TABLE OF CONTENTS

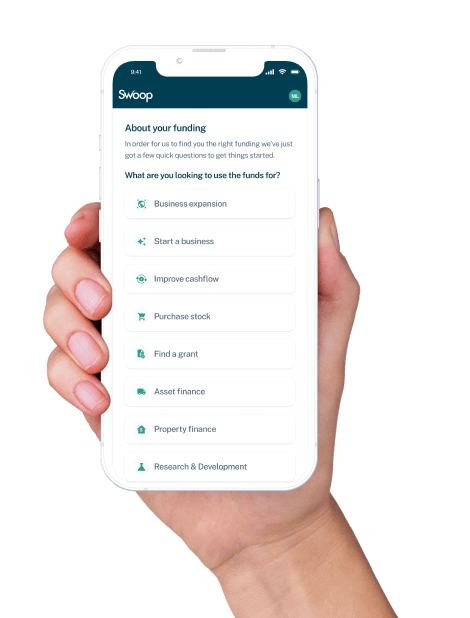

Speed through to business loans and other lending options – get your business rolling with Swoop

Swoop is a credit broker and does not provide capital. We work with a range of companies to offer clear comparisons that allow customers to make choices on financial products & services. Swoop may receive a commission, which may vary by product but typically in the form of a fixed percentage of the loan amount. For certain lenders, we do have influence over the interest rate, and this can impact the amount you pay under the agreement.

No matter if you’re a sole trader, a startup, or an SME, it’s likely that at some point in your business’ life, you’ll need extra funds to power growth. Instead of seeking cash investors, fast and cost-effective business loans can be a better option. Acquisitions, debt reduction, solid working capital. Stop waiting on slow cashflow or investors to expand. Boost your company’s growth with a loan that’s purpose-built for business needs.

A business loan is a form of borrowing designed for businesses, rather than individuals. Business loans enable you to borrow a lump sum of cash that you can then use to help your business get off the ground or to expand.

Business loans can be used for a variety of purposes, whether that’s to help you buy business premises, new equipment, company vehicles, cover salaries, improve cash flow or even consolidate existing debt.

A business loan enables you to borrow from £1,000 up to several million. With a traditional business loan, you borrow a lump sum that is then repaid in monthly instalments over several years, with interest added on top.

However, other types of borrowing can be repaid in as little as a few months. Interest rates and fees will vary according to the loan type provided and the borrower’s status.

A word from Andrea

"It’s no secret that businesses need funds to grow, however cost-effective business loans can be a better option than traditional cash investors. Business loans are often non-dilutive sources of funding, which means your company gets the injection of cash it needs without you giving away control of your business."

There’s a range of different business loans to choose from. Some, known as secured loans, require the borrower to provide security (collateral) to reduce the lender’s risk. Others, known as unsecured loans, do not.

You can usually borrow a larger amount and benefit from lower interest rates with a secured loan. But if you fail to repay your loan on time, you risk losing the asset you’ve used as collateral.

Common UK business loan types include:

A business loan calculator is a great starting point to understanding the cost of your loan. Use our free loan calculator below to work out your average monthly interest payments and the total monthly repayment amount, as well as the total interest paid and the total cost of the loan.

Your loan details

This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan.

Your results

Monthly payments

£-

Avg. monthly interest

£-

Total interest

£-

Total cost of finance

£-

The type of loan that’s right for your business depends on your business goals and circumstances. To help you decide, ask yourself the following questions:

You can also speak to our experts here at Swoop who will be more than happy to discuss the options with you.

Business loans are often repaid monthly, with interest, but some loans, such as a commercial mortgage, might be repaid quarterly. Many short-term loans, such as invoice financing or merchant cash advances, are repaid from incoming business receipts, so repayments will be quick and automatic.

Your repayments and your repayment period should be outlined in your loan documents.

Eligibility criteria will vary depending on the type of loan you’re applying for and the lender. Often your business must be based in the UK, and you may need to meet certain turnover requirements. If you’re applying for a secured loan, you also need to have sufficient assets to use as collateral.

To secure the very best interest rates you need a good credit score. Some lenders will still accept applicants with poor credit, but you may not be able to borrow as much, and interest rates will likely be higher.

The interest on business loan repayments is usually tax deductible, but the repayments of loan capital (the original amount borrowed) won’t be.

Interest is usually considered a business expense which means that as long as you’ve used the loan for business purposes only, you should be able to claim interest repayments as a tax deduction, lowering your tax bill.

Not all business lending is regulated by the Financial Conduct Authority (FCA), although some loan providers are. You can check whether your loan provider is regulated on the Financial Services Register.

Whether your loan provider is regulated or not, it’s important to always borrow from a reputable provider and it’s worth checking customer reviews before proceeding, as this can highlight any potential issues.

