TABLE OF CONTENTS

It’s a full service that gives you the ability to offer payment solutions to your clients, allowing them to finance the purchase of any business asset or equipment.

The process is clear, simple, and fast. Plus you’ll get a dedicated expert (a business development manager) to guide you every step of the way.

Our panel of lenders is ever-growing. Whether your client is a small business, or large international organisation, we have a range of flexible and affordable options to suit.

Vendors are businesses that sell vehicles, machinery, equipment and other business assets to other businesses.

Vendor finance provides a facility for these dealers, manufacturers, resellers or suppliers to offer affordable asset finance to their customers.

To read about the differences between a vendor and supplier, click here.

Vendor finance is a method of asset finance offered by a seller, (vendor, supplier, manufacturer, reseller etc), to the buyer of their equipment or assets. By benefiting from asset finance, the vendor can offer an option to spread the cost of the asset to their customers. Some vendors may provide the capital for these loans themselves. Others may utilise the capital and services of an external finance provider.

A form of asset finance, vendor financing is an ideal way for these B2B equipment suppliers, manufacturers and resellers wishing to expand their sales network, maintain good customer relationships, and maintain profit margins.

Vendor finance is a facility that can help boost a vendors profitability by complementing the asset or equipment sales. Swoop for vendors can provide affordable and efficient financing solutions for the vendors’ customers.

No. Ownership of the equipment or asset is with the underlying bank or lender for the duration of the agreement.

It may be. Usually, the sold goods act as security for the loan, but in some cases, further security may be required, such as a Personal Guarantee.

The finance provider may repossess the asset or equipment that was sold, claim against assets used as supplementary collateral, or may be entitled to the buyer’s future cashflow.

Swoop for Vendors is a great solution for sellers who wish to accelerate their sales stream, increase turnover, and upsell equipment to increase the value of each sale. Plus, customers who benefit from this extra interaction and transaction value are more likely to become long-term clients who will buy again and again.

For buyers, vendor financing is an ideal way to get the equipment they need when they need it, instead of waiting for cashflow to improve.

Vendor financing is a great way to increase business opportunities and create long-lasting vendor/customer relationships. However, for vendors, setting up an in-house financing department can be costly and time-consuming, and it may place unwelcome strain on cashflow. Working with a lending partner who can provide the necessary capital, vendor lending experience and loan administration may be a better way to go.

Swoop has access to vendor-finance lenders, with terms and conditions to suit every vendor’s business situation. Make your business grow faster with the best vendor financing today.

We provide you with full training on how to use our platform and your clients with training on the benefits of a finance facility. We also offer additional and ongoing training as it's needed.

Each vendor will have a dedicated business development manager to support with any training, general queries and feedback.

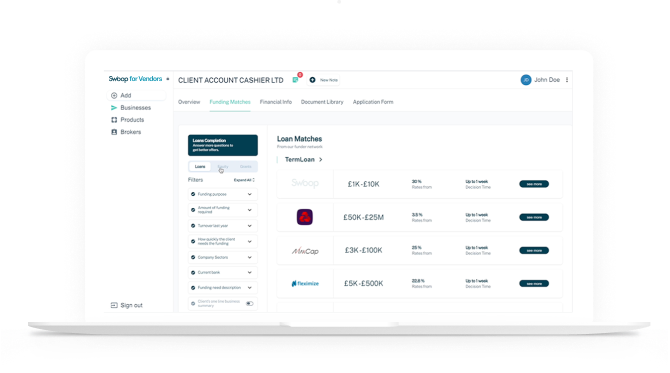

The Swoop for Vendors platform has been especially developed so that vendors can prepare and submit deals without appointed representative status for the FCA.

We know some vendors would prefer to have appointed representative status, and we are happy to provide it under Swoop’s FCA licence.

We can provide indemnity insurance. To learn more, please fill out the form that appears when you click 'Register your interest'.

We know that all vendors have different needs. With this in mind, we've created the following packages:

| Tech package | Access to the tech platform to allow client onboarding, bank and accountancy integrations, whole of market access, deal tracking, dynamic applications and deal submission. You'll also receive ongoing training and support from Swoop's specialist vendors team. |

| Tech + white label (own branded site) | Tech package + own branding on all client-facing software. A white label site enables the vendors to onboard clients with Swoop’s smart onboarding. |

Our dedicated vendor team will give you and your clients an efficient and professional service throughout the process. You can massively boost the competitiveness of your market position by offering our complete finance solution!

Chris is a freelance copywriter and content creator. He has been active in the marketing, advertising, and publishing industries for more than twenty-five years. Writing for Barclays Bank, Metro Bank, Wells Fargo, ABN Amro, Quidco, Legal and General, Inshur Zego, AIG, Met Life, State Farm, Direct Line, insurers and pension funds, his words have appeared online and in print to inform, entertain and explain the complex world of consumer and business finance and insurance.

Swoop promise

At Swoop we want to make it easy for SMEs to understand the sometimes overwhelming world of business finance and insurance. Our goal is simple – to distill complex topics, unravel jargon, offer transparent and impartial information, and empower businesses to make smart financial decisions with confidence.

Find out more about Swoop’s editorial principles by reading our editorial policy.

Join the 95,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

We work with world class partners to help us support businesses with finance

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google Maps35 Bull Street, Lewis Building, Birmingham B4 6AF, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google MapsThanks for requesting a call back

a member of the team will be in touch.