TABLE OF CONTENTS

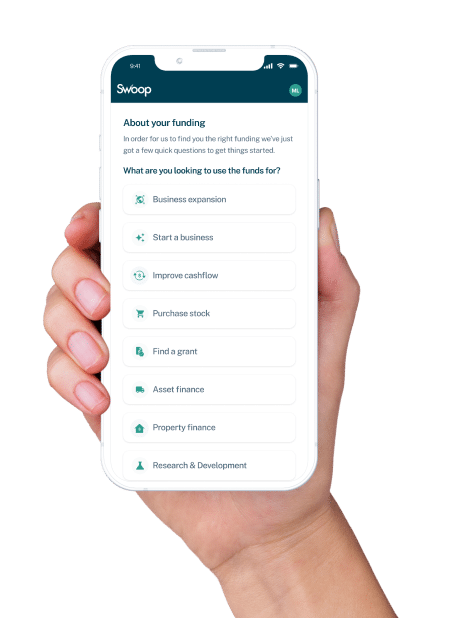

Speed through to business loans and other lending options – get your business rolling with Swoop

Loans

Equity

Grants

Swoop is a credit broker and does not provide capital. We work with a range of companies to offer clear comparisons that allow customers to make choices on financial products & services. Swoop may receive a commission, which may vary by product but typically in the form of a fixed percentage of the loan amount. For certain lenders, we do have influence over the interest rate, and this can impact the amount you pay under the agreement.

No matter if you’re a sole trader, a startup, or an SMB, it’s likely that at some point in your business’ life, you’ll need extra funds to power growth. A business loan can fund your start-up, finance your investments, cover expansions and acquisitions, or boost your working capital.

A business loan is a financial product that allows businesses to borrow money, typically from banks, credit unions, and online lenders, although some loans may come from private sources. Business loans can be used for many purposes such as mergers and acquisitions, purchasing equipment and vehicles, managing cash flow, or covering operational costs. Business loans typically come with a range of fees, plus fixed or variable interest rates and repayment schedules that can run from a few days up to 25 years.

There are many types of small business loan. Popular options include:

An SBA loan is a loan that is issued and partially backed by the US Small Business Administration (SBA). The SBA helps small businesses gain access to the capital they need to start, grow, and expand their operations. SBA loans typically come with competitive interest rates and long repayment terms, with some loans specifically designed to support minorities and groups who traditionally encounter difficulty obtaining regular business financing.

Popular SBA loans include:

The most common type of SBA loan, providing up to $5 million in funding with repayment terms of up to 25 years. These loans are 85% backed by the US government, which reduces the risk for lenders. However, strict eligibility criteria apply, collateral or a personal guarantee is usually required and the approval process could take several months.

Designed for faster approval, offering up to $500,000 with an approval decision typically made within 36 hours. Express loans are 50% backed by the U.S. government, which increases the risk for lenders and may result in higher interest rates and fees. The same eligibility criteria usually applies.

Available through nonprofit and community-based lenders, offering up to $50,000 with more relaxed eligibility requirements. They can be a good fit for businesses and start-ups who need smaller amounts of funding or who may struggle to qualify for other financing options. Collateral or a personal guarantee may be required.

With a business term loan, you receive a single, lump-sum cash injection which you pay back in regular instalments, plus interest and any fees, over a fixed period of up to 25 years. Instalments may be weekly, monthly or quarterly depending on the type of business you operate.

Some term loans may be unsecured, so you do not provide collateral to protect the lender if you default. Other term loans – typically for larger sums or for riskier businesses – may require security. This means you pledge assets such as property, vehicles or machinery to protect the lender from loss. If your business defaults on the loan, the lender can seize these assets and sell them to recover their money.

Interest rates on unsecured term loans tend to be higher and the amount you can borrow will usually be smaller than you may find with loans where you provide collateral.

A business line of credit, also known as a revolving line of credit, is a loan that functions like a high-value credit card. Businesses can withdraw cash as they need it, when they need it up to the limit of their borrowing. You may repay the line with regular instalment payments or with irregular payments from received income and you can withdraw the repaid cash again if needed. Unlike term loans, with a line of credit you only pay interest on the sums you have withdrawn, not the whole loan total. This can significantly reduce your borrowing costs.

Equipment finance falls into two classes – loans to buy the equipment, and leases that are long-term equipment rental agreements:

You borrow a sum of cash to buy the equipment and then repay it over time. Interest charges and fees are added to the principal amount you borrow, while the lender retains a lien on the machinery during the term of the loan. At contract end you’ve paid off the loan and you own the equipment outright.

With a lease, you’re not buying the equipment, you’re entering into a long-term rental agreement. Depending on the type of lease you choose, (finance lease or operating lease), you may have the option to buy the machinery at contract end for a pre-agreed sum, (which could be as low as $1 but is typically the residual value of the machine – which means what it’s worth in used condition).

