There are several different metrics businesses can use to calculate their financial health and performance, and EBITDA is one of them. EBITDA is often used by businesses to compare their financial performance against that of their competitors, while analysts might use it to help determine the sustainability of an organisation.

Additionally, if you are looking for a business loan, many banks will use EBITDA to assess whether a company can repay its debts.

This guide takes a closer look at how to calculate EBITDA and its pros and cons.

What is EBITDA?

EBITDA stands for earnings before interest, taxes, depreciation and amortisation. It is a type of earnings metric that can help understand a business’s ability to generate cash flow for its owners. It also helps financial advisers and analysts calculate how much a business is earning before any reductions and modifications take place.

EBITDA doesn’t account for the different ways a company might use debt, equity, cash or other sources of capital to finance its operations. It also excludes non-cash expenses such as depreciation, and it excludes taxes. As such, EBITDA can be a useful way to evaluate a business and is often used to compare two similar businesses or determine a company’s cash flow potential.

EBITDA became a popular method of measuring a company’s performance in the 1980s. Investors and lenders involved in leveraged buyouts found it a useful way to estimate whether the targeted company had the profitability to pay off the debt likely to be incurred in the acquisition. Because a buyout would usually result in changes to the capital structure and tax liabilities, it made sense to exclude the interest and tax expenses from earnings.

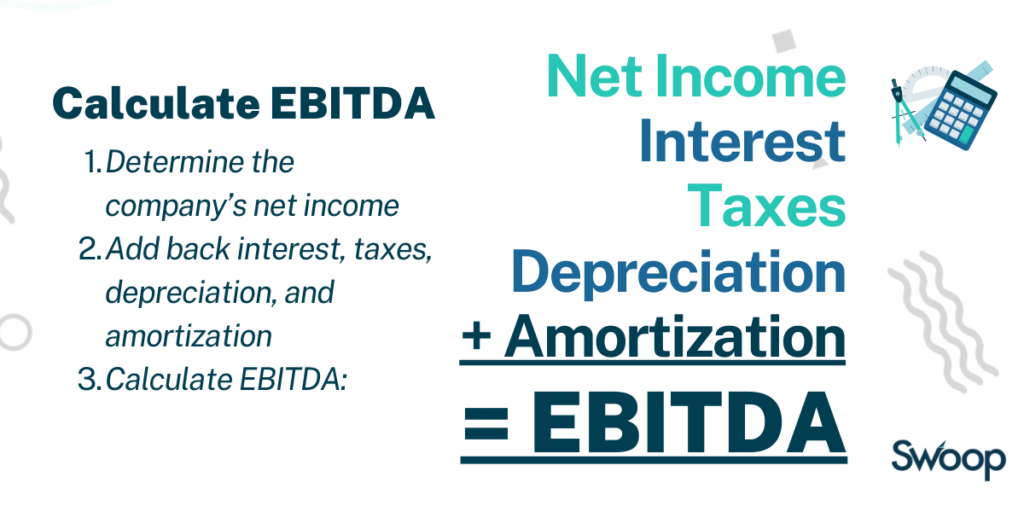

Calculating EBITDA

There are two ways to calculate EBITDA. One is based on net income and the other on operating income. We’ve outlined both methods below:

EBITDA Formula

The first EBITDA formula is as follows:

Net income + taxes + interest expenses + depreciation + amortisation = EBITDA

The second EBITDA formula is:

Operating income + depreciation and amortisation = EBITDA

To use EBITDA, it’s important to understand what each part of the formula means.

Earnings

Your earnings are usually your net profit. Your net profit is the total revenue generated from sales, minus the total amount you deduct as a legitimate business cost.

Interest

Interest expenses are the cost of having debt. For EBITDA, the interest you are charged when you repay your debt is added back to your earnings.

Taxes

A company’s taxes can vary from one period to the next and are affected by a number of conditions that might not directly relate to your company’s operating results.

Depreciation & amortisation

Depreciation and amortisation represent the gradual decrease in value of assets over time. Depreciation applies to tangible assets such as machinery or vehicles, and EBITDA adds back this loss in value. Amortisation applies to intangible, or non-physical, assets such as patents or copyrights which eventually expire, and this is also added back.

Try our handy EBITDA calculator today and easily calculate EBITDA for your business

Why use EBITDA?

EBITDA is considered to more accurately reflect the performance of a business and it can give an analyst a quick estimate of the company’s value. What’s more, if a business is not making a net profit, EBITDA can be used by investors to evaluate the business. It can be ideal for comparing similar companies in the same industry and business owners often use it to compare their performance against competitors.

Disadvantages

One of the biggest disadvantages of EBITDA is that it’s possible for companies to include or exclude different components which can make it a misleading measurement for traders and analysts. Companies can decide to present financial decisions in a more favourable light, by excluding debts for example, and this can make a company seem more profitable than it actually is.

EBITDA also does not account for certain expirable assets or assets that depreciate in value over time.

For these reasons, EBITDA should not be used exclusively as a measure of a company’s financial performance. A high EBITDA can make a company look like a good investment, but only using this metric could result in an investor putting money in a company with high debt to repay or an organisation that needs to spend a lot of money replacing old equipment.

Advantages

Although there are a number of drawbacks, EBITDA is often used because it only accounts for necessary expenses for the day-to-day running of a business and it represents the cash flow generated by ongoing operations. It is also a good indicator for how well a business is able to produce profits and an easy way to compare how well it’s performing against its competitors.

What is the debt to EBITDA ratio?

The debt to EBITDA ratio measures a company’s ability to repay its debt. A high ratio can suggest that the company’s debt is too much of a financial burden.

If you’re taking out a business loan, the bank might include a debt-to-EBITDA ratio in your loan agreement. If it does, you will need to stick to this ratio or risk having to repay the loan in full immediately.

Example EBITDA calculation

Below is an example EBITDA calculation for Company ABC:

- Total revenue: R1,000,000

- Net income: R450,000

- Taxes: R190,000

- Interest: R20,000

- Depreciation and amortisation: R10,000

Net income + taxes + interest expenses + depreciation + amortisation = EBITDA

R450,000 + R190,000 + R20,000 + R10,000 = R670,000

Another example EBITDA calculation for Company XYZ is as follows:

- Total revenue: R1,000,000

- Net income: R400,000

- Taxes: R190,000

- Interest: R25,000

- Depreciation and amortisation: R8,000

R400,000 + R190,000 + R25,000 + R8,000 = R623,000

To work out the EBITDA margin, you can divide the EBITDA by total revenue.

For example:

Company ABC

(R670,000 / R1,000,000) x 100 = 67%

Company XYZ

(R623,000 / R1,000,000) x 100 = 62.3%

Bear in mind that if one company has a lower revenue but a higher EBITDA margin compared to another, investors will view this company as having a more sustainable business model, making it a better investment.

yet? Register here!

yet? Register here!