TABLE OF CONTENTS

China is now the world’s largest exporter of goods. Around 25% of Australia’s manufactured imports come from China. If you’re also thinking about working with Chinese suppliers, you first have to consider the process of importing the goods from China to Australia as it can be a daunting process involving many steps.

Page written by Ian Hawkins. Last reviewed on October 18, 2024. Next review due July 1, 2026.

You can import a lot of goods from China, given its manufacturing capabilities and product offerings. China is known for producing various products across industries, including electronics, textiles, machinery, furniture, toys, clothing, footwear, home appliances, and consumer goods. Additionally, China is a leading exporter of industrial components, raw materials, and goods used in manufacturing processes worldwide. Overall, the range of goods available for import from China is extensive, offering businesses a wide range of products to suit their needs and preferences.

Importing from China is a common business practice for various reasons. China is known for its vast manufacturing capabilities, offering a wide range of products at competitive prices. The country has a robust infrastructure, skilled workforce, and efficient supply chains, making it a cost-effective source for goods across industries.

China’s large-scale production capacity allows businesses to access economies of scale, reducing production costs and improve profitability. Furthermore, China’s network of suppliers and manufacturers provides businesses with a wide range of products and customisation options to meet specific market demands.

Importing from China also allows businesses to capitalise on the country’s technological advancements and innovation, particularly in sectors such as electronics, textiles, and machinery. Overall, importing from China offers businesses access to high-quality products, competitive pricing, and different sourcing options, making it a popular choice for companies looking to optimise their supply chains and remain competitive in the global marketplace.

You can have the products shipped by air or sea. Do consider that sea freight is way cheaper than air freight.

The shipping fee for sea freight is based on the weight of the goods and cubic metres. Ask your supplier to provide you with an estimate for the weight and cubic metres of your stock once it is packaged and ready for export. You can choose between two modes of shipment– either FCL (Full Container Load) or LCL (Less than Container Load). Shipments via LCL usually take longer since the goods have to be consolidated at the source port then de-consolidated upon arrival at the destination port. Although it takes a bit longer, it’s also way cheaper. With FCL, you’re booking a full container which only makes sense if the load consists of at least 15 CBM.

The sea freight cost from China to Australia per 20-foot container may amount to $900. For LCL, the estimated cost is $18-$38 per cubic metre. You need to book at least 1 cubic metre. For smaller goods, the cost is around $2.5 per kilogram with a minimum order quantity of 1 kilogram. It’s best to choose sea freight if you’re shipping large items. Sea freight containers are cheaper and also offer more security and protection to your cargo. However, the transit times are definitely longer, usually 30-40 days. If you want fast shipping, air freight can be a better option.

Air freight shipping from China to Australia usually takes 5-10 days. It takes longer than express freight services since the goods undergo more complex processes like customs clearance and cargo handling among other factors like weather conditions, carrier capacity, and flight schedules.

Freight rates depend on the carrier, so make sure to do your research to get the latest estimates. You’d usually have to pay for air freight plus surcharges. Air freight calculations usually depend on the chargeable weight. There are five main classifications: +45KG, +100KG (goods over 100KG) +300KG, +500KG, +1000KG. If there’s no corresponding freight level, the air freight rate is calculated based on the TACT price.

Freight rates will differ between carriers, so make sure you do your research. The costs also

vary depending on the seasonality. During low season, the rates are cheaper, and during peak season, air freight rates may also shoot up. In general, air freight rates from China to Australia sit around $4-$7 per kilogram. For smaller items such as documents and other important papers, air freight is usually the better option. For larger shipments, sea freight is the more cost-effective choice.

Another thing you need to consider when shipping goods from China to Australia is the Customs Value. It’s used to determine how much custom duties you have to pay to the Australian Border Force. There’s a fixed processing fee per import, and the total charge is based on the shipment’s Customs Value.

Customs Value is derived from the total value of all items in your shipment, and the Customs

Duty is calculated as a percentage of the Customs Value. It ranges between 0% and 10%, but

for most shipments from China to Australia, the average rate is around 5%.

