Right now, the UK’s economic outlook is relatively unsure. We’re in a period of cautious optimism, with adjustments being made in the wake of new inflation rates, but many startups are still facing obstacles when it comes to getting the right funding from investors. Although the UK has shown a 0.7% GDP growth in early 2025, many small businesses are still struggling with debt and economic challenges.

To better understand how startups are navigating this environment, we’ve analysed data from more than 114,000 businesses to uncover the truth about lending, funding, and debt in 2025. Our UK startup finance report covers all the areas you need to know about when it comes to starting a business and securing funding. Here’s what our researchers uncovered:

Where are UK startups holding the most debt?

As much as we’re looking at the state of startups across the UK, each city has its own diverse economy, and small businesses are likely to thrive in certain areas more than others. So, which cities and industries are experiencing the worst debt in 2025?

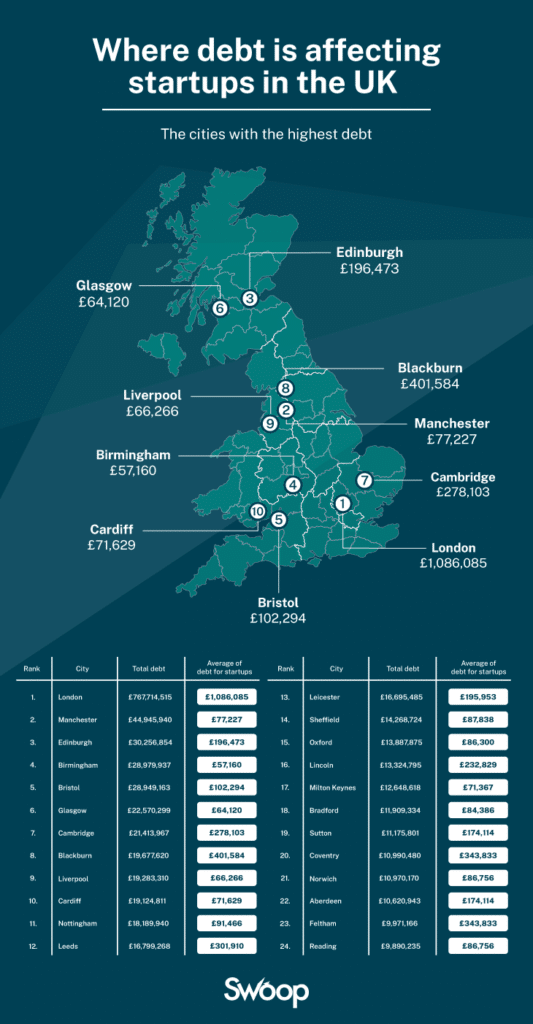

The cities with the highest debt

As you might expect, London is the city with the highest total debt in the UK. Across more than 5,500 startups in the capital, over £750,000,000 of debt has been accumulated. That’s an average of £136,403 of debt per startup. By comparison, Manchester’s total debt adds up to £46,802,735 – a fraction of London’s financial troubles.

London is not the only city with a high average debt, however. Blackburn is another forerunner, with £401,584 owed on average by its 49 startups. Oxford has 46 startups listed on our platform in the area, with an average of £301,910 in debt across each of them. Meanwhile, Cambridge’s average debt adds up to £273,160 across its 79 businesses, with a total of £21,579,655 owed.

Some areas stand out as having high average debt despite being home to fewer startups. Wokingham, for example, has a total debt of more than £13 million despite being home to just 17 startups. Compared to other major cities, such as Newcastle (£6.1 million average debt across 128 startups) and York (£6.8 million average debt across 81 startups), it’s a surprising outlier given the size of the town.

While London experiences the most debt overall, the fact that smaller areas can still amass large amounts of debt suggests that they’re more reliant on outside funding, which often can’t be returned given the size of the local economy. This shouldn’t discourage startup leaders from establishing their businesses away from the capital, however, as some areas away from London have proven financially successful.

