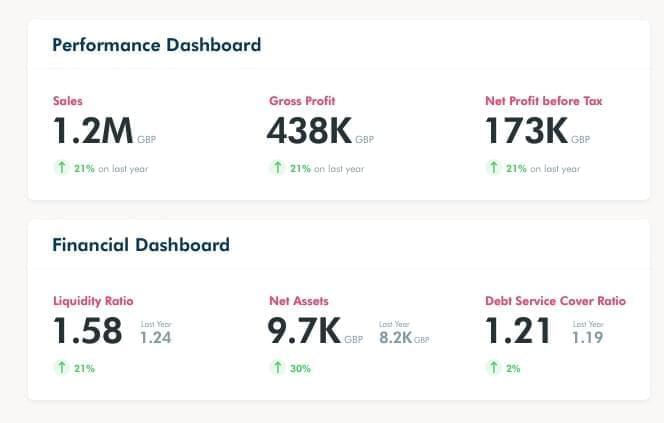

A DSCR over 1 is good and the higher it is the better. So, if you are below 1, you should talk to your advisors before proceeding to apply for a loan facility. This is why one of the first features we have rolled out on Swoop, is your financial dashboard which calculates your DSCR for you.

Funding providers don’t want to lose their investment or deal with the hassle of defaults. So, they look for reassurances that your business has generated income and will continue to generate enough income to pay the loan facility back.

Having just enough cash to cover your loan payments generally isn’t enough. They are looking to see if you have sufficient cash “reserve” to pay off the loan.

Working out your Debt Service Coverage Ratio

Funding providers will have slightly different methods for working out DSCR. So, it is advisable to ask the funding provider at the start of the loan application process how they calculate DSCR. However, the most common formula for calculating debt service coverage ratio is as follows:

DSCR = Business’s Annual Net Operating Income / Business’s Annual Debt Payments

Try our handy debt service coverage ratio calculator today.

Common Mistakes When Calculating DSCR

When trying to figure out your own DSCR, there are a couple of common mistakes:

Not Accounting for Existing Business Debt

The DSCR formula has to include existing debt as well as the loan you are applying for. A common error that SMEs make when calculating their DSCR is only accounting for the loan that they are applying for. Funding providers need to see all your business debt.

The following list contains types of debt that you should include in your calculation:

- Bank loans

- Short-term loans

- Leases

- Invoice financing

- Business lines of credit and business credit cards

What is a good DSCR score?

While every funding provider is different, most will look for a DSCR ratio of 1.15 or more. The state of the economy can be a driver in driving the ratio up and down.

DSCR <1: You have negative cash flow and don’t have enough income to service all your debt.

DSCR=1: You have exactly enough cash flow to cover your debt but don’t have any cash reserves

DSCR>1: You have positive cash flow and have more income to pay off your debt.

Calculate before Applying

So, as you can see your DSCR is a very important factor in deciding whether you will get approved for a loan facility. We highly recommend checking your DSCR before applying for a loan facility, so that you don’t get a poor credit score for getting rejected on the back of a low DSCR.

Through setting up your account on Swoop and integrating your accountancy software, you will be able to keep abreast of your DSCR at all times, so that you know when it is a good time to apply for loan facilities.

yet? Register here!

yet? Register here!