So, if the Customs Value of the shipment is $10,000, the total Customs Duty you need to pay for is $500. If you want a more accurate estimate, look up your product’s HS Code or ask your manufacturer for it. Then, click here to find the applicable duty rate.

For taxable supplies and importations, you also need to pay for GST or Goods and Services Tax. This is a mandatory fee whether or not you’re GST-registered. However, shipments that are for warehousing purposes aren’t liable for GST until they’re cleared from the warehouse for ‘home consumption’. There are also certain exemptions like for medical supplies, certain food items, or low-value import thresholds. Currently, the classification for low-value import is set at $1,000.

Goods and services tax is 10% of the Taxable Importation. You can get the taxable importation value by adding up the following:

For example:

Taxable Importation = 10,000 + 500+ 800 + 25 = $11,325

Goods And Service Tax (GST) = 10% * 11,325 = $1,132.5

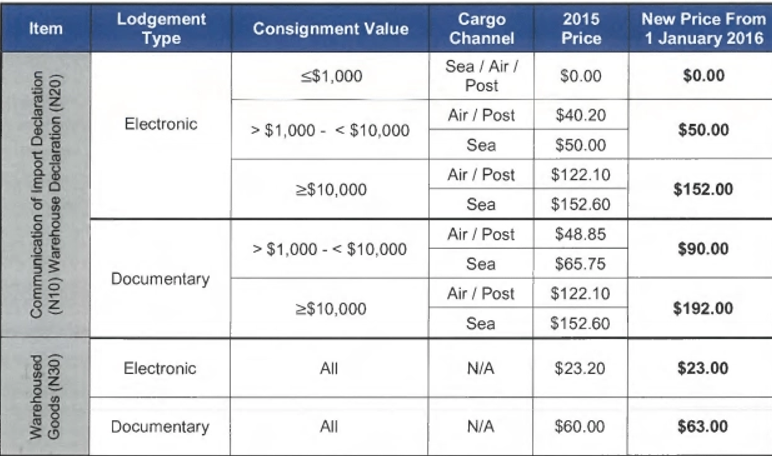

Customs will also charge processing fees although some are only applicable to certain types of goods. The import processing charge is based on the consignment value of the shipment. If you want to save more, electronic import declarations are much cheaper than document submission.

Making payments to Chinese suppliers involves several common methods that make sure that the transaction is secure.

One option is to use international wire transfers through banks. This method involves transferring funds electronically from an Australian bank account to the supplier’s bank account in China. While wire transfers are widely accepted and relatively straightforward, they may incur fees and take several business days to process.

Another popular payment method is using online payment platforms. These platforms offer easy ways to transfer funds internationally, often with lower fees and faster processing times compared to traditional bank transfers. However, it’s important to verify whether the supplier accepts payments through these platforms and consider any associated fees or currency conversion charges.

Additionally, letters of credit and documentary collections can provide added security for international transactions. LCs involve a bank guaranteeing payment to the supplier upon the fulfilment of certain conditions specified in the letter of credit. Documentary collections involve the transfer of shipping documents through banks, making sure that the payment is made upon receipt of goods.

It’s important to communicate clearly with the supplier regarding preferred payment methods, currency preferences, and any additional fees or requirements related to the transaction.

To ship goods from China to Australia, you need to submit the required documentation set by Australia’s Customs authorities. You need to secure the following:

Commercial invoices outline all the export transaction details and the shipping terms including the HS codes and value of the goods, the identities of both the importer and exporter, the weight and quantity of the goods, the total invoice value, and payment terms.

This serves as the exporter’s checklist. The Customs and other relevant parties will also use it to ensure that the shipment has been properly packed and is good to go. All the key details are laid out including the commercial invoice number and importer and exporter details as well as the items’ quantity, weight, measurements, and description– even the types of packaging used (e.g. carton, box, vials, etc.)

