TABLE OF CONTENTS

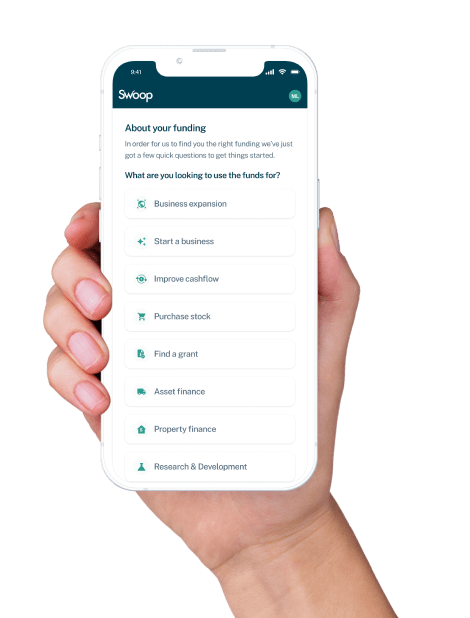

Speed through to business loans and other lending options – get your business rolling with Swoop

Swoop is a credit broker and does not provide capital. We work with a range of companies to offer clear comparisons that allow customers to make choices on financial products & services. Swoop may receive a commission, which may vary by product but typically in the form of a fixed percentage of the loan amount. For certain lenders, we do have influence over the interest rate, and this can impact the amount you pay under the agreement.

You want to focus on your business, not on figuring out how to get a business loan. We make it easy for you to apply in minutes – then we’ll sift through the options from banks and other lenders to find the funds you need in as little as 24 hours.

A business loan calculator is a great starting point to understanding the cost of your loan. Use our free loan calculator below to work out your average monthly interest payments and the total monthly repayment amount, as well as the total interest paid and the total cost of the loan.

Your loan details

This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan.

Your results

Monthly payments

$-

Avg. monthly interest

$-

Total interest

$-

Total cost of finance

$-

The simplest definition of a business loan is a lump sum of capital that you receive from a bank or other lender to invest in your business, and that you pay back through regular payments. There are many specific types of business loans that may suit your needs and be available to you, such as:

Secured business loans are secured by an asset that your business owns, such as real estate, vehicles or machinery. If your business stops making payments, the lender has the right to take the assets that were pledged as collateral. Because the lender has the security of your collateral, they will generally allow you to take a longer time to repay the loan and charge a lower rate of interest.

Unsecured business loans do not require you to offer assets as security. Instead, the lender will base the loan terms mainly on your credit history, income and cash flow projections. Because the lender does not have security in case your business stops making payments, they will likely give you less time to repay the loan and charge a higher rate of interest.

Startup loans are designed to help a new business launch and grow. Since your business does not yet have assets or a track record, a lender may want to see the details of your business plan, your founders, your financial progress so far, and your projected earnings.

Small business loans are often used to provide a quick cash injection when it is needed to grow the business, improve productivity or solve an issue. For example, to upgrade or repair equipment, purchase inventory, renovate or move, buy or finance a vehicle, hire and train employees, launch a marketing campaign, pay overdue taxes or settle outstanding supplier invoices.

Government loans have become a much bigger opportunity for businesses since the start of COVID-19. They are attractive for a number of reasons, including the fact that they are generally not secured, you may not have to repay the full amount, and you might find it is easier to qualify for a government loan than a loan from a bank or other lender. There are many other varieties of Canadian business loans that might work for you. Join Swoop to start seeing the best options in minutes.

The interest rate on a Canadian business loan is based on the Bank of Canada policy rate, plus an additional amount that reflects the level of risk being taken by the lender.

For example, a small business that has been profitable for the past 10 years is less risky than a brand new startup, so it will usually pay a lower rate of interest. A business owner with a perfect credit score will likely be able to borrow at a lower rate than someone equally talented who has a blemish or two on their record.

Likewise, a business that owns a commercial building or has vehicles or machinery that can be pledged as security for a loan can expect to obtain a lower rate of interest than a business that cannot offer collateral.

COVID-19 opened up some new funding options, including government loans and grants, that may be available with little or no interest charges. It makes sense to investigate these options.

Join Swoop and we’ll scan the market to find the best rates for the funding you need.

Register your business and we will find some of the best small and medium business loan options for you within minutes.

Canadian business loans come in many shapes and sizes and can be used for a wide variety of things such as:

Purchasing assets that are needed to operate your business, such as inventory, machinery or vehicles.

Covering expenses related to growing your team, advertising and marketing your business, staying up-to-date with your taxes and invoices, or anything else that’s required to keep your business running.

Developing opportunities to grow your business, such as renovating or changing your location, adding a new location, establishing a partnership, or acquiring another business.

One key difference between a personal loan and a business loan is the use of funds. In most cases, the proceeds of a business loan must be used for business purposes, such as purchasing equipment, hiring staff or stocking up on inventory. In contrast, the proceeds of a personal loan may be used for personal expenses, such as buying a car or renovating the kitchen.

Another difference is the application process and lending criteria. Whereas a personal loan may be based solely on your personal income, assets and credit rating, a business loan may take into account the cash flow, assets and even future earnings projections of your business.

Yes, it’s often possible to get a business loan if you have a poor credit rating, although it may require some extra steps, such as offering security or a personal guarantee.

Many business loans are made for exactly these purposes. If you have an idea for a new business, you may be able to secure funding based on your experience, business plan and other factors. If you know of an existing business that you wish to purchase, the financial history and future projections of the business will be considered as part of your application. There are lenders in Canada who are capable of providing business loans for either of these scenarios.

Yes, a business loan without collateral is known as an unsecured loan. These are common and there are many lenders who will provide this type of business loan. Since you are not pledging an asset as collateral, the lender will assess other factors when making the loan, such as your credit score and cash flow.

When you take out a secured business loan, you offer collateral to the lender such as real estate, vehicles or machinery. If your business stops making payments, the lender has the right to take the assets that were pledged as collateral.

When you take out an unsecured loan, there is no collateral. Instead, the lender will base the loan terms mainly on your credit history, income and cash flow projections.

Both types of loans are popular with small and medium-sized businesses in Canada.

A business loan is usually structured with a set interest rate, maturity date, and monthly payment. For example, a business loan with a 10-year term would be repaid in a series of 120 equal monthly payments. This makes it easy to plan your cash flow and know exactly when your debt will be paid off.

The Canada Small Business Financing Program makes it easier for small businesses to get loans from financial institutions by sharing the risk with lenders. Over the past 10 years, small businesses have received over 56,000 loans totalling $10 billion dollars. If you are concerned about your ability to qualify for a business loan in Canada, this program may be a good option.

Yes, small business lenders will almost definitely require a credit check, especially if you are personally guaranteeing the loan on behalf of the business.

If you’re wondering how to get a business loan, the first step is the application. There is a huge range of lenders offering loans to small and medium businesses, and they all have different eligibility criteria and application processes.

The requirements of your application will depend on the lender and the type of business loan you are seeking - with a secured loan, the lender will need information about you and your business, as well as about the asset you are offering as security.

You can get started in minutes when you join Swoop.

Related pages

Join the 95,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google Maps35 Bull Street, Lewis Building, Birmingham B4 6AF, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google MapsClever finance tips and the latest news

Delivered to your inbox monthly

Join the 95,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.