What is Debt Service Coverage Ratio?

Debt Service Coverage Ratio (DSCR) is one of the biggest financial ratios that loan providers use to analyse your loan application. The ratio is highly useful because it offers a good indication on whether you’ll be able to pay back the loan facility with interest.

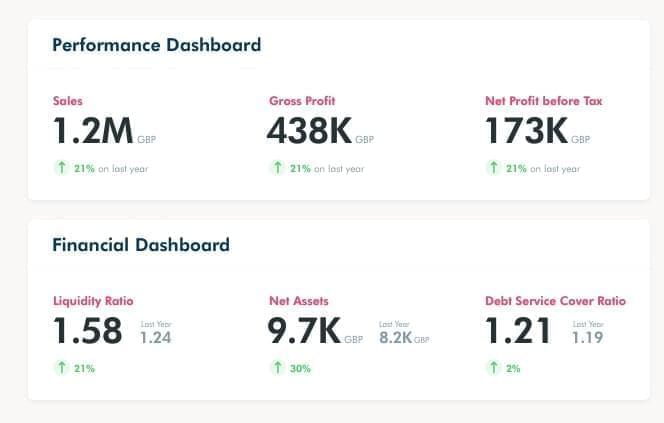

A DSCR over 1 is good and the higher it is the better. So, if you are below 1, you should talk to your advisors before proceeding to apply for a loan facility. This is why one of the first features we have rolled out on Swoop, is your financial dashboard which calculates your DSCR for you.

Funding providers don’t want to lose their investment or deal with the hassle of defaults. So, they look for reassurances that your business has generated income and will continue to generate enough income to pay the loan facility back.

Having just enough cash to cover your loan payments generally isn’t enough. They are looking to see if you have sufficient cash “reserve” to pay off the loan.

Why is the DSCR important?

The DSCR is important for various stakeholders in financial analysis. It helps stakeholders assess a business’s ability to cover its debt obligations with its operating income. This ratio is particularly important for lenders and investors as it provides insights into the financial health of a business.

A high DSCR indicates that the business generates enough income to cover its debt obligations, lowering the risk for lenders and investors. On the other hand, a low DSCR may signal that the business is struggling financially, leading to a higher risk.

Overall, the DSCR helps stakeholder understand, evaluate, and manage the risk related to debt repayment.

What is the debt service coverage ratio used for?

The DSCR is used to asses a company’s ability to manage its debt obligations. By comparing operating income to debt obligations, it indicates if a company generates enough cash flow to cover its debt, including interest and principal repayments.

A high DSCR suggests strong financial management and operational efficiency, lowering the risk of default. On the other hand, a low DSCR may indicate financial risk and challenges in meeting obligations.

Beyond assessing credit risk for lenders, DSCR is also used by investors and analysts when evaluating a company’s financial health and sustainability. It influences decisions like loan approvals, credit assessments, and investment evaluations. Furthermore, it helps understanding the financial impact and risk exposure, guiding stakeholders in making informed decisions to support long-term financial success.

Working out your Debt Service Coverage Ratio

Funding providers will have slightly different methods for working out DSCR. So, it is advisable to ask the funding provider at the start of the loan application process how they calculate DSCR. However, the most common formula for calculating debt service coverage ratio is as follows:

DSCR = Business’s Annual Net Operating Income / Business’s Annual Debt Payments

Try our handy debt service coverage ratio calculator today.

What factors affect DSCR?

Several factors can influence DSCR, these include:

- Revenue and cash flow: Higher revenues and consistent cash flows positively affect DSCR as they provide the resources needed to cover debt.

- Operating expenses: Efficient management of operating expenses can improve DSCR by increasing cash flow and thereby cover any debt.

- Interest rates: Fluctuations in interest rates can impact DSCR, especially for variable-rate debt. Higher interest rates increase debt service requirements, potentially reducing DSCR.

- Debt structure: The terms and structure of debt, such as maturity dates and repayment schedules, influence DSCR. Longer maturities or flexible repayment terms can lower the pressure on DSCR.

- Capital expenditures: Large capital expenditures can affect cash flow and reduce DSCR if not offset by increased revenue.

- Industry trends: Industry-specific factors, such as market demand and competition, can impact revenue and cash flow, thereby affecting DSCR.

- Risk management: Effective risk management practices, including diversification and insurance, can reduce the impact of unexpected events on DSCR.

- Financial policy: Companies’ financial policies, such as dividend payments and share repurchases, can influence DSCR by affecting cash flow.

Considering these factors and their potential impact on DSCR can help businesses make informed decisions about debt management and overall financial health.

Common mistakes when calculating DSCR

When trying to figure out your own DSCR, there are a couple of common mistakes:

Not Accounting for Existing Business Debt

The DSCR formula has to include existing debt as well as the loan you are applying for. A common error that SMEs make when calculating their DSCR is only accounting for the loan that they are applying for. Funding providers need to see all your business debt.

The following list contains types of debt that you should include in your calculation:

- Bank loans

- Short-term loans

- Leases

- Invoice financing

- Business lines of credit and business credit cards

What is a good DSCR score?

While every funding provider is different, most will look for a DSCR ratio of 1.15 or more. The state of the economy can be a driver in driving the ratio up and down.

DSCR <1: You have negative cash flow and don’t have enough income to service all your debt.

DSCR=1: You have exactly enough cash flow to cover your debt but don’t have any cash reserves

DSCR>1: You have positive cash flow and have more income to pay off your debt.

What are the advantages and disadvantages of DSCR?

The debt service coverage ratio (DSCR) presents both advantages and disadvantages in financial analysis.

The advantages of using DSCR include:

- Financial health assessment: DSCR helps business owners assess the ability of a business to cover its debt obligations with its operating income. This helps in evaluating the financial health of a business.

- Risk assessment: It assists lenders and investors in assessing the risk when they want to fund a business. A higher DSCR indicates lower risk, while a lower DSCR may indicate higher risk.

- Comparative analysis: DSCR allows you to compare different businesses, industries, or projects, providing insights into their relative financial strength and performance.

However, there are also some disadvantages of using the DSCR:

- Sensitivity to assumptions: DSCR calculations rely on various assumptions such as future cash flows, which may be subject to change. Small variations in these assumptions can impact the DSCR, potentially leading to misconception.

- Limited scope: DSCR primarily focuses on a business’s ability to meet its debt obligations and may not look at other important aspects of financial performance or risk.

- Manipulation: In some cases, businesses may manipulate their financial statements to falsely increasing the DSCR ratios, misleading lenders and investors.

- Timing issues: DSCR may not accurately reflect short-term fluctuations in cash flow or unexpected events that impact debt service obligations, leading to potential misconception of financial health.

Calculate before applying

So, as you can see your DSCR is a very important factor in deciding whether you will get approved for a loan facility. We highly recommend checking your DSCR before applying for a loan facility, so that you don’t get a poor credit score for getting rejected on the back of a low DSCR.

Through setting up your account on Swoop and integrating your accountancy software, you will be able to keep abreast of your DSCR at all times, so that you know when it is a good time to apply for loan facilities.

yet? Register here!

yet? Register here!