Take the pain out of finding investors for your business

Swoop uses smart matching to match your business to the most suitable investors from its huge network of over 200 venture capital funds, angel networks, family offices and angel investors.

Swoop uses smart matching to match your business to the most suitable investors from its huge network of over 200 venture capital funds, angel networks, family offices and angel investors.

If your business needs money to grow, you’ve the option of selling a stake in exchange for investment. Equity finance investors will have a claim on your future earnings but, in contrast to a loan, you don’t pay any interest – nor do you have to repay capital.

Equity finance could suit your business if you have an expansion plan or project that lenders such as banks aren’t willing to support, or if you want to avoid loan payments.

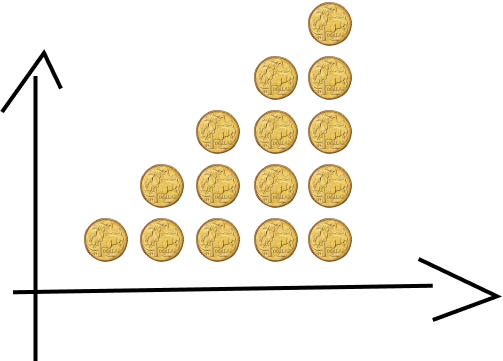

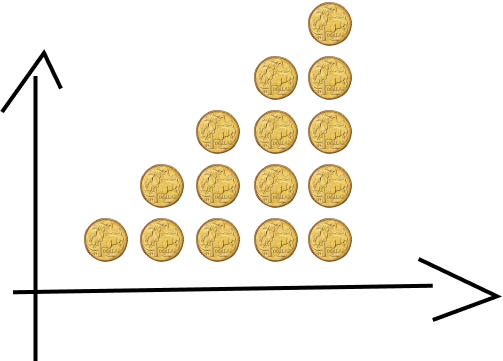

Your journey from startup to successful business could involve multiple rounds of equity financing from different types of investors, e.g. business angels, venture capitalists and private equity funds. Equity finance has two obvious advantages for businesses:

Equity financing works by raising capital through the sale of shares in a company. When a business go for equity financing, it sells ownership stakes to investors in exchange for funding. These investors then become shareholders and gain a proportional claim on the company's assets and future profits.

The amount of ownership an investor receives depends on the amount of capital they provide and the overall valuation of the company. Unlike debt financing, equity financing does not require repayment of the funds or interest payments. Instead, investors take on the risk of the business, sharing in its potential profits or losses.

This type of financing is often used by startups and growing companies that may not have the cash flow to service debt or that prefer to avoid taking on debt.

Equity financing includes various methods through which businesses raise capital by selling ownership stakes in exchange for funds:

Each method has its own advantages, risks, and considerations, and businesses should carefully evaluate their options before seeking equity financing.

Equity financing can be a valuable source of capital for businesses looking to grow and expand, but it's important to carefully weigh the pros and cons before seeking this funding option.

Some of the pros related to equity finance are:

On the other hand, equity finance also have its cons:

The risks related to equity financing include the potential loss of control over the company, as selling shares means giving up a portion of ownership and decision-making power to investors. This can lead to conflicts if the interests of the new shareholders do not align with those of the original owners.

Additionally, the process of raising equity can be time-consuming and costly, involving legal fees, regulatory compliance, and the effort of pitching to potential investors. Equity financing also cut the ownership stake of existing shareholders, which means a smaller share of future profits.

Furthermore, there is the risk that the company's valuation might be lower than expected, resulting in less capital raised. Finally, if the business does not perform well, the investors may not receive a return on their investment, which could strain relationships and affect the company's reputation.

Equity financing involves raising funds by selling ownership stakes in the company to investors in exchange for capital. Investors become owners of the business and share its profits and losses. This type of financing does not require businesses to make regular interest payments or repay the principal amount borrowed. Instead, investors expect to receive returns on their investment through dividends, capital appreciation, or a share of future profits.

In contrast, debt financing involves borrowing funds from lenders or financial institutions. Businesses are required to repay the borrowed amount along with interest over a specified period, regardless of the company's financial performance. Debt financing allows businesses to maintain full ownership and control of the company, as lenders do not have an ownership stake in the business. However, debt financing increases financial risk, as businesses must meet regular interest payments and repayment obligations, which can strain cash flow and liquidity.

Yes, you can use equity financing and debt financing together. This approach allows you to benefit from the advantages of both types of funding. By combining equity financing with debt financing, you can raise the necessary capital while managing the cost of borrowing and maintaining some level of control over your company.

Equity financing provides capital without the obligation to repay, while debt financing can offer tax advantages and does not cut ownership. Using both methods together can help diversify your funding sources, optimise your capital structure, and potentially reduce the overall cost of capital.

Deciding if equity financing is a good idea involves considering several factors:

Business stage: Evaluate whether your business is at a stage where it can attract investors and benefit from their capital and expertise. Startups and growing companies often find equity financing more advantageous.

Capital needs: Assess how much capital you need and for what purpose. If your funding requirements are substantial and for long-term growth, equity financing might be suitable.

Control and ownership: Consider your willingness to share ownership and control of your company. Equity financing involves giving up a portion of ownership, which could affect decision-making.

Debt capacity: Determine if you have the capacity to take on debt. If your business cannot handle additional debt or if taking on more debt would be too risky, equity financing can be a better alternative.

Investor expertise: Weigh the potential benefits of bringing in investors who can offer valuable industry knowledge, connections, and business expertise.

Financial health: Evaluate your company's current financial health and future profitability. A strong financial position can attract better investment terms.

Valuation: Consider the current valuation of your company. A favourable valuation can help you raise more capital without giving up too much ownership.

Long-term goals: Align the decision with your long-term business goals. Make sure that equity financing supports your strategic goals and growth plans.

Costs and efforts: Account for the time, effort, and costs involved in raising equity, including legal fees, regulatory compliance, and investor relations.

By carefully considering these factors, you can make an informed decision about whether equity financing is a good idea for your business.

Finding an investor involves several steps. Start by identifying the type of investor that aligns with your business needs, such as venture capitalists, angel investors, or private equity firms.

Research potential investors who have a history of investing in your industry or business stage. Networking is key, so attend industry events, pitch competitions, and networking sessions to meet potential investors. Use your existing network by seeking introductions from business contacts, mentors, or advisors.

Prepare a compelling pitch that clearly outlines your business model, market opportunity, financial projections, and growth strategy. Use online platforms and social media to connect with investors and join startup communities where investors are active.

Lastly, be persistent and follow up on leads, showing your dedication and enthusiasm for your business.

Investors want to know several key aspects about your business to assess its potential for success and return on investment. They are interested in understanding your business model and how it generates revenue. Investors look for a clear value proposition and competitive advantage that differentiates your business from others in the market.

Your business' financial performance is also important, so investors will look at your past financial statements and future forecasts. They also want to know about your team, including the founders' backgrounds, skills, and experience, as a strong, capable team is essential. Investors are interested in your business plan and growth strategy, including how you plan to scale and expand your market reach.

Additionally, investors want to understand the risks related to your business and how you plan to reduce them. Information about your current funding situation, how much capital you are looking for, and how you intend to use the funds is also important. Finally, they are interested in the potential exit strategies and the expected timeline for getting a return on their investment.

Read about some popular types of equity finance below, but it’s best to register now for full access to all the options available to you.

Ready to grow your business?

Join the 95,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google Maps35 Bull Street, Lewis Building, Birmingham B4 6AF, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google MapsClever finance tips and the latest news

Delivered to your inbox monthly

Join the 95,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.