The industries with the highest debt

When it comes to the industries that borrow the most money, wholesale and retail trade ranks as the sector with the most debt in the UK. With 4,908 startups listed in the industry, more than £373 million is owed in total. This industry is also the most common listing on our platform, suggesting that an oversaturated market could play a role in its struggles to return on funding.

Finance and insurance ranks as the industry with the second-highest amount of debt, with roughly £312 million owed across its 360 businesses. With a smaller market share, its average debt per business is much higher than other industry sectors towards the top of our rankings.

Information and communication businesses have a total of £262 million in debt, placing it in third, while real estate (£239 million) and professional, scientific, and technical activities (£234 million) rank fourth and fifth, respectively.

Some sectors with particularly expensive barriers to entry, such as construction (which ranks sixth), require plenty of funding to get off the ground. This might play a part in why these industries amass so much debt, as startups need major investments to break into their field.

By comparison, startups in fields with less competition and smaller investments are able to make returns without becoming swamped in debt. Sport, biotech, and fashion rank as some of our industries with the least total debt.

How does startup debt differ by gender?

When comparing the gender of startup leaders, female-led businesses account for just 19% of companies and only 8% of total debt. Meanwhile, male-led startups account for 60% of businesses and 61% of total debt. The remaining 21% of businesses were either led by both men and women or didn’t have any gender data available.

This shows that there are still significant barriers facing female-led startups when it comes to securing funding, as they take up a much smaller portion of the market than male-led or mixed businesses. Women could be held down due to access to funding, barriers in the hierarchical structure of their companies, or even a different attitude towards taking risks than male leaders who experience fewer struggles in their roles.

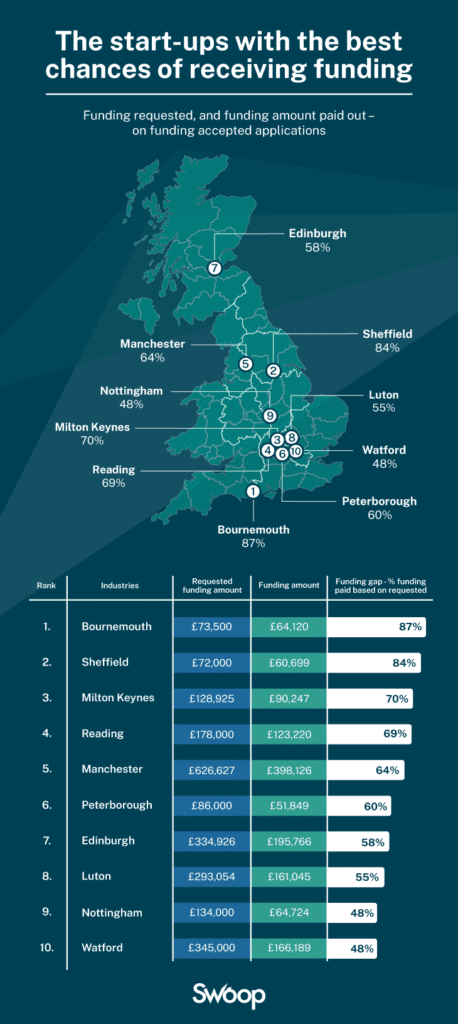

Which cities have the highest funding success?

As London’s total debt continues to grow, many cities away from the capital are starting to become hotspots for startup success, with a number of regional cities outpacing London in their growth of small businesses.

Bournemouth ranks as the city where startups are most likely to receive funding, with 87% of funding in the area paid out from requests that we monitored. Compared to an average requested amount of £73,500, businesses were typically awarded £64,120.

Sheffield follows closely behind with 84% of funding accepted, while Milton Keynes finishes third with 70%. Reading (69%) and Manchester (64%) round out the top five.

These smaller areas are likely applying for loans with more specific goals in mind or accessing regional funds that allow them to focus on a smaller target demographic. Perhaps this is why we’re noticing regional hotspots receiving more attention from startup lenders than London in 2025.

By comparison, London startups only receive 22% of their requested funding on average, ranking towards the lower end of our data. The major city with the least funding success is Liverpool, with just 4% of requests being fulfilled – compared to an average of £10,000,000 in requests, only £429,600 is typically granted.

