Take the pain out of finding investors for your business

Swoop uses smart matching to match your business to the most suitable investors from its huge network of over 200 venture capital funds, angel networks, family offices and angel investors.

Swoop uses smart matching to match your business to the most suitable investors from its huge network of over 200 venture capital funds, angel networks, family offices and angel investors.

If your business needs money to grow, you’ve the option of selling a stake in exchange for investment. Equity finance investors will have a claim on your future earnings but, in contrast to a loan, you don’t pay any interest – nor do you have to repay capital.

Equity finance could suit your business if you have an expansion plan or project that lenders such as banks aren’t willing to support, or if you want to avoid loan payments.

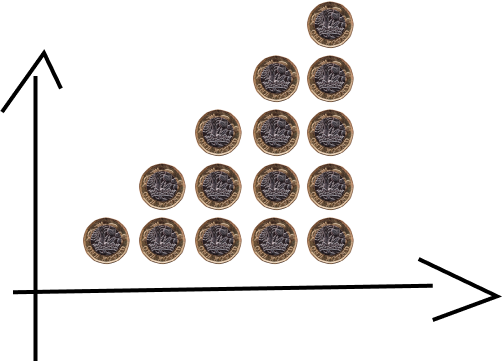

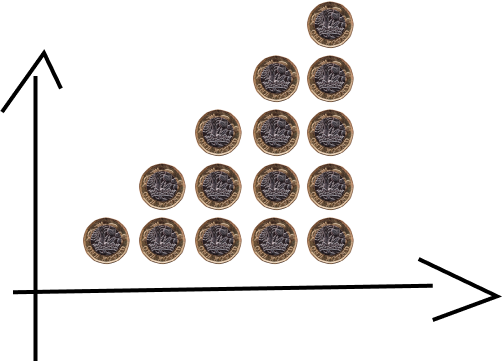

Your journey from startup to successful business could involve multiple rounds of equity financing from different types of investors, e.g. business angels, venture capitalists and private equity funds. Equity finance has two obvious advantages for businesses:

Read about some popular types of equity finance below, but it’s best to register now for full access to all the options available to you.

Equity finance is the method of raising finance by selling shares (equity) of your company to existing shareholders or new investors who will share in the profits. The people who buy the shares then become your shareholders.

Equity finance can be a good option for new or small businesses that are finding it difficult to get a loan.

Equity financing works by selling a company’s stock in exchange for cash. The proportion of your company that is sold will depend on how much has been invested in the company and what the business is worth at the time of financing. As your business grows, so will the value of the investor’s stake in your company.

Businesses can choose multiple rounds of equity financing from different types of investors, such as business angels, crowdfunding, or venture capitalists (VCs).

While equity financing requires you to sell a stake in your business in return for funds, debt financing involves borrowing money and repaying it with interest added, with the most common form being a loan.

Unlike equity, debt does not involve relinquishing any share in ownership or control of your business. However, equity financing is generally viewed as the less risky of the two as there is no obligation to pay back the money injected into your business, so there are no monthly repayments and the money invested can be put towards helping the business grow.

Businesses can benefit from both debt financing and equity financing, but businesses that require a large amount of money to grow and scale quickly will usually find equity financing more suitable, while those that need funds quickly to finance everyday expenses and operations may prefer debt financing.

Debt financing is usually (though not always) cheaper than equity financing because equity investors take on more risk and therefore demand higher returns. The interest you pay on debt financing is also tax deductible, whereas dividends paid to shareholders are not.

In addition, once the loan is fully repaid, your company will have no further obligation to the lender, making it a cheaper option than equity financing for profitable companies.

Businesses will generally attract a different form of investor at the various stages of their evolution in order to meet financing needs. We’ve outlined the main options below:

Family and Friends: As the name suggests, a friends and family round is an investment round wherein the funds are provided by friends and family of the founders. The source of funds come from people you already know and most importantly trust you.

Business angels: Business angels or angel investors are private individuals who are prepared to invest their own money into startup or early-stage businesses in return for a share of the company’s equity.

Equity crowdfunding: Where funds are raised from a large number of people – ‘the crowd’.

Venture capital: Venture capital funds look to invest larger sums of money than business angels in return for an equity stake in startups and early-stage businesses. It is most suited to high-growth businesses with long-term growth potential.

Private equity: Suitable for established private businesses. Private equity funds give your business money in return for a large share in your business.

Initial public offering (IPO): An IPO marks the first time a company sells shares to the public and is also known as floating or listing on the public markets.

Convertible debt is where money is invested in a company in exchange for shares to be issued at a later date – often when the company has raised finance from other investors. In return for investing early, convertible equity investors are given a discount on the price of the shares issued to other investors.

Before deciding whether equity finance is right for your business, it’s worth asking yourself the following questions:

If you’re happy to give up a share of your company in return for investment in your business and you would benefit from expert knowledge and experience, equity finance could be right for you.

If you’ve decided equity finance would suit your business, register with Swoop to speak abut how we can assist in match you with the most relevant equity finance for your business; our team are more than happy to offer you some free advice on your options.

Written by

Rachel has been writing about finance and consumer affairs for over a decade, helping people to get to grips with their finances and cut through the jargon. She's written for a range of websites and national newspapers including MoneySuperMarket, Money to the Masses, Forbes UK, and Mail on Sunday. Rachel has covered almost every financial topic, from car insurance and credit cards, to business bank accounts and mortgages.

Swoop promise

At Swoop we want to make it easy for SMEs to understand the sometimes overwhelming world of business finance and insurance. Our goal is simple – to distill complex topics, unravel jargon, offer transparent and impartial information, and empower businesses to make smart financial decisions with confidence.

Find out more about Swoop’s editorial principles by reading our editorial policy.

Related pages

Ready to grow your business?

Join the 110,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

We work with world class partners to help us support businesses with finance

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google Maps

Clever finance tips and the latest news

Delivered to your inbox monthly

Join the 110,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.