The cost of energy for UK businesses has gone through the roof. Even with recent government interaction to keep a lid on prices, the average business is now paying more than double for their energy, and some have seen increases of over 500%. VAT is a tax paid on energy use. It increases the price that users pay and it can be a painful added burden. But what exactly is VAT, how much does it cost, and which businesses must pay it? Read on to discover all you need to know about VAT on business energy bills and how to reduce its impact on your cashflow.

What is VAT?

VAT (value-added tax) is a form of sales tax that is added to most products and services sold by VAT-registered businesses. VAT is charged at three different rates – standard rate of 20% (most goods and services), 5% (some goods and services, such as children’s car seats and home energy), and 0% for zero-rated goods and services such as most food and children’s clothes. (See the government’s full list of goods and services that VAT applies to).

Businesses are allowed to reclaim most of the VAT they are charged by their suppliers, and they will usually collect VAT from the customers they sell to. The charging of VAT starts at the production source, (such as a factory), and continues through the sales pipeline with businesses paying VAT, claiming it back, then charging it out again, until the process reaches a customer who cannot claim the tax back – usually a non-VAT registered business, or a private consumer.

VAT-registered businesses are obligated by law to:

- Include VAT in the price of all goods and services they sell and at the correct rate.

- Maintain records of how much VAT they pay for things they buy for their business.

- Account for VAT on any goods they import into the UK.

- Report the amount of VAT they charge their customers and the amount of VAT they have paid to other businesses by sending a VAT return to HM Revenue and Customs (HMRC) – usually every 3 months.

- Pay any VAT they owe to HMRC.

The VAT businesses pay to HMRC is usually the difference between any VAT they’ve paid to other businesses, and the VAT they’ve charged their customers. If they’ve charged more VAT than they’ve paid, they must pay the difference to HMRC. If they’ve paid more VAT than they have charged their customers, HMRC will usually refund the difference.

Does my business need to be VAT registered?

UK law states that you must register your business for VAT if:

- You expect your VAT taxable revenue to be more than £85,000 in the next 30-day period.

- Your business had a VAT taxable revenue of more than £85,000 over the last 12 months.

Taxable revenue is your sales of goods and services that would be liable to VAT, (non-exempt).

When you first register for VAT, your business is given a VAT number. This is your unique VAT identity, and you must include it on invoices and VAT receipts that you give to customers. HMRC will also tell you when to submit your first VAT return and payment (if applicable), and what your ‘effective date of registration’ was, (either the date you went over the £85k threshold, or the date you asked to register).

Does VAT apply to business gas and electricity?

Yes. Businesses must pay VAT on their energy tariffs – both electricity and gas are at the rate of 20% unless you’re eligible for the reduced rate of 5%.

How much is VAT on business gas and electricity?

VAT for businesses gas and electricity is charged at the standard rate of 20%, although some businesses may qualify for the reduced rate of 5%, (see below).

What is the VAT rate on energy for micro-businesses?

A micro-business is defined as a business that has at least two of the following:

- A revenue of £632,000 or less.

- £316,000 or less on its balance sheet.

- 10 employees or less.

Micro-businesses will pay the 20% standard VAT rate on their energy use unless they are eligible to pay the reduced rate of 5%. To qualify for the lower rate, they must meet certain requirements:

Either:

- At least 60% of their business’s energy is used for dwelling or residential accommodation.

- They are a charitable or non-profit organisation.

Or they are classed as a low energy user. This means:

- They use less than 33kWh of electricity per day or 1,000kWh per month.

- They use less than 145kWh of gas per day, or 4,397kWh per month.

Qualifying business should check with their energy supplier to ensure they are on the reduced rate. Businesses that have been paying the standard rate of 20% when they were eligible for the reduced rate may be able to claim a partial refund on any overpayments made during the last four years. To make a claim, you must contact your supplier and fill out a declaration form.

How do I find out how much VAT I’m paying?

The VAT rate and the amount of tax you are charged on your business energy is shown on your bill. If you are unsure of the details and would like a second opinion, get in touch and speak to one of Swoop’s energy experts to discover if you can reduce the amount of VAT you pay.

Can I claim VAT back on electricity and gas?

No. VAT is payable on all business and domestic energy. It doesn’t matter if you operate from business premises or if you work from home, you must pay VAT on any gas and electricity you use for work purposes. Although paying for commercial energy is a business-to-business transaction, you can’t claim the VAT back in the same way that you would with other business expenses.

Does my business qualify for reduced VAT on business energy?

To qualify for the reduced 5% VAT rate on their energy bill, businesses must show that:

- At least 60% of their business’s energy is used for dwelling or residential accommodation.

- They are a charitable or non-profit organisation.

- Or they use less than 33kWh of electricity per day or 1,000kWh per month.

- Or they use less than 145kWh of gas per day, or 4,397kWh per month.

Can charities claim VAT back?

If a VAT registered charity organisation is paying VAT on some goods and services, it may qualify to claim back the tax. Charity organisations that are not VAT registered cannot reclaim VAT they are charged on goods and services they purchase.

Can schools and universities claim VAT back?

