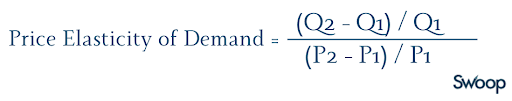

Here, P1 and Q1 represent the starting price and quantity, while P2 and Q2 represent the new price and quantity.

Interpreting your results

Once you input the values, the calculator provides the elasticity coefficient, which falls into one of the following categories:

- Perfectly elastic (∞): Any slight change in price results in an infinite change in quantity demanded.

- Elastic (>1): Demand is highly sensitive to price changes (luxury goods, non-essential items).

- Unitary elastic (=1): The percentage change in demand is equal to the percentage change in price.

- Inelastic (<1): Demand is relatively insensitive to price changes (necessities, fuel, medications).

- Perfectly Inelastic (0): Demand remains unchanged regardless of price changes.

Why is price elasticity important for businesses?

Price elasticity helps businesses make informed pricing decisions, balance revenue, and anticipate market trends. One of its key benefits is revenue optimization, as it allows you to determine the best pricing strategy to maximize profits for your business. By analyzing how price changes affect demand, you can adjust pricing to achieve higher sales or maintain profitability.

Price elasticity also provides a competitive edge, helping businesses assess how their pricing compares to competitors and how consumers may respond to different price points. This insight is especially important in industries where small price changes can shift market share. Plus, inventory planning becomes more effective when businesses can forecast demand fluctuations based on price changes, allowing them to manage stock levels efficiently and reduce waste or shortages.

Another major advantage is gaining consumer insights, and understanding how price-sensitive customers are within a particular market. If demand is highly elastic, businesses may need to be more cautious with price increases, while inelastic demand gives them more flexibility to adjust pricing without significant loss of customers.

Real-world examples of price elasticity

Price elasticity plays a role across different industries. In luxury markets, demand is often elastic; for example, a slight increase in the price of designer handbags may lead to a significant drop in sales as consumers turn to alternatives. On the other hand, essential goods, such as gasoline, typically have inelastic demand, despite price fluctuations, consumers still need to purchase them for daily use.

A middle ground exists with subscription services, which may exhibit unitary elasticity, meaning that a 10% price increase could result in a proportional 10% drop in subscribers.

Factors affecting price elasticity

Several factors influence whether a product is price-elastic or inelastic:

- Availability of substitutes: More alternatives make a product more elastic.

- Necessity vs. luxury: Essential items tend to have inelastic demand, while luxury goods are more elastic.

- Proportion of income spent: Expensive items relative to income are more elastic.

- Time horizon: Demand elasticity changes over time as consumers adjust spending habits.

Frequently asked questions

What does it mean if my product has an elasticity coefficient of 2.5?

This means demand is elastic, and consumers are highly responsive to price changes. A 1% price increase leads to a 2.5% decrease in quantity demanded.

How can I use price elasticity data to set prices?

If your product is elastic, reducing prices may boost sales volume and revenue. If inelastic, you can raise prices with minimal impact on demand.

Can elasticity change over time?

Yes, elasticity can shift due to economic conditions, competition, and evolving consumer preferences.

Try our price elasticity calculator today

Whether you’re a business owner, economist, or student, understanding price elasticity is essential for data-driven decision-making. Use our Price Elasticity of Demand Calculator to gain valuable insights and optimize your pricing strategies!

Disclaimer: This calculator is for informational purposes only. Please consult a financial expert for professional pricing recommendations.

yet? Register here!

yet? Register here!