One of the biggest risks is not being able to repay your business loan. If you have poor credit or a limited credit history (if you’re a new business, for instance), you’re likely to pay a higher interest rate. This can make your loan repayments more expensive.

It’s therefore crucial to check you can afford to meet the loan repayments before you apply for a loan. If you’re unable to do so, you risk damaging your business credit score and, if the loan is secured, you could lose the asset you’ve used as collateral.

Additionally, keep in mind that if you’ve signed a personal guarantee, you will become personally liable for repaying the debt if your business can’t.

You can often apply for a business loan online or you may need to contact the lender by phone. When you complete the application, you’ll need to provide basic business information as well as certain paperwork. This often includes:

As part of the application, the lender may run a credit check on the business and its owners or directors.

If the lender is satisfied with the due diligence, they will make an offer, which sets out how much they will lend, the time-period for repayment, and what the interest rates and fees will be.

If the borrower accepts these terms, an agreement is drawn up and after signing, the funds are either paid into the borrower’s bank account or to a third party if the funds are for something like a commercial property purchase.

If you’re looking for a business loan, compare your options carefully, looking at eligibility criteria, borrowing amounts and interest rates.

If you’re feeling confused, Swoop is here to help. Register with Swoop today to find the best business loan for you.

When applying for a business loan, the better your credit score, the cheaper it is to borrow.

Swoop has joined forces with Credit Passport to rate your business’ credit. The service is free and does not affect your credit score.

Loan finance for business (or, more broadly, lending or ‘debt finance’) is a catch-all for any type of borrowing that you pay back, with interest and/or a fee. If your business needs to raise money (capital) you can either borrow from a lender (i.e. debt financing) or sell a share of ownership in your business in return for capital (equity financing). You can of course combine the two.

The reason that people often use broader term ‘debt finance’ rather than ‘loan finance’ is because some types of borrowing (e.g. operating leases or supplier finance) are not actually loans and don’t appear on your balance sheet. Whatever stage you are at in your growth story Swoop can match you to the right lending options, whether you’re looking for startup loans, working capital loans or even a loan to cover VAT costs. Your credit score isn’t impacted when you search for lending options with Swoop.

Lenders typically carry out a hard credit check when you apply for a business loan, and this can cause your credit score to temporarily drop. Some lenders may check the credit score of the business and the business owners or directors. Too many searches on your credit report in a short space of time can have a bigger impact on your credit score, so it’s best to space out applications by three to six months.

Yes, you may be able to repay your business loan early but be aware that some lenders charge early repayment penalties and fees for doing so. Check the small print of your loan before you proceed.

It depends on the type of loan. Some loans, such as merchant cash advances, can be agreed and paid into your bank account in one or two days. Other loans, such as asset financing, can take much longer.

Business loans can be used for a variety of purposes, whether that’s to cover dips in cashflow, pay salaries or buy inventory, vehicles, plant, and machinery. They can also help you to cover marketing costs, move to a new premises, or consolidate existing debt.

Yes, you might be able to get a business loan with bad credit, but you will have fewer lenders to choose from. Keep in mind that you might not be able to borrow as much as you’d originally hoped, and interest rates are likely to be higher if you have poor credit.

If you are in good standing with your current loan(s) and your cashflow shows you can afford the extra repayments, you may be able to top-up your business borrowing. In most cases, the application process for a top-up will remain the same as your original loan.

Business loans can be both secured and unsecured. Unsecured business loans will typically be for smaller amounts, with higher interest rates and shorter repayment terms.

Secured loans let you borrow more but require you to use an asset as security against the loan. Because this lowers the lender’s risk, interest rates are usually more competitive, and you can borrow over a longer term.

Your business loan term will vary depending on the value of your loan, the type of loan you take out and how much you are able to repay each month. Unsecured business loans can typically last between one and five years, while secured business loans might have a repayment term of up to 25 years.

There is no set minimum for the credit score you or your business needs to get a business loan. However, the higher it is, the more likely you are to get accepted for a loan and secure a better interest rate.

Lending criteria varies between providers and other factors such as your annual turnover and existing levels of debt will be considered too.

If you have previously been denied a business loan, it is important to take time to reassess your current financial situation. Applying for another business loan soon after being rejected for one can damage your credit score.

Take steps to improve your credit score by paying bills on time and paying off any existing business debts before you apply again.

As the number of female entrepreneurs continues to grow in the UK, alternative lenders and some government-backed lenders have schemes and funding solutions available specifically for women-led SMEs.

Related pages

Join the 70,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

We work with world class partners to help us support businesses with finance

Suite 42, 4th Floor, Oriel Chambers, 14 Water Street, Liverpool, L2 8TD

View in Google MapsKingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google MapsSuite 105A, Airivo, 18 Bennetts Hill, Birmingham, B2 5QJ

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google MapsClever finance tips and the latest news

delivered to your inbox, every week

Join the 70,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.

Thanks for requesting a call back

a member of the team will be in touch.