Return on capital employed calculator

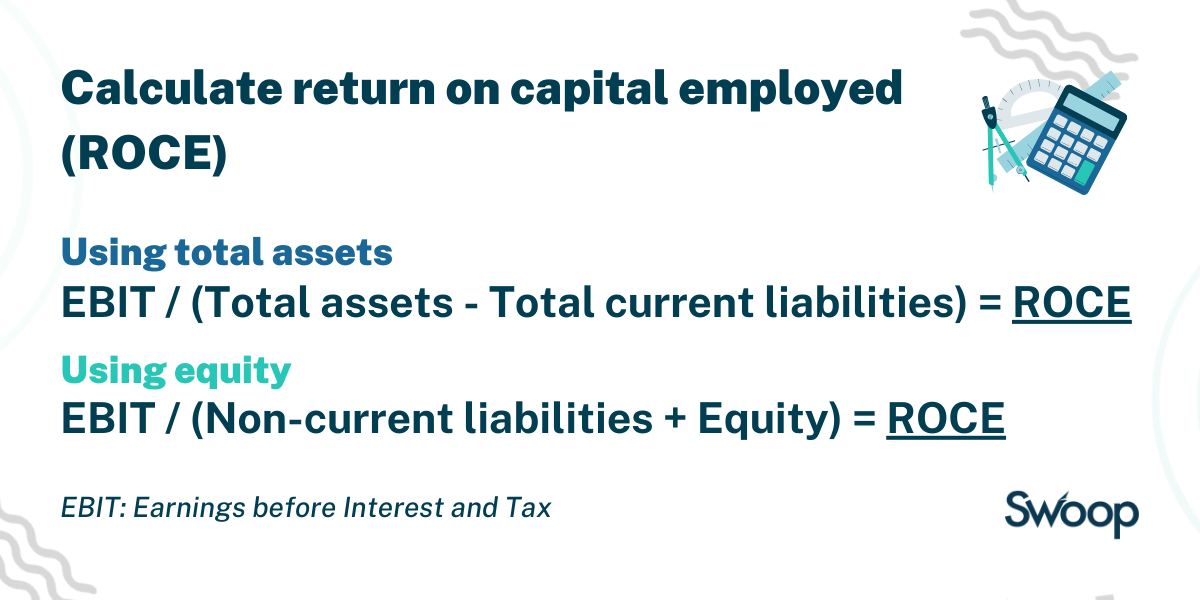

To calculate the Return on capital employed (ROCE), you’ll need two pieces of information: the operating profit and the capital employed.

To calculate the Return on capital employed (ROCE), you’ll need two pieces of information: the operating profit and the capital employed.

This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan.

ROCE stands for return on capital employed. It is a financial ratio that measures the profitability and efficiency of a company’s capital investments. ROCE indicates how well a company is generating profits from its invested capital.

ROCE is used as a performance metric by investors, analysts, and managers to assess a company’s profitability and the efficiency with which it utilises its capital. A higher ROCE indicates that the company is generating more profits relative to the capital invested, which is generally considered favourable.

It’s important to note that ROCE can vary across industries, so it is often more meaningful to compare a company’s ROCE to its industry peers to get a better understanding of its performance.

All calculators

Join the 110,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

We work with world class partners to help us support businesses with finance

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google Maps

Clever finance tips and the latest news

Delivered to your inbox monthly

Join the 110,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.