Because you’re not repaying the whole cost of the equipment, leasing usually requires lower monthly payments than a business loan. You may also pay a smaller down payment – perhaps equal to only one or two months repayment instalments.

If you choose not to buy the machinery at the end of the lease, (or you have chosen an operating lease that typically forbids it), the equipment goes back to the lender. You would then need to take out a new lease and obtain new machinery. (Which could allow you to obtain more modern and up to date equipment).

Some lessors (lenders) may give you the option to extend the lease if you prefer to keep the machinery but do not wish to pay the residual.

Commercial real estate loans can be used to buy, construct, or develop business property and land. Popular loans include:

Use a commercial mortgage to buy land or existing property over an agreement term of up to 25 years.

Commercial bridge loan

Commercial bridge loans are flexible, short-term loans that organizations can use to cover a temporary shortfall in funding. Bridge loans can ‘bridge the gap’ between selling one property and buying another, or cover construction and renovation costs.

Use a construction loan to cover the cost or new-builds or the redevelopment or refurbishment of an existing commercial property.

A business loan calculator is a great starting point to understanding the cost of your loan. Use our free loan calculator below to work out your average monthly interest payments and the total monthly repayment amount, as well as the total interest paid and the total cost of the loan.

Your loan details

This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan.

Your results

Monthly payments

$-

Avg. monthly interest

$-

Total interest

$-

Total cost of finance

$-

Further ways to fund your business:

Also known as invoice financing, this type of loan allows you to borrow against the value of your unpaid invoices and it can be a solid option for businesses that lack other forms of collateral. Instead of waiting 30, 60, or 90 days to get paid, the lender may provide up to 95% of your invoice value within a few days or even hours of the bill being raised. Your invoices act as security for the loan, no added collateral is required.

Personal loans for business function similarly to business term loans – you receive a lump sum of money and repay it over time. However, personal loans tend to have lower borrowing limits, higher interest rates, and more rigid repayment terms compared to business loans. Collateral may be required.

Merchant cash advances are suitable for businesses that accept customer payments by credit and debit card. Borrow against the value of your card sales. As your card sales increase, your borrowing limit goes up. Pay the loan back with a fixed percentage of your card sales on a daily, weekly or monthly basis. Your sales act as security for the loan, no added collateral is required.

Revenue-based financing functions like a merchant cash advance but with higher borrowing limits. Based on the size and regularity of their total revenues, (credit card sales plus other income), businesses typically receive a lump sum and pay it back over a short-term schedule, sometimes by small deductions from their daily sales. No added collateral is required.

Interest rates for business loans start at 5%. However, the rate you pay will be determined by the type of loan you choose, your credit and financial profile, your type of business, and the sums you need to borrow. Keep in mind that unlike consumer loans, business loans are tailored to your unique business circumstances. Few business loans are exactly alike.

Business loans up to $10million are available. However, the amount you can borrow will be decided by factors unique to you and your business. Additionally, the structure of your business loan – for example is it a term loan or a merchant cash advance – will impact the sum you can borrow.

Only you can say if a business loan is right for your business. The fact is, if you need extra funds you have four basic options – bring in external investment, use personal savings or borrow from family or friends, apply for a business grant, or take out a business loan. If you’re not comfortable with the first two options and you can’t wait for a grant to come through, then a loan may be your best option. However, you should never take out a loan that you may struggle to repay, and you must ensure your cash flow can handle the extra payments that a business loan demands. Lastly, before you consider a business loan you should ask yourself a question – what will the loan do for my business? If you have a clear and positive use for the funds, a loan may be right for you.

If you’re borrowing because your business is in distress you are probably making the situation worse and you should look to other options – such as cost cutting or seeking a business partner – before opting for a loan.

The terms and conditions on business loans can vary significantly, so shopping around for the best deal is essential. You can do this by approaching banks, credit unions and online lenders one by one over days, weeks, or even months, or you can use the services of a loan marketplace that can quickly introduce you to a choice of financing offers from a range of lenders. Some marketplace platforms can also give you advice and help you with the application process. This can be especially useful for borrowers who have never taken out a business loan before.

Lenders will typically consider a range of factors before approving a business loan request. Key factors they may look at include:

Working with business finance experts can make all the difference when applying for funding. Contact Swoop to discuss your borrowing needs, get help with your application and to compare top quality business loans from a choice of lenders. Give your business the boost it deserves. Register with Swoop today.

Related pages

Join the 95,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google Maps35 Bull Street, Lewis Building, Birmingham B4 6AF, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google MapsClever finance tips and the latest news

Delivered to your inbox monthly

Join the 95,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.