Climate change is the number one global issue, and governments across the world are reacting to the problem by introducing programmes that urge businesses and private citizens to reduce their carbon footprint. Lowering our energy consumption is a simple, but effective strategy to help achieve this goal. In the UK, the government is doing more than just asking businesses to be more energy efficient, they are aiming to deter business energy use with a tax called the Climate Change Levy. Most businesses will pay this tax, but there are some exemptions and rate reductions available. Read on to discover if your organisation qualifies for relief, and how to make your business less prone to pay this penalty.

What is the Climate Change Levy (CCL)?

The Climate Change Levy (CCL) is a tax designed to make UK businesses more sustainable. It aims to increase business energy efficiency and drive reductions in greenhouse gases.

In simple terms, the CCL deters commercial energy users from consuming energy that creates carbon emissions. The more energy-efficient your business is, and the less carbon-creating energy you use, the less CCL you pay. In theory, the CCL encourages businesses to consume less energy and to switch to on-site energy sources, such as commercial solar panels.

How is it charged?

The CCL is charged on energy used for heating, lighting, and power purposes, such as natural gas, electricity, petroleum, and coal. It is not charged on-road fuel for vehicles and other oils that are already subject to excise duty.

CCL is a two-rate tax – main rate and the carbon price support rate. The amount of CCL your business pays depends on how much energy you use – you are charged per kilowatt hour (KWh) for gas and electricity and per kilogram (kg) for other fuels, such as coal.

Businesses pay CCL at the Main Rate on:

- Electricity.

- Gas.

- Solid fuels like coal, lignite, coke, and petroleum coke.

The carbon price support rate (CPS) is paid by owners of electricity generating stations and operators of combined heat and power (CHP) stations. Businesses that generate some or all of their own energy (using solar, and wind turbines for example) and make money by selling excess power back to the grid, will usually be classed as small generators and are exempt from this charge.

CPS is charged on:

- Gas.

- LPG.

- Coal and other solid fossil fuels.

Who pays CCL?

You pay the main rate of CCL if your business operates in one of the following sectors:

- Industrial.

- Commercial.

- Agricultural.

- Public services.

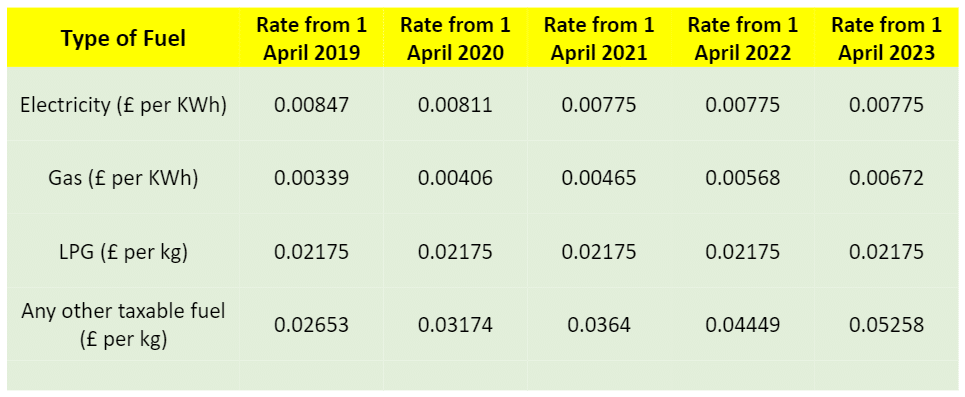

Climate Change Levy rates

CCL is charged at different rates for different types of fuel. Main Rates are:

Is VAT charged on the Climate Change Levy?

Yes. VAT is also charged on the CCL – effectively a tax on a tax – so the true rate of CCL that most businesses pay is typically 20% higher than the figures shown above.

Climate Change Levy exemptions

Some energy users are exempt from CCL. You do not have to pay the main rate if you are a:

- Business that uses small amounts of energy.

- Domestic energy user.

- Charity engaged in non-commercial activities.

Paying a reduced rate

You may get a reduction on the main rates of CCL if you’re an energy intensive business and have entered into a climate change agreement with the Environment Agency. Energy intensive businesses can get the following reductions:

- 92% reduction for electricity.

- 86% reduction for gas.

- 77% reduction for liquefied petroleum gas (LPG).

- 86% reduction for coal and other solid fossil fuels.

Check if your business is eligible. Your industry trade association may also be able to give advice.

Are charities exempt?

Yes, as long as their activities are non-commercial. This means they do not sell products or services to raise funds for their operations, but instead rely on gifts and donations.

When was the Climate Change Levy introduced?

The Climate Change Levy was first introduced in April 2001. In the years since it has gone through several updates and the levy rates have changed to reflect economic events and energy consumption levels.

How can I make my business more energy efficient

- Turn off all non-essential equipment when the business is closed

Even when not in use, ‘vampire’ machines and devices such as computers, printers, and copiers, continue to burn energy in ‘sleep mode’. Turn off everything you can at the end of the business day.

- Conduct an energy audit of your business

You can’t make savings if you don’t know what is using what or where the wastage is. An energy audit runs a fine-tooth comb over the business, revealing all the areas where savings can be made.

- Maintain steady heat and A/C

Don’t fiddle with the heating and A/C controls. Constant adjustment wastes energy and costs money. Set a comfortable temperature and let the thermostat to the rest.

- Switch from electric to gas for heating

Even with the cost of installation, it may work out cheaper in the long run to heat your premises with natural gas than higher priced electricity.

- Keep heating and cooling vents clear

Warm and cool air needs to circulate to be effective. Obstructing the air flow from vents with furniture or other obstacles will make your heating and A/C less efficient and consume more energy.

- Cool down for less

Air conditioning is costly to use, with the typical central A/C unit consuming 3500 watts per hour when running. Other cooling methods, such as desk and ceiling fans run for a tiny fraction of this energy cost. A/C systems also need clean air flow for best efficiency. Changing filters every six months can cut 5 to 15% off your air conditioning’s energy consumption.

- Reduce hot water use

It costs money to heat water. Consider ways to lower the hot water use in your place of business. This means everything from leaky hot water taps to over-filled kettles and unnecessary vehicle cleaning.

- Switch supplier

It may not reduce your business energy consumption, but it could lower the price you pay per unit. If you can switch supplier without incurring a penalty, shop around for the best quote available.

How can I make further savings on my business energy bill?

As the cost of doing business keeps rising, organisations must reduce their costs to stay competitive. Making savings starts with your energy bill. As well as finding out if you are exempt or if you can get a reduction of CCL, make sure you are paying the lowest rate of VAT, are on the best electricity and gas tariffs, and you’re claiming every refund and exemption you are entitled to.

Don’t miss out on savings. Get in touch with Swoop and speak to an energy expert, who’ll help you find the best tariffs, pay the lowest VAT, and keep your energy costs in check.

Swoop requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

- CCL: https://www.gov.uk/green-taxes-and-reliefs/climate-change-levy

- CCL rates: https://www.gov.uk/guidance/climate-change-levy-rates

- Energy intensive industries: https://www.sefe-energy.co.uk/blog/which-businesses-use-the-most-energy/#1

- Energy intensive user reductions: https://www.gov.uk/guidance/climate-change-agreements–2

yet? Register here!

yet? Register here!