TABLE OF CONTENTS

Know-it has teamed up with Swoop to help your business improve cash flow and get paid faster. A dedicated Funding Manager will help you find a tailored finance solution specific to your businesses needs.

If your annual turnover is a minimum of £30,000 and you get paid by invoice on 14-day terms or more, then yes, invoice financing could work for you. Key considerations for approval include:

Use our handy invoice finance calculator to get an understanding of how much you could release from invoices owed to you.

* Will be paid to you when your client has paid the invoice in full and within the agreed invoice term.

This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan.

Have your financial statements and invoice details ready.

Tell us about you and your business with our simple application.

If approved, you’ll receive a no-obligation, personalised quote.

Once you accept, we run some final checks to process your funding and deposit the money straight into your account.

Invoice discounting and invoice factoring have different cost structures. Invoice financing companies charge interest on the loan, plus an administration fee. Factoring agents charge something called the ‘factor rate’. This is a hybrid calculation, and it works out as a percentage of every invoice and a ‘time-charge’ that reflects the length of time that credit is extended. Because factoring agents take over the company’s sales ledger and assume responsibility for chasing customers for payment, their administration costs are higher than those for invoice financing. This means factoring usually costs more than invoice financing.

Invoice financing costs are straightforward. Borrowers are charged interest and credit management fees. Typical interest rates range from 1.5% to 3% over Bank of England base rate and are calculated daily. Credit management fees typically vary from 0.25% to 0.5% of turnover. Interest and fees are usually billed on a monthly cycle. There may also be other costs – such as an origination fee for processing the loan.

Invoice financing companies will consider risk when calculating the interest rate and their management fee. The credit-worthiness of your customers, the length of time they take to pay, and your business’ credit history are key parameters in this calculation.

Invoice factoring costs are called the factor rate. It is based on the level of risk and the volume of invoices. Factors like low risk, (your customers are unlikely to default on payment), and high volume, (the cash value of factored invoices is high).

Factor rates can vary from 0.5% to 5% of the invoice value. This is applied as a fee and for a set time – for example, 3% for the first 30 days of an advance against the invoice. The factor will also charge a further percentage if the advance is outstanding beyond this initial period – for example, 0.5% for every 10 days after the first 30 days. Some factors set a ‘flat rate’ that does not have an escalating charge rate. The cost is the same, even if the invoice takes more than 30 days for payment.

Invoice financing and invoice factoring have their unique pros and cons:

For businesses that need to boost their cashflow, invoice finance can be an ideal funding solution: no need for hard assets, no personal guarantees, get up to 95% of your invoice value as soon as you raise it, and eliminate months of waiting for customers to pay.

If you are seeking a flexible and scalable solution to your cashflow problems, and the higher costs associated with invoice finance are acceptable to you, invoice finance is worth considering.

Keep in mind that invoice finance is designed to defeat cash flow issues; it is not a replacement for revenue. While loans and overdrafts can give you a cash injection when business is slow, invoice finance relies on your business successfully winning sales and raising invoices. If you fail to secure new sales, invoice finance will not solve underlying problems. Low revenue is always low revenue. Invoice finance alone cannot get you through a ‘dry patch’.

Join the 110,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

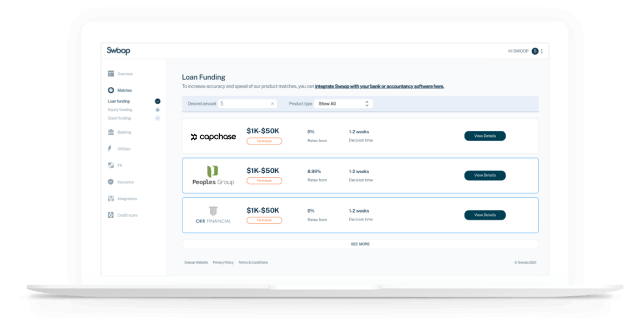

We work with world class partners to help us support businesses with finance

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google Maps

Swoop Finance Limited helps UK firms access business finance by working directly with businesses and their trusted advisors. We act as a credit broker, not a lender, and do not provide loans or finance products ourselves. We introduce applicants to a panel of lenders, equity funds, and grant agencies based on individual circumstances and creditworthiness.

Commission Disclosure: We typically receive a commission from the finance provider (either a fixed fee or a fixed percentage of the amount you receive) upon successful placement. Different providers pay different rates. For certain lenders, we may have influence over the interest rate, which can impact the total amount payable under your agreement.

Regulatory Information:

FCA: Authorised and regulated by the Financial Conduct Authority as a credit broker (FRN: 936513) and registered as an Account Information Services Provider (Ref: 833145).

ICO: Registered with the Information Commissioner’s Office (Ref: ZA600162); registration can be verified at ico.org.uk.

Company Details: Registered in England & Wales with Companies House (No. 11163382). Registered Address: The Stable Yard, Vicarage Road, Stony Stratford, Milton Keynes, MK11 1BN. VAT Number: 300080279.

Terms: All finance and quotes are subject to status, income, and terms and conditions. Applicants must be aged 18 or over. Guarantees and indemnities may be required. Please refer to our terms and conditions and our complaints procedure for further details.

Clever finance tips and the latest news

Delivered to your inbox monthly

Join the 110,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.

Thanks for requesting a call back

a member of the team will be in touch.