The UK economy has encountered a complex set of challenges in recent times. However, there are signs of cautious optimism on the horizon. The UK is now projected to see GDP growth of 1.6% in 2025—making it the third strongest performer among G7 nations*.

A range of factors have shaped the current economic climate, including the lingering impact of interest rate increases, global uncertainties, and the recent introduction of new tariffs by the US administration. These shifts continue to influence businesses and employees across the country.

In response, many businesses are turning to financing not out of necessity, but as a strategic choice—using debt to invest in growth, manage cash flow, and stay competitive in a changing environment. Far from being a sign of distress, taking on debt in this context can be a smart and forward-looking move.

To better understand how UK businesses are adapting, Swoop analysed internal data from 52,143 companies to assess the current state of business debt across the country.

Aiming to shed light on average debt per company, business age, leadership gender, industry sectors, and regional variations, we’ll examine where in the UK has the greatest level of business debt, as well as provide key insights into how to best utilise and manage debt to grow your business.

UK company debt: A deeper look

In order to get a full picture of the state of UK business debt, our analysis covered industries as expansive as the technology and food sectors, as well as more traditional areas such as mining and aerospace.

It revealed that the average debt per company stands at £365,375 – a figure that really underscores the heavy financial pressures many businesses are currently experiencing.

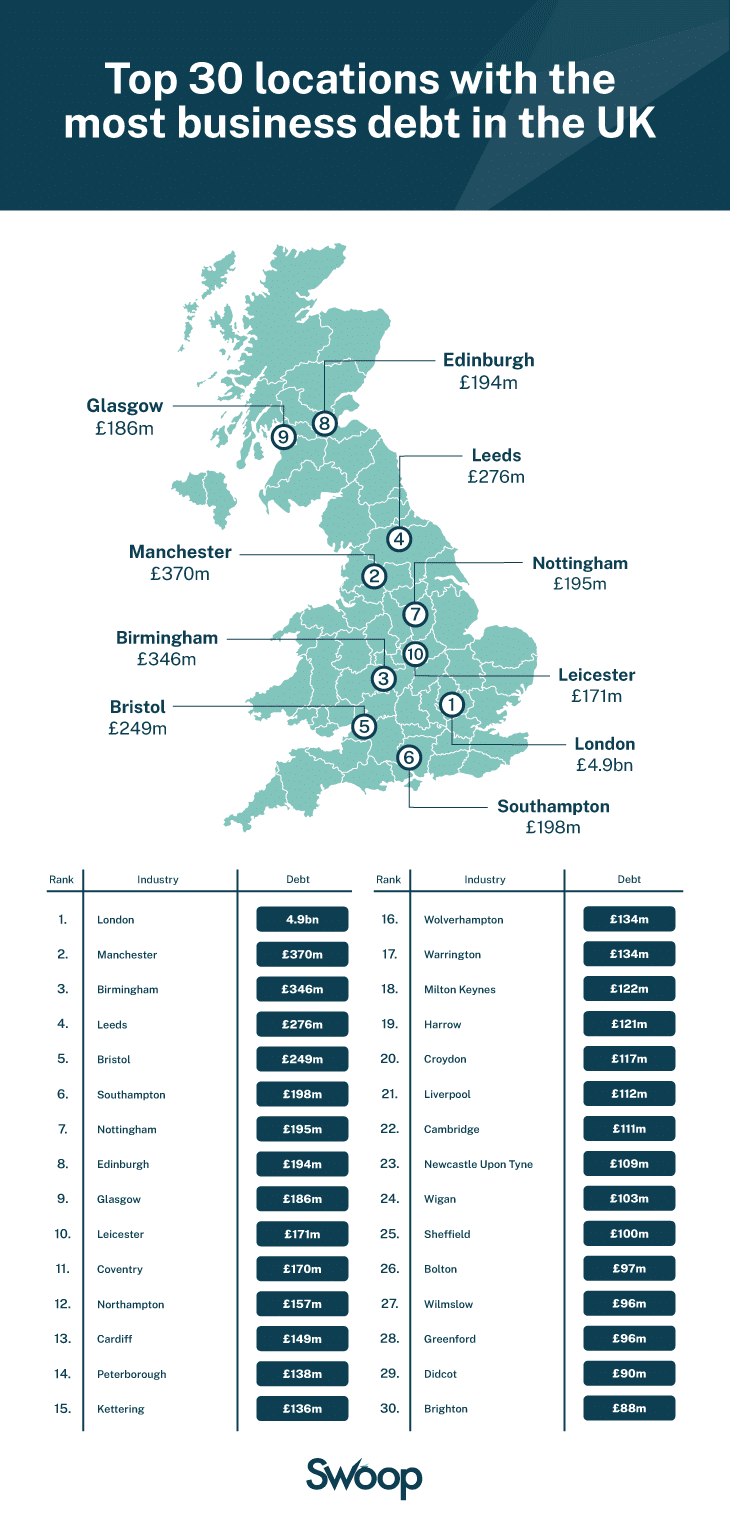

Specific geographical analysis shows that London businesses have, unsurprisingly, the highest amount of debt in the UK (£4.94 billion), followed by Manchester (£370 million) and Birmingham (£346 million), with Leeds (£276 million) and Bristol (£249 million) rounding out the top five.

Which UK industries carry the most debt?

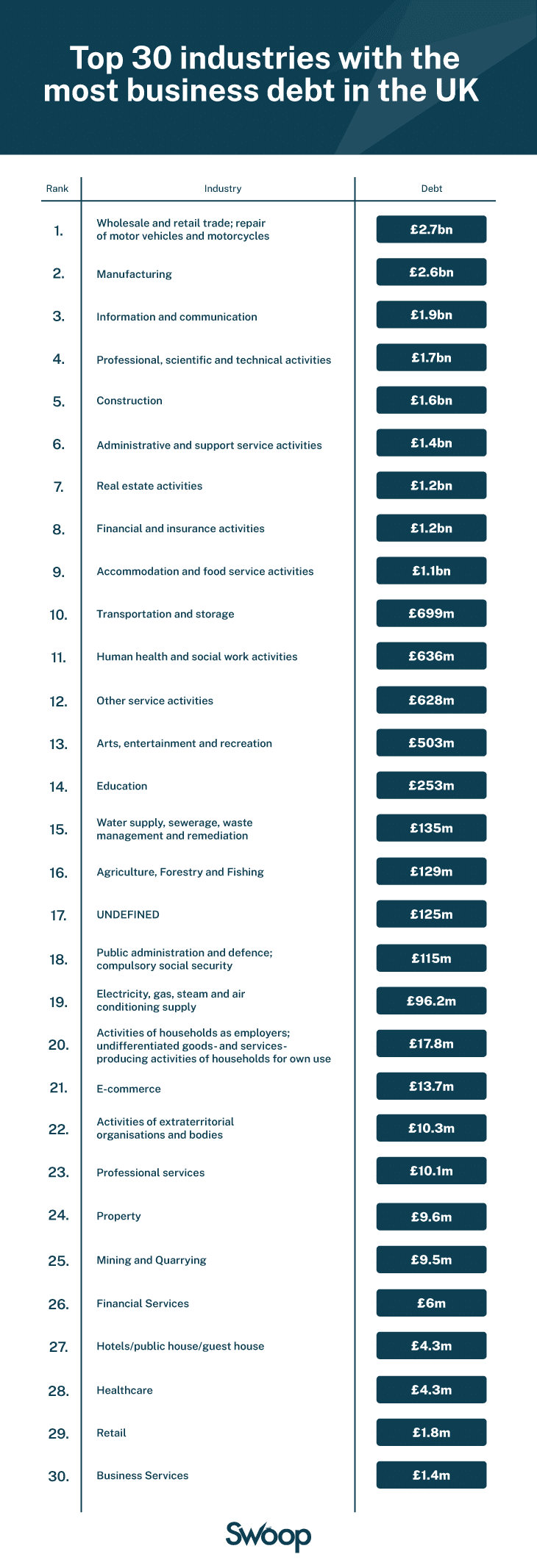

As you might expect, certain UK industries are shouldering more debt than others. The wholesale and retail trade is way ahead of the pack with a combined debt of over £2.7 billion, while the manufacturing trade sits at £2.6 billion behind, reflecting the capital-intensive nature of the industry.

There are also interesting patterns to be teased out between the size of debt and the age of the company. Are established firms taking on more debt than new businesses, or are startups struggling for cash?

Well, our research reveals a complex state of affairs. For example, businesses in their first five years have already amassed over £2.5 billion in debt, but by far the largest debt is held by those companies that are aged 21-25 years, with in excess of £1.5 billion.

The lowest debt? Businesses aged 46 to 50 years old.

Again, there are also wide regional differences among these. Unsurprisingly, startup-heavy London sits at the top, seeing young companies carrying £761 million in debt, while Tunbridge Wells is the location with the largest tally of old business debt – some £45 million.

This comparison further highlights that, while established businesses can carry significant levels of debt, newer enterprises are potentially amassing greater levels of debt at a faster rate.

