TABLE OF CONTENTS

Page written by Chris Godfrey. Last reviewed on February 20, 2026. Next review due July 1, 2027.

The old saw that says advertising pays still rings true. Getting your business name out there, building awareness for your products and services and creating a brand identity that draws in your customers are essential actions to succeed. However, marketing activities can be expensive and for businesses without deep pockets, using valuable working capital to fund an ad campaign or promotion can be risky.

Business marketing loans are designed to overcome this problem. Don’t put strain on cash flow. Borrow the funds you need to put your business name up in lights.

A business marketing loan is a type of financing designed to help businesses fund advertising, branding, and promotional activities to attract customers and increase sales. Businesses use marketing loans to enhance brand awareness, launch new products, or expand into new markets. These loans can be short- or long-term, secured or unsecured, with repayment terms that vary from lender to lender.

Marketing loans can be used to fund almost any type of marketing activity:

You can also use marketing loans to cover the costs of hiring professional ad agencies, videographers, photographers, PR agencies and more.

There are many types of business marketing loan. Popular options include:

Term loans are the most common type of commercial loan. Offered by traditional banks, credit unions and online lenders, these loans are typically used for one-off investments where borrowers know exactly how much cash they need. You receive a single, lump-sum cash injection and then pay it back in regular instalments over a fixed period. Collateral may be required.

Also known as a revolving line of credit, this is a loan that functions like a high-value credit card but comes with lower interest rates and fees. Borrowers can withdraw as much as they want when they want from a loan facility up to the limit of their borrowing. Collateral may be required.

Available for businesses that accept customer payments by credit and debit card. With a merchant cash advance businesses borrow against the value of their card sales. As their card sales increase, their borrowing limit goes up. The loan is paid back via a fixed percentage of card sales on a daily, weekly or monthly basis. The card sales act as security for the loan, no added collateral is required.

Revenue-based financing is similar to a merchant cash advance but with higher borrowing limits. Based on the size and regularity of their total revenues, (not just their credit card sales), businesses may receive a lump sum and pay it back over a short-term schedule, typically by small deductions from their daily sales. This type of loan can usually be secured quickly as qualification rules are less intensive and credit scores are not so critical. The loan may also be structured as subordinated debt which can keep the pressure off existing and future banking relationships. Collateral may be required.

Eligibility criteria for business marketing loans varies by lender and the type of loan. However, common factors that influence qualification include:

Typical documentation requirements include:

The interest rate, fees, and terms and conditions of marketing loans can vary significantly. Shopping around before settling on a deal is essential. You can do this by approaching banks, credit unions and online lenders one by one over days, weeks, or even months, or you can use the services of a loan marketplace that can quickly introduce you to a choice of marketing loan from a range of lenders.

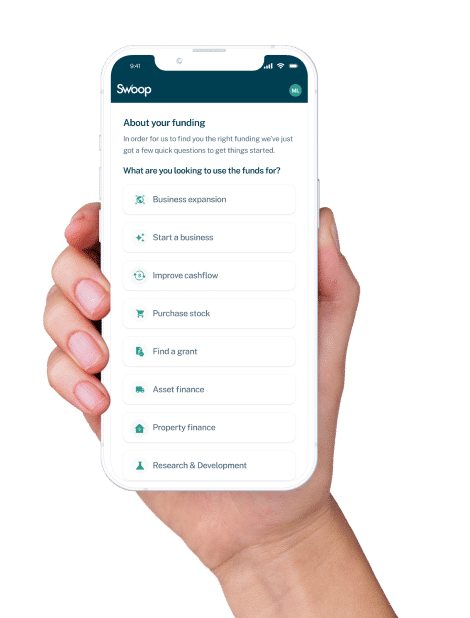

Some marketplace platforms can also give you advice and help you with the application process. This can be especially useful for business owners who have never taken out a marketing loan before.

Working with business finance experts can make all the difference when applying for a marketing loan. Contact Swoop to discuss your borrowing needs, get help with your application and to compare high-quality marketing loans from a choice of lenders. Make your business famous. Register with Swoop today.

Written by

Chris is a freelance copywriter and content creator. He has been active in the marketing, advertising, and publishing industries for more than twenty-five years. Writing for Barclays Bank, Metro Bank, Wells Fargo, ABN Amro, Quidco, Legal and General, Inshur Zego, AIG, Met Life, State Farm, Direct Line, insurers and pension funds, his words have appeared online and in print to inform, entertain and explain the complex world of consumer and business finance and insurance.

Swoop promise

At Swoop we want to make it easy for SMEs to understand the sometimes overwhelming world of business finance and insurance. Our goal is simple – to distill complex topics, unravel jargon, offer transparent and impartial information, and empower businesses to make smart financial decisions with confidence.

Find out more about Swoop’s editorial principles by reading our editorial policy.

Related pages

Ready to grow your business?

Get your free Business loan for marketing quote today

Join the 110,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google Maps

Disclaimer: Swoop Finance Pty Ltd (ABN 52 644 513 333) helps Australian firms access business finance, working directly with firms and their trusted advisors. We are a credit broker and do not provide finance products ourselves. All finance and quotes are subject to status and income. Applicants must be aged 18 and over and terms and conditions apply. Guarantees and Indemnities may be required. Swoop Finance Pty Ltd can introduce applicants to a number of providers based on the applicants’ circumstances and creditworthiness, we may receive a commission or finder’s fee for effecting such introductions. Swoop Finance Pty Ltd does not provide any kind of advice and in giving you information about providers products, we are not making any suggestion or recommendation to you about a particular product. Offers of finance are subject to a separate assessment process by the provider and subject to their terms and conditions. If you feel you have a complaint, please read our complaints section which is contained within our terms and conditions.