You also need the Certificate of Origin to clear Customs. It shows the origin of both the manufacturing and shipping. This document allows Customs to establish whether or not the importation is legal and whether or not you’re qualified for special conditions in terms of tax & duty obligations.

You’ll also be required to fill in a SAC declaration/ import declaration which indicates the nature of the goods being imported, the identity of the importer, the method of transportation, and the tariff classification as well as customs value. If the import value is less than $1,000, you’ll fill in the SAC or Self-Assessed Clearance Declaration. If the import value is over $1,000, you need the import declaration.

The Packing Declaration describes the shipment’s packing materials. Certain packing materials like straw, wood, or bark may be at risk for fungi or pest infestation which is a problem for ocean freight whose transit times take longer. To avoid such risks, importers need to fumigate vulnerable packing materials and present a fumigation certification on top of the Packing Declaration.

Australia doesn’t require companies or individuals to have an import license to ship goods into the country. However, certain goods, no matter the value, necessitate permits to clear the goods from customs control. You may also have to obtain certificates or permits from relevant regulatory bodies including the Therapeutic Goods Administration or the Department of Agriculture, Water and the Environment. To verify the applicable regulations, check the Australian Border Force (ABF) website or consult with a licensed customs broker.

The customs import duty rate ranges from 0-10%, but most goods incur a 5% charge in Australia. There are some cases where VAT and Duty relief are applicable like for products shipped for sampling purposes.

The transit times are usually as follows:

The expected costs depend on the mode of shipping:

The ChAFTA is a bilateral FTA (Free Trade Agreement) between China and Australia. This is

meant to liberalise economic flows between the two countries; reduce trade barriers; increase Australian exports; and facilitate trade via streamlined customs processes.

Importing from China to Australia doesn’t require an import license, but certain requirements and regulations apply depending on the goods in question. Visit the ABF website to verify the categories of goods and the corresponding regulations.

It depends on the shipping mode used. For smaller shipments, you may not have to work with a customs broker. However, if you’re dealing with important shipments crucial to your operations, any delay or mistake can be costly. Also, import paperwork can be quite exhaustive, and a customs broker can help sort all the required documentation.

If you don’t have your own transportation infrastructure or don’t know how to manage freight logistics, hiring a freight forwarder can come in handy. They can help you optimize the shipment, ensure timely deliveries, and minimize expenses. They make sure that all goods are transported in the safest, most efficient, and most cost-effective way.

From customs duty to taxes and processing fees, importing from China is both costly and complicated. Plus, many clients operate on credit which further slows down businesses’ cash flow. This is where financing services like import finance come in handy. Business Finance solutions like Swoop provide funding to importers to afford shipping goods from overseas.

For businesses that are struggling with cash flow issues, import financing can be a huge help. It can fund up to 100% of your overseas purchases– freight costs, customs duty, and taxes included. It’s also easier and faster to access as compared to regular business loans. If importing from China to Australia is beyond your means, access import financing today!

We offer simple, secure, and blazing-fast business finance. Get started today and get matched with the best funding options for your business.

Ready to grow your business? Sign up and solve your cash flow problems in one fell swoop!

Ian Hawkins is Head of Content at Swoop. As a freelance business journalist and filmmaker he has reported from Europe, Central and North America and Africa. His films and writing have appeared on BBC World, Reuters and CBS, and he has spoken at conferences on both sides of the Atlantic on subjects including data, cyber security, and entrepreneurialism.

Swoop promise

At Swoop we want to make it easy for SMEs to understand the sometimes overwhelming world of business finance and insurance. Our goal is simple – to distill complex topics, unravel jargon, offer transparent and impartial information, and empower businesses to make smart financial decisions with confidence.

Find out more about Swoop’s editorial principles by reading our editorial policy.

Related pages

Ready to grow your business?

Get your free Importing from China to Australia quote today

Join the 95,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google Maps35 Bull Street, Lewis Building, Birmingham B4 6AF, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google MapsClever finance tips and the latest news

Delivered to your inbox monthly

Join the 95,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.