Get faster VAT refunds with InstantVAT

Start receiving your VAT refunds in as little as 24 hours. Signup takes less than 5 minutes and there are no changes to any business or accounting processes.

No card details, credit checks or personal/corporate guarantees required – just faster refunds.

Fast-track the HMRC queues

As VAT refund processing becomes slower and less reliable, InstantVAT offers a solution that helps avoid HMRC delays and stay focused on your business’ success. Fast track the HMRC queues and get your VAT refunds faster.

All VAT-registered businesses are eligible for this low-cost solution.

47+ days

Saved waiting for HMRC to pay your VAT refunds per year

2,000+

Businesses are actively receiving InstantVAT refunds

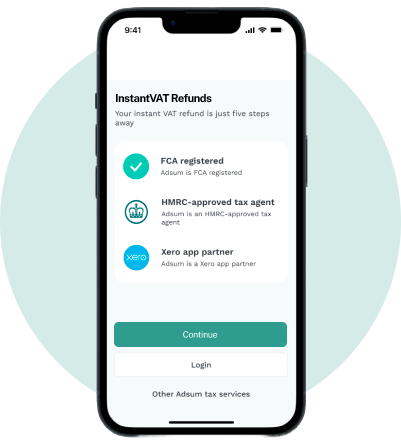

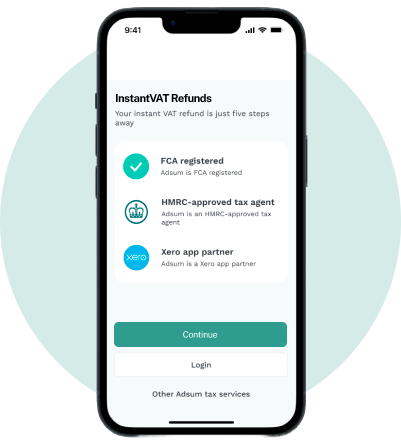

How InstantVAT works for UK businesses

Sign up

The initial setup is quick and easy. Just link your Government Gateway account and let us know where you want your InstantVAT paid to.

Submit your VAT return

You or your accountant submits your VAT return however you normally do. Your current business and accounting processes don’t need to change!

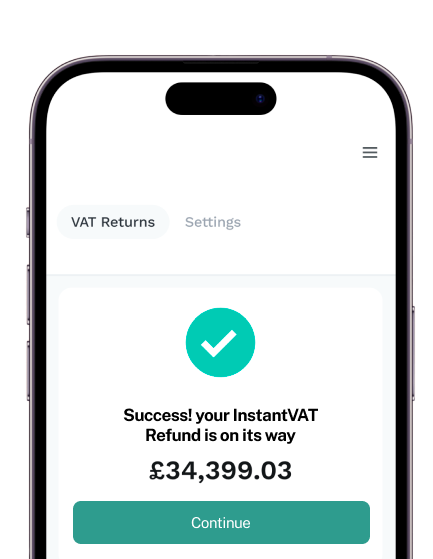

Get your VAT refund

You’ll now start receiving your VAT refunds in as little as 24 hours and always at least 3 business days faster than HMRC.

Get your refunds instantly once HMRC verifies your VAT return.

- Easy signup. Less than 5 minutes to set up

- Refund sent straight to your business bank account (minus fees)

- Simple to activate or deactivate at any time

- No changes to your business or accounting processes required

Testimonials

Instant VAT refunds are a game-changer. For a 2% commission it makes a lot of sense just to have certainty of cash flow. It’s very simple, very quick to set up, hardly any paperwork. And you get access to your VAT refund straight away. There must be thousands of startups that need this product.

Matthew Fleetham

Owner, Saunton Vineyard, Devon

Guesswork gone 🙂 Easy sign up, instant advice, feedback and support where required and most importantly the guesswork of when our VAT will hit our account now a thing of the past. Very happy to recommend.

Patrick Davin

CEO, MUTE

I have used the Instant VAT Refund service several times now, and I must say, it's an absolute game-changer. It’s ideal for those that receive frequent refunds from HMRC and need to maintain cash flow.

Oliver Rowlinson

Director, Vestonic Asset Management Limited

All VAT registered businesses are eligible for this low cost solution

InstantVAT Refunds are quick and easy to set up and don’t require you to change your existing VAT submission process. Best of all, this service is