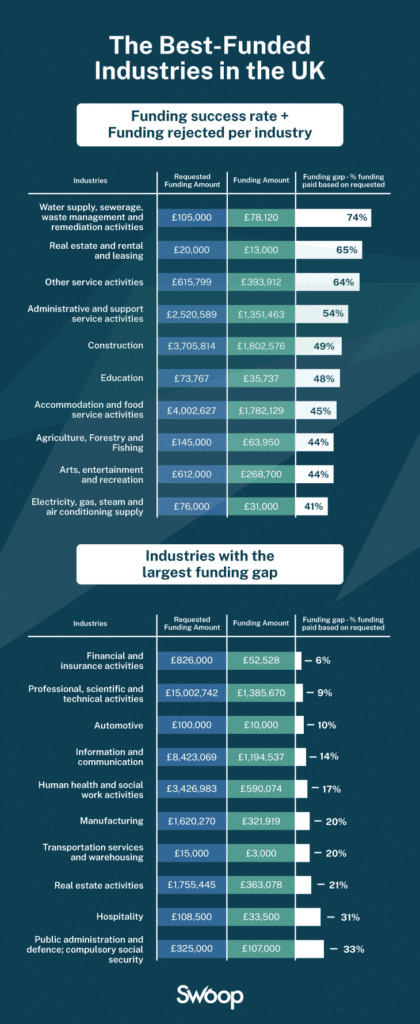

Which industries are most likely to get secure funding?

With some sectors seeing a greater demand for startup businesses than others, it’s clear that certain industries are more likely to secure funding from investors than areas with less demand or a greater risk of failure.

According to our data, water supply, sewage, and waste management businesses were the most likely to receive a large amount of their requested funding. With an average request in the field amounting to £105,000, investors typically granted £78,120 to startup leaders, resulting in a 74% success rate.

Real estate and rental services were the second-most successful field, with 65% of funding being secured (£13,000 granted on average compared to £20,000 requested), while administrative services ranked third with a 54% success rate, despite requiring more funding on average than higher-ranking industries (£2.5 million requested vs £1.3 million granted).

In terms of industries that struggled to receive secure funding, financial and insurance services were the most likely to receive just a fraction of their requested funds, with 6% being granted on average. This may be due to the large risk of failure with these businesses, and the knock-on effects of owing money to customers.

Science and automotive industries also both ranked towards the bottom of our findings (9% and 10%, respectively). The gaps in funding requested and granted in these sectors suggests that more specialist funds may be required to allow innovative projects to get a strong start.

These numbers may not only reflect the availability of funding in these sectors but also the financial acumen of their leaders. A strong knowledge of the economy and your business’ goals are more likely to earn you secure funding than merely relying on an interesting business idea, so be sure to prepare an in-depth plan when applying for financial assistance with your startup.

General tips for funding success

Each startup has its own unique identity, so understanding your goals and priorities when launching a business will help you secure funding that works for you. However, as a general rule of thumb, you can try following these pieces of advice to pitch confidently for the funds you want:

1. Be unique

Our data shows that oversaturation is a huge problem in today’s startup climate. If you’re looking for funding in an industry with too many competitors, or in a city with too much debt, you may face barriers to entry when it comes to launching your business.

If you’re able to focus on a region or demographic that may feel underrepresented by other startups, you’ll be less pressured to compete with other businesses in the field, letting you grow your startup at your own pace.

2. Understand how much you need to break into your field

As we mentioned earlier, some industries have a much more expensive barrier to entry than others. A field such as construction or science will require equipment that costs much more than a smaller industry, such as retail or hospitality. Understanding the scope of your investments before you apply for funding is important, as you want your lenders to feel as though you know the ins and outs of your business plan.

3. Consider your options

With such a wide range of business grants and business loans on offer, it’s important to find an option that suits your needs. By researching your lending options thoroughly, you can find providers who can cater to your goals, taking the hassle out of the funding process.

yet? Register here!

yet? Register here!