TABLE OF CONTENTS

At Swoop, we know there’s no such thing as downtime for small businesses. That’s why we have partnered with lenders that can provide you with fast access to finance, regardless of the time of day.

Regardless of the circumstances, businesses should have the opportunity to secure funding at any time or day they choose to apply. Whether facing unexpected financial obligations or striving to stay ahead of competitors, the ability to access funds promptly is crucial.

Thankfully, anytime business loans offer a solution to these challenges, providing Irish SMEs with hassle-free access to the necessary funds. Unsure about the concept of quick business loans or how anytime business finance operates? Continue reading to discover everything you need to know about boosting your cashflow, regardless of the time.

The key lies in the term ‘anytime.’ Anytime business loans are designed for businesses that require access to funds. Applications are typically approved within seconds and processed swiftly, often depositing the borrowed amount into the recipient’s account in 24 hours or less.

When it comes to securing a traditional business loan, the journey begins with the completion of a formal application and submission of the required documentation to the lender.

This stack of information is then carefully reviewed by an underwriter, this process that can span several days or even weeks. Once the loan receives approval, contracts need to be signed and exchanged, and only after this step will the funds be transferred into the borrower’s account. From the moment of application to the disbursement of funds, the processing time for typical business loans is around 3 to 4 weeks.

However, it is worth noting that traditional loans may offer higher borrowing amounts compared to these anytime business loans.

Anytime business loans leverage advanced software to assess the borrower’s application by taking into account credit scores and readily accessible business information to evaluate risk. Initial approval can be granted in under a minute, after which additional steps and final approval will be set by the lender. Upon receiving final approval, funds are transferred electronically and can be available in the borrower’s account as early as the next day.

As any SME knows, financial surprises can pop up out of nowhere, and there are all sorts of reasons that can suddenly put a strain on your cash flow. That’s where anytime business loans come to the rescue! They’re here to soften the blow of those unexpected situations by providing funds at a moment’s notice, and you can use them for just about anything you need.

Here are some ways anytime business loans can help you out in a pinch:

With anytime business loans, you have the flexibility to address these financial needs promptly and keep your business running smoothly.

Firstly, you need to meet the minimum application criteria:

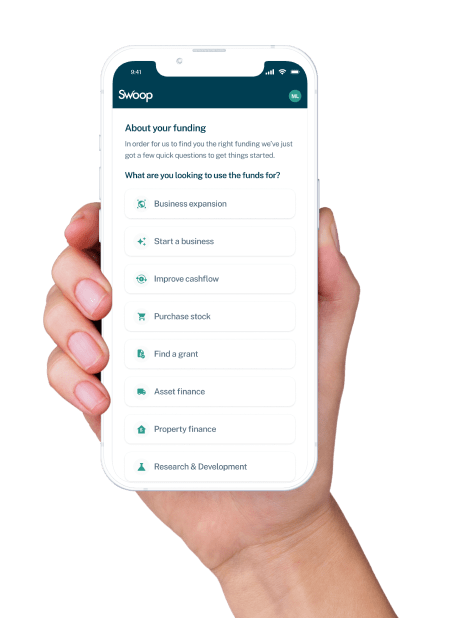

If you fit the criteria above, applying for an anytime business loan is quite simple: Register with Swoop online and begin your application – receiving your initial approval in seconds.

Anytime business loans can get funds into your business bank account in just a few days, sometimes even within 24 hours of getting the green light.

Need finance but unsure of the cost? Use our handy calculator to work out your monthly interest and repayment amounts, plus total interest and cost.

Your loan details

This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan.

Your results

Monthly payments

€0

Weekly payments

€0

Daily payments

€0

Avg. monthly interest

€0

Total interest

€0

Total cost of finance

€0

Borrow €When it comes to getting fast business finance, SMEs can often find themselves stuck in an endless loop of searching and applying to multiple lenders. And let’s face it, all that waiting around can seriously mess with your business plans. But here’s a better idea: team up with Swoop! We’ve got your back and can connect you with business loans from a wide range of lenders.

The best part? Even if your credit score isn’t great or you’ve been turned down elsewhere, there’s still a chance we can get you the loan you need, fast. So why keep running in circles when Swoop can make it happen?

If your business needs money in a hurry, and you are outside of regular business hours, register with Swoop to find the best rates, the best terms and the best anytime business loan.

We have a wide range of loan options

Join the 110,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

We work with world class partners to help us support businesses with finance

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google Maps

Clever finance tips and the latest news

Delivered to your inbox monthly

Join the 110,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.