Winners, losers and lessons learned from the 2008 crash

AUTHOR: Orlando Stirling

Economists are predicting a global recession by the end of 2022. With a recession comes uncertainty – and also, potentially, opportunity.

Can we learn from the past?

The 2008 crash was the last major financial event that affected countries worldwide. The UK economy shrank by more than six percent between the first quarter of 2008 and the second quarter of 2009 and took five years to recover to the size it was before the recession. The latest data show that despite COVID-19, the UK economy is now 11 percent bigger than it was before the recession.

While recessions cause hardship and business failure, they are also drivers of innovation and change. To survive, or even thrive, during a recession, businesses must make strategic decisions about how they will face the particular challenges affecting their industry and take advantage of new opportunities.

The 2008 recession winners

Three industries were able to use the 2008 recession as a springboard to success.

While discretionary spending went down, essential goods and services held relatively strong. Healthcare, for example, is considered by many to be a “must have” and did relatively well through the downturn. As Investopedia notes, however, not all healthcare companies are created equal: recessions are likely to damage those companies made vulnerable through having more debt and less income flow. Nevertheless, if your business is truly “essential” to your customers, you are in a strong position to survive recession.

Discount retailers have enjoyed particular success during a recession as consumers seek out either substitute ‘cheaper goods’ or buy fewer items.

Perhaps more surprisingly, food delivery services also thrive in recession. Like health care, people need food and can only cut spending on it to a certain extent.

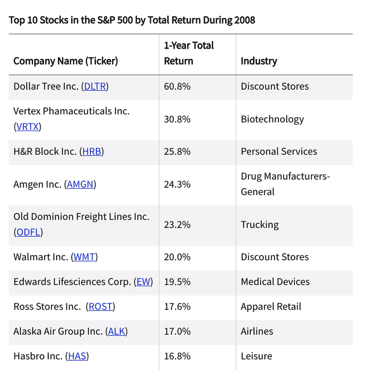

The S&P Top 10 Stocks for 2009 tell their own story (see table below). Besides discount stores like Poundland, several other companies that make or sell food also made the list, including packaged food company General Mills, and chains such as McDonald’s Corp. Moreover, Healthcare, food, consumer staples, and basic transportation are examples of relatively inelastic industries that can perform well in recessions. They may also benefit from being considered essential industries during a public health emergency like the pandemic.

Why do some industries do better in recessions than others?

As the 2008 global crisis showed, not every industry is untouchable. Manufactures are prone to being hit by recessions: as the Guardian reported, UK manufacturing suffered as banks scaled back lending to them during the 2008 recession. Car manufactures for example, like Jaguar, Land Rover and Honda laid off workers and ‘short-time working’ was introduced as the lack of finance available to consumers saw sales decrease by more than 30 percent at the height of the credit crunch. As a result, the manufacturing industry, which relied so heavily on loans, didn’t thrive immediately following the 2008 crash.

The crash also brought significant rates of unemployment which in 2008 reached 8.4 percent, its highest rate since 1995. As the economy shrank, employers were less able to afford staff and by the end of 2011, almost 2.7 million people were looking for work.

Travel and accommodation companies also struggle: when there’s less money to go around, non-essential travel budgets are cut. Hotels see a sharp decrease in the number of people checking in, sales flatten.

Consumers also take fewer vacations, or look for cheaper options. While this is bad news for airlines and hotels, through COVID-19 we have seen companies such as Zoom and Google have thrived – as have the industries around them.

Lessons to be learned

What can the 2008 recession tell us about tackling the coming downtown?

- Diversify your customer base

Who are your customers? If you are focusing on a demographic who are vulnerable to fluctuations in a recession situation, you may wish to reach out to customers who will be less affected – such as those in the industries that do well in recessions.

Remember, it is always easier to retain a customer than acquire a new one, so think now about how to win loyalty for when things get difficult.

If you rely heavily on just one or a small number of customers, make sure you understand their business and how they are being affected.

- Strengthen your operating systems

One of the key factors for businesses that survived the recession is that they had a strong operating system. With the supply chain issues becoming a major headache for businesses across industries, running an efficient operation is King. You do not want to be wasting resources, time or money.

Consider as well that you are part of a business ecosystem: you have businesses from home you buy and businesses to whom you sell. Networking with them and understanding their needs and issues may provide valuable intelligence for weathering the coming storm.

- Protect your cashflow

Cash flow is the most important thing about your business. Over 80 percent of businesses that fail cite cash flow issues as a reason for shutting up shop.

And in the 2008 crash, the majority of lending was done by banks and when they closed their books, businesses suffered. Today, there are literally hundreds more lenders in the market. With thousands of products, you are more likely to find a solution to a cash flow issue.

Swoop, which has full visibility of the market and can help you identify the products that are right for you and will accept your application, is an essential tool to any business navigating through a recession.

- Keep a good attitude

We can predict change, but we can’t predict the direction of change. The pandemic is a great example of a “Black Swan” event which changed the business landscape almost overnight.

Recessions are tough, but they do come to an end.

Business founders should remember that prior to the crash, the prime minister was confidently predicting “the end of boom and bust“, and for many, business could not be better. That all changed very suddenly.

Founders are optimistic by nature. They seek solutions, they find answers. Remember that in this recession – and the next one – there will be winners. And the winners will be those who change their course according to the prevailing wind.

What can my business do right now to protect cash flow?

There may be opportunities for you to switch to a better energy tariff, or other ways to protect cash flow – upload your energy bill to Swoop so our energy task force can check if there are savings to be made.

You should also ensure that you’re paying VAT at the correct rate. For some businesses, this is 5% rather than 20%. Check you are paying the correct amount as the difference this makes to your cash flow could be a game changer.

yet? Register here!

yet? Register here!