TABLE OF CONTENTS

Tax season — a time that can feel overwhelming for many self-employed clients and small business owners facing substantial self-assessment tax bills. But as their advisor, you have the option to offer a solution that helps them avoid the stress of it all — Self-Assessment Tax Funding.

Here’s why this type of tax funding is important, and how Swoop can help make it simple for you and your clients.

Unlike traditional employees, self-employed individuals and small business owners must calculate and pay taxes directly to HMRC, with the annual Self-Assessment Tax Return due by January 31st. For many, this deadline can cause stress and confusion — not only in calculating what’s owed but also in coming up with a large lump sum at the start of the year, which can be tough when cash flow is tight.

Self-Assessment Tax Funding offers a practical solution to this. It covers the tax payment upfront on behalf of the self-employed business owner, allowing them to spread the repayments over a more manageable timeframe.

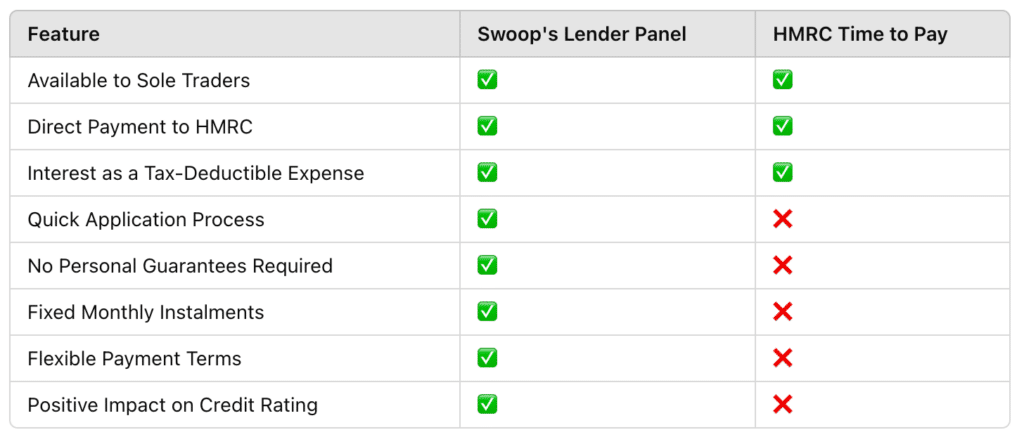

When it comes to self-assessment tax funding, Swoop’s network of specialist lenders offers options that can often be more flexible and beneficial than HMRC’s Time to Pay (TTP). Here’s why it might be a better alternative for your client:

Flexible repayment terms: HMRC’s TTP arrangement has strict criteria that may not suit every client. Through Swoop’s extensive lender network, your clients can access a variety of repayment options that are better aligned with their cash flow needs.

No Personal Guarantees required: Unlike some TTP agreements, the funding available through Swoop’s partners doesn’t require personal guarantees, helping your clients avoid exposing personal assets.

Potential positive impact on credit score: Choosing funding via Swoop’s lenders can potentially help clients build a positive credit history and greater access to other funding products. Whereas, Time to Pay arrangements may not have the same effect.

Competitive interest rates and no penalties: Due to the vast network of options, Swoop’s platform offers a competitive interest rate environment, better serving the end client. Additionally, you won’t incur any potential penalties associated with TTP’s rigid terms, giving clients a cost-effective and more manageable repayment plan.

Partnering with Swoop means giving your clients a trusted pathway to meet their tax obligations with ease, be it self-assessment tax funding and beyond. Our mission is to enhance your access to funding, streamline advisor workflows, and provide clients with a smooth, digital experience that saves both time and money.

Interested in learning more about self-assessment tax funding? Reach out to our team — we’d love to support you and your clients through a stress-free tax season.

Related pages

Get your free Self assessment tax funding quote today

Join the 110,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

We work with world class partners to help us support businesses with finance

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google Maps

Swoop Finance Limited helps UK firms access business finance by working directly with businesses and their trusted advisors. We act as a credit broker, not a lender, and do not provide loans or finance products ourselves. We introduce applicants to a panel of lenders, equity funds, and grant agencies based on individual circumstances and creditworthiness.

Commission Disclosure: We typically receive a commission from the finance provider (either a fixed fee or a fixed percentage of the amount you receive) upon successful placement. Different providers pay different rates. For certain lenders, we may have influence over the interest rate, which can impact the total amount payable under your agreement.

Regulatory Information:

FCA: Authorised and regulated by the Financial Conduct Authority as a credit broker (FRN: 936513) and registered as an Account Information Services Provider (Ref: 833145).

ICO: Registered with the Information Commissioner’s Office (Ref: ZA600162); registration can be verified at ico.org.uk.

Company Details: Registered in England & Wales with Companies House (No. 11163382). Registered Address: The Stable Yard, Vicarage Road, Stony Stratford, Milton Keynes, MK11 1BN. VAT Number: 300080279.

Terms: All finance and quotes are subject to status, income, and terms and conditions. Applicants must be aged 18 or over. Guarantees and indemnities may be required. Please refer to our terms and conditions and our complaints procedure for further details.

Clever finance tips and the latest news

Delivered to your inbox monthly

Join the 110,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.

Thanks for requesting a call back

a member of the team will be in touch.