Short answer: A ‘good’ credit score is anything 700 or above. But, of course, there’s so much more to it than that. Credit scores range between 300 and 900, with higher scores indicating a better credit history.

And if you’re thinking a personal credit score has little effect on you as a business owner, think again. Like a business credit score, a good personal credit score can mean approvals for business financing, better terms on loans, higher credit limits, and fewer hoops to jump through in the funding process.

At Swoop, we want our clients to feel empowered when they’re on the hunt for funding. One of the ways to do this is by knowing and strengthening your credit score, long before you need to use it.

Keep reading to learn more about:

- Why a good credit score is important

- What affects your score

- How to improve your credit score

- How Swoop can help even if you do not have stellar credit

Why is a good credit score important?

Your credit is important because it is one of the main factors lenders look at first to determine how you’ve managed money in the past. As the saying goes, your past behavior is the best predictor of future performance. A good credit score can open doors to financial opportunities that can fuel your business’s growth and success.

A good credit score opens up valuable opportunities for your business. With it, you can access better loan options, enjoy faster approvals, and secure lower interest rates because lenders see you as a lower risk. It also strengthens relationships with suppliers, who may offer more favorable terms or extend credit lines. In short, a strong credit score shows lenders and vendors that your business is financially responsible and trustworthy.

What factors affect my credit score?

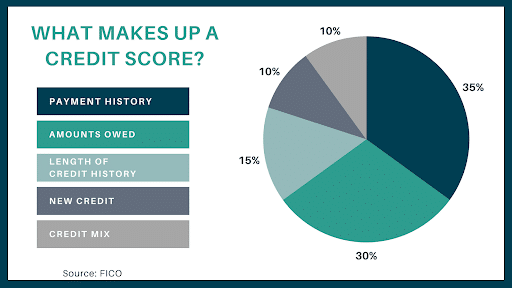

There are a handful of elements that have an effect on your credit score. There’s also a difference in scoring models – you have both a FICO score and a VantageScore. FICO assigns specific weights to each factor, while VantageScore ranks the factors based on how “influential” they are to your overall score.

- Payment history (35%): Your track record of paying bills on time is the biggest factor in determining your credit score.

- Credit utilization (30%): The percentage of your available credit that you’re using. Aiming to keep it below 30% is recommended.

- Length of credit history (15%): The longer you’ve had credit (credit history) can lead to a higher score, since it gives lenders a better view of your financial habits over time.

- New credit inquiries (10%): Each time you apply for credit, a hard inquiry is made, which can temporarily lower your score. Plus these inquiries can stay on your report for up to two years.

- Credit mix (10%): You want to have a good mix of credit accounts (loans, credit cards, etc.) on your report.

How can I improve my credit score?

In one word– consistency. Building a positive credit score doesn’t happen overnight. If it did, then everyone would have one. What makes the score coveted is its inability to be easily manipulated. However, it is far easier to damage it than to build it up so here are some pointers to go about it.

Pay all bills on time

From the FICO scoring list above, the biggest element that plays into your credit score is the ability to pay your debtors on time consistently. Even one late payment can drop your score and could remain on your credit for years to come. Many lenders allow you to set up automatic payments or reminders to keep you in the know about when your payments are coming due.

Keep credit usage low

There is a happy medium to this step, as you definitely want to make sure you are using your credit but aim to keep your credit usage ratio below 30%. For example, if you have a total credit limit of $10,000, try to use no more than $3,000 of that. Paying down balances and avoiding maxing out credit cards can help keep this ratio low and show lenders that you’re not overextending yourself financially.

Keep credit accounts open

While it may seem counterproductive to have unused credit accounts open it actually can do more harm than good by closing accounts, especially if you’ve had the accounts for an extended period of time. Closing old credit accounts can shorten your credit history and increase your credit utilization ratio. Instead, keep these accounts open especially if you don’t pay a fee for them, like an annual credit card fee for example.

Space out credit applications

This may seem like a catch-22 scenario if you need to establish credit or build credit but be sure to give some breathing room between applications for credit lines. Each application generates a hard inquiry, which can lower your score and remain on your report for several years. Instead, be mindful about which credit lines are most beneficial and space out applications over time.

Monitor your credit reports

Your credit score is a powerful factor in the funding process, so it’s important to keep a close eye on it. People with good credit can sometimes be targeted by scammers who attempt to use their identity for personal gain.

There are two key steps to protect yourself from this:

- Regularly review your credit reports: Checking your reports can help you catch any errors or signs of fraudulent activity that might negatively impact your score. You can check your credit score with either of the credit bureaus, however, it’s important to note that while checking your Equifax credit score is free, accessing your credit score with TransUnion requires a monthly fee, except for residents of Quebec. Canadians can also check their credit score for free with any of the big banks or third-party providers.

- Set up alerts on your accounts: Many financial institutions offer alert services that notify you of any unusual activity, helping you act quickly if something suspicious happens.

What do I do if I don’t have a credit score?

If you’re new to having credit, then you’ll first need to establish credit which can be tricky but not impossible. Here are some low to mid-lift ways that most people go about it when first starting out

- Become an authorized user: By far one of the lowest lift ways of establishing credit is being added to someone else’s credit card account, you can benefit from their positive payment history. They simply add you to their existing credit line and then you also possess access to their credit history and credit limit in the eyes of lenders.

- Open a secured credit card: A secured card is a credit card that requires a cash deposit but can help you build credit when used responsibly. For example, if you have a secured card with a $250 deposit, then you now have a $250 limit for that card. Some issuers may even allow you to transfer over to a non-secured (traditional) credit card once you’ve shown the proper usage.

- Take out a small loan: This one can be tricky depending on the lender. Securing a small personal and paying it off on time can help build your credit history but finding a lender that will provide a personal loan without a strong credit history can be difficult. Look for lenders who specialize in helping those with limited or no credit history, or consider credit unions or online lenders that offer starter loans.

Why has my credit score changed?

Credit scores are fluid and can change for various reasons throughout a credit cycle (about a month).

- Changes in credit utilization: If you’ve recently maxed out a credit card or paid off a large balance, your score may fluctuate accordingly.

- Late payments: Missing a payment or paying late can cause your score to drop.

- New credit inquiries: Each new credit application you submit can lower your score temporarily.

- Aging accounts: As your accounts age and show more responsible behavior, your score may improve.

Read more: Why did my credit score drop?

How Swoop can help

At Swoop we specialize in helping small to medium-sized business owners secure the funding they need to establish or grow their business. Our lenders specialize in looking at applicants holistically, including considering credit scores and past credit usage.

That being said, we’re experienced in helping businesses from all walks of the credit track and are here to present all of the funding options available to you, including business loans, business grants and more.

Register today to take the next step in your business journey.

yet? Register here!

yet? Register here!