Yes and no. VAT registered UK schools and universities provide education to their students exempt from VAT. This applies to state schools, and fee- paying private schools and state and private colleges and universities. However, because VAT registered schools and universities may provide some goods and services to students that are subject to VAT, they are classed as ‘partially exempt organisations’ and can only claim back some, not all, of the VAT they are charged by suppliers.

Examples of goods and services that schools and universities may provide that are liable to VAT:

- Letting of facilities to wedding parties and commercial organisations.

- Sales of laptop computers (even if at or below cost).

- Commission from photographers.

- Admission charges to school plays, concerts, dances.

- Sales of goods from school and campus shops.

- Vending machine sales.

Can VAT claims be backdated?

Yes. Businesses have up to 4 years to claim back any input VAT that they did not claim back previously. The 4 years’ time limit runs from the due date of the VAT return on which you should have made the original claim, not the date of the supplier’s VAT invoice.

What is the Climate Change Levy (CCL) and how does it affect VAT on business energy?

The Climate Change Levy (CCL) is a tax designed to make UK businesses more sustainable. It aims to increase business energy efficiency and drive reductions in greenhouse gases.

In simple terms, the CCL deters commercial energy users from consuming energy that creates carbon emissions. The more energy-efficient your business is, and the less carbon-creating energy you use, the less CCL you pay. In theory, the CCL encourages businesses to consume less energy and to switch to on-site energy sources, such as commercial solar panels.

How is it charged?

The CCL is charged on energy used for heating, lighting, and power purposes, such as natural gas, electricity, petroleum, and coal. It is not charged on-road fuel for vehicles and other oils that are already subject to excise duty.

CCL is a two-rate tax – Main Rate and the Carbon Price Support Rate. The amount of CCL your business pays depends on how much energy you use – you are charged per kilowatt hour (KWh) for gas and electricity and per kilogram (kg) for other fuels, such as coal.

Businesses pay CCL at the Main Rate on:

- Electricity.

- Gas.

- Solid fuels like coal, lignite, coke, and petroleum coke.

The Carbon Price Support Rate (CPS) is paid by owners of electricity generating stations and operators of combined heat and power (CHP) stations. Businesses that generate some or all of their own energy (using solar, and wind turbines for example) and make money by selling excess power back to the grid, will usually be classed as small generators and are exempt from this charge.

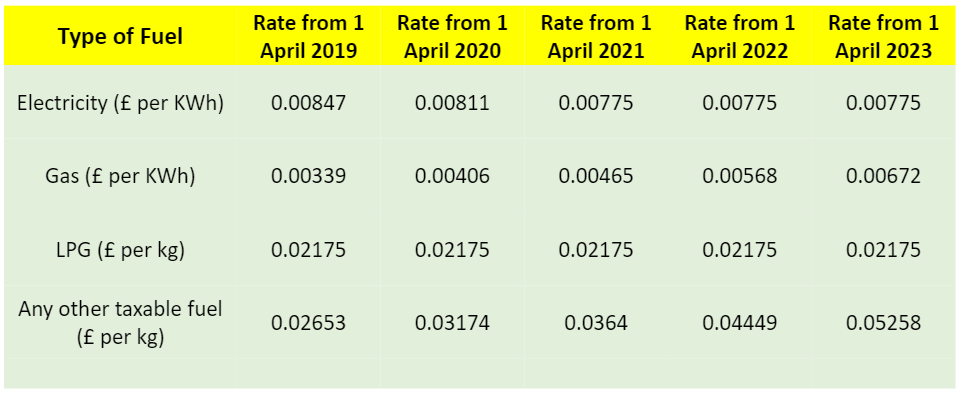

Climate Change Levy rates

CCL is charged at different rates for different types of fuel. Main Rates are:

Is VAT charged on the Climate Change Levy?

Yes. VAT is also charged on the CCL – effectively a tax on a tax – so the true rate of CCL that most businesses pay is typically 20% higher than the figures shown above.

Climate Change Levy exemptions

Some energy users are exempt from CCL. You do not have to pay the main rate if you are a:

- Business that uses small amounts of energy. (If you qualify for the reduced 5% VAT rate on your energy bill, you are a low energy user).

- Domestic energy user.

- Charity engaged in non-commercial activities.

How do I apply for reduced VAT rates?

To apply for the reduced 5% VAT rate on your business energy bill, you will need to contact your energy supplier and fill out a declaration form. You must contact multiple suppliers and complete a declaration form for each provider if:

- You’ve switched business energy suppliers during the last four years.

- You have more than one energy supplier (such as different vendors for gas and electricity).

- Your business has multiple sites that are eligible for the discount.

You can get a declaration form from your supplier or from HMRC.

How can I make further savings on my energy bills?

As the cost of doing business keeps rising, organisations must reduce their costs to stay competitive. Making savings starts with your energy bill. Ensure you pay the lowest rate of VAT, are on the best electricity and gas tariffs, and you’re claiming every refund and exemption you are entitled to.

Don’t miss out on savings. Get in touch and speak to one of Swoop’s energy experts to help you find the best tariffs, pay the lowest VAT, and keep your energy costs in check.

yet? Register here!

yet? Register here!