TABLE OF CONTENTS

Speed through to business loans and other lending options – get your business rolling with Swoop

Swoop is a credit broker and does not provide capital. We work with a range of companies to offer clear comparisons that allow customers to make choices on financial products & services. Swoop may receive a commission, which may vary by product but typically in the form of a fixed percentage of the loan amount. For certain lenders, we do have influence over the interest rate, and this can impact the amount you pay under the agreement.

No matter if you’re a sole trader, a startup, or an SME, it’s likely that at some point in your business’ life, you’ll need extra funds to power growth. Instead of seeking cash investors, fast and cost-effective business loans can be a better option. Acquisitions, debt reduction, solid working capital. Stop waiting on slow cashflow or investors to expand. Boost your company’s growth with a loan that’s purpose-built for business needs.

A business loan is a loan that companies make to fund their startup expenses or expansions. It is provided either by a bank or a lending firm. Like all loans, a business loan is required to be repaid within a certain frame and at a certain interest rate, as agreed by both parties.

Business loans Australia have a range of options available for small business owners which are as follows:

Business loans are financial tools that provide companies with access to capital for various purposes. Typically, businesses approach lenders such as banks or alternative lenders to secure funds. The loan process involves several steps: application, evaluation, approval, and disbursement.

When applying for a loan, businesses submit relevant documentation outlining their financial standing, including income statements, balance sheets, and cash flow forecasts. Lenders assess these documents to evaluate the borrower’s creditworthiness and risk profile. Factors such as the company’s revenue, profitability, industry trends, and collateral may influence the lender’s decision.

Once the loan is approved, the terms of the loan are finalised. Businesses are then required to comply with the terms, making payments on time, and to repay the loan over a specified period. Usually, these payments typically cover both the principal and interest.

Business loans can be used for various purposes, such as expanding your business, purchasing inventory or equipment, covering day-to-day expenses, or managing cash flow. The specific terms and conditions of the loan, including interest rates and repayment terms, may vary based on factors such as the borrower’s creditworthiness, the lender’s policies, and current market conditions.

When getting a business loan, you need to first work out how much money you need which can be determined by identifying what exactly you need the loan for.

Then, prepare a business plan outlining your financial situation and goals of your business. Most private lenders that offer traditional business loans don’t process loan applications if they don’t come with a detailed business plan.

You also need to decide whether you plan on securing your loan from a bank or an online lender.

The following are the documents you should prepare before proceeding with your application:

Other documents and identification may be requested further along the process.

To apply for a business loan in Australia, follow these steps:

Some loan applications can take days or weeks before approval, so it’s important to be patient. Remember, applying for numerous loans from different lenders could harm your credit rating.

When comparing business loans, it’s essential to consider several factors to make an informed decision. First, evaluate the interest rates offered by different lenders, as this will directly impact the cost of borrowing. Also, read the loan terms, including repayment periods and any exstra fees or penalties.

Consider the lender’s reputation and how they treat their customers. You want someone who’s reliable and easy to work with. When you’re applying for the loan, make sure the process is straightforward, quick, and they’re upfront about everything. Transparency is the key.

Additionally, make sure to carefully assess the all loan options available, considering not only the amount you need to borrow but also if the lender’s offering is the right kind of financing that fits your business needs. Also look at factors such as repayment terms, flexibility, and any additional perks or benefits provided.

By researching and comparing these things, you’ll be in a better position to find the best loan that fits your business’ financial needs and goals. Taking this careful approach will help you make better decisions and set your business up on solid financial ground.

A business loan calculator is a great starting point to understanding the cost of your loan. Use our free loan calculator below to work out your average monthly interest payments and the total monthly repayment amount, as well as the total interest paid and the total cost of the loan.

Your loan details

This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan.

Your results

Monthly payments

$0

Weekly payments

$0

Daily payments

$0

Avg. monthly interest

$0

Total interest

$0

Total cost of finance

$0

Borrow $Business loan interest rates are determined through a combination of factors that vary depending on the lender and your business situation. The lenders consider current market interest rates, the your creditworthiness, the purpose of the loan, the loan amount, and the repayment term. All these factors get combined to come up with a rate that works for both sides.

One common method used by lenders is to set interest rates based on a benchmark rate to which they add a margin. This margin reflects the lender’s assessment of the your credit risk and other factors. The total rate is then applied to the loan amount to figure out how much interest needs to be paid.

Additionally, the structure of the loan, including whether it’s fixed-rate or variable-rate, can affect how the interest rate is calculated. Fixed-rate loans have a constant interest rate throughout the loan period, giving borrowers a clear idea of what they’ll pay each time. On the other hand, variable-rate can change as the benchmark rate moves, making payments unpredictable.

Ultimately, the specific method used to calculate business loan interest rates can vary among lenders, and you should always carefully review and understand the terms and conditions of the loan before proceeding.

These are the aspects of your business that lets lenders determine whether or not to approve your loan request:

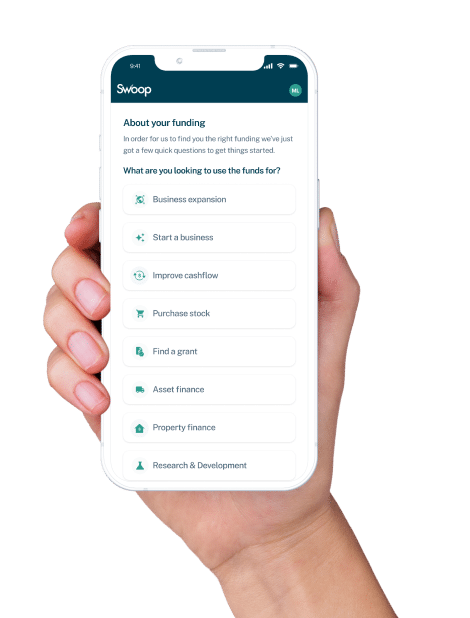

With Swoop, searching for the right funding for your business is straightforward and hassle-free. We sift through various funding products and lenders to find the right solution your business needs. Swoop helps to streamline the funding process so that you only apply to lenders suited to your financial position.

Using Swoop allows you to have your own virtual CFO.

Related pages

Ready to grow your business?

Join the 110,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google Maps

Disclaimer: Swoop Finance Pty Ltd (ABN 52 644 513 333) helps Australian firms access business finance, working directly with firms and their trusted advisors. We are a credit broker and do not provide finance products ourselves. All finance and quotes are subject to status and income. Applicants must be aged 18 and over and terms and conditions apply. Guarantees and Indemnities may be required. Swoop Finance Pty Ltd can introduce applicants to a number of providers based on the applicants’ circumstances and creditworthiness, we may receive a commission or finder’s fee for effecting such introductions. Swoop Finance Pty Ltd does not provide any kind of advice and in giving you information about providers products, we are not making any suggestion or recommendation to you about a particular product. Offers of finance are subject to a separate assessment process by the provider and subject to their terms and conditions. If you feel you have a complaint, please read our complaints section which is contained within our terms and conditions.

Clever finance tips and the latest news

Delivered to your inbox monthly

Join the 110,000+ businesses just like yours getting the Swoop newsletter. Free. No spam. Opt out whenever you like.