TABLE OF CONTENTS

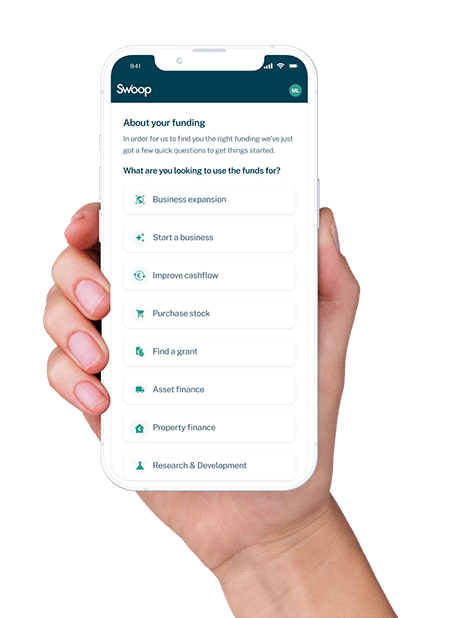

Speed through to business loans and other lending options – get your business rolling with Swoop

Swoop is a credit broker and does not provide capital. We work with a range of companies to offer clear comparisons that allow customers to make choices on financial products & services. Swoop may receive a commission, which may vary by product but typically in the form of a fixed percentage of the loan amount. For certain lenders, we do have influence over the interest rate, and this can impact the amount you pay under the agreement.

No matter if you’re a sole trader, a startup, or an SME, it’s likely that at some point in your business’ life, you’ll need extra funds to power growth. Instead of seeking cash investors, fast and cost-effective business loans can be a better option. Acquisitions, debt reduction, solid working capital. Stop waiting on slow cashflow or investors to expand. Boost your company’s growth with a loan that’s purpose-built for business needs.

A business loan calculator is a great starting point to understanding the cost of your loan. Use our free loan calculator below to work out your average monthly interest payments and the total monthly repayment amount, as well as the total interest paid and the total cost of the loan.

Your loan details

This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan.

Your results

Monthly payments

€0

Weekly payments

€0

Daily payments

€0

Avg. monthly interest

€0

Total interest

€0

Total cost of finance

€0

Borrow €Loan finance for business (or, more broadly, lending or ‘debt finance’) is a catch-all for any type of borrowing that you pay back, with interest and/or a fee. If your business needs to raise money (capital) you can either borrow from a lender (i.e. debt financing) or sell a share of ownership in your business in return for capital (equity financing). You can of course combine the two.

The reason that people often use broader term ‘debt finance’ rather than ‘loan finance’ is because some types of borrowing (e.g. operating leases or supplier finance) are not actually loans and don’t appear on your balance sheet. Whatever stage you are at in your growth story Swoop can match you to the right lending options, whether you’re looking for startup loans, working capital loans or even a loan to cover VAT costs. Your credit score isn’t impacted when you search for lending options with Swoop.

Related pages

Join the 110,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

We work with world class partners to help us support businesses with finance

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google Maps

Clever finance tips and the latest news

Delivered to your inbox monthly

Join the 110,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.