Is gender a factor in business debt?

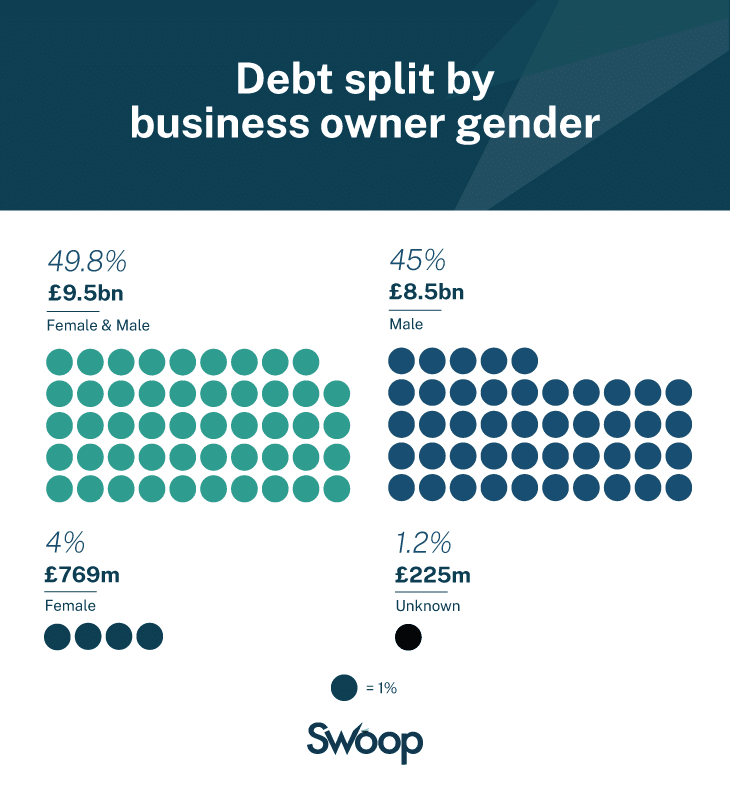

Examining the leadership of these businesses, we found that 45% of those surveyed were owned by men, compared to just 4% being owned by women, while 49.8% had joint male and female leaders.

But while the average debt of female-led businesses stood at £91,755, and the figure for those run by men stands at £315,246, it’s businesses with joint ownership that carry by far the most debt with an average of £698,502 – over double that of male-run businesses!

Tips for better-navigating business debt

Understanding the nuances of business debt is crucial in today’s economic climate, and our study illuminates the financial landscapes in which UK businesses are operating in. That’s why it’s essential for businesses to recognise that guidance and support are available to help manage and overcome challenging financial situations:

- Assess your financial position: Regularly review your financial statements to understand your debt levels and overall financial health.

- Prioritise clearing high-interest debt: Focus on paying off debts with the highest interest rates first to reduce overall financial burden.

- Explore refinancing options: Consider refinancing existing loans to secure better interest rates or more favourable terms. Our guide on how to refinance a business loan offers detailed insights.

- Seek professional advice: Engage with funding specialists to explore tailored solutions for your business. Our guide to small business loans provides valuable information.

- Develop a repayment plan: Create a structured plan to manage repayments, ensuring they align with your business’s cash flow and operational needs.

Navigating business debt can be daunting, but with informed strategies and the right support, it’s possible to manage and even leverage debt to foster growth. At Swoop, we’re committed to empowering businesses to make better and more informed financial decisions. Subscribe to the newsletter and join the 95,000+ businesses staying in the know.

Our methodology

52,143 businesses analysed from our database.

Average debt by city and business

We analysed the number of businesses in each city and the total debt within that city to determine the average business debt. This approach ensures a fair comparison, preventing cities with more businesses from appearing to have disproportionately higher debt levels.

Industry debt

This data reflects the total debt across various industries for all businesses using Swoop Funding.

Industry debt by city

We compiled this data into a table to allow for easy filtering. By sorting from high to low, you can identify the top industries with the highest debt in specific cities. For example, “These are the top five industries in debt in London.”

We also have data on industries and how much debt companies have between years founded.

Debt by gender

This data examines total debt by gender, considering the number of male- and female-owned businesses among Swoop Funding clients. Since we have more male-led businesses in the dataset, we calculated an adjusted average to ensure a fair and balanced comparison.

City data

This dataset includes:

- Average business debt per city

- Debt levels adjusted for the number of businesses

- Debt trends over time

- Age of business

Swoop requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

*UK to have third-strongest G7 growth in 2025, IMF forecasts

yet? Register here!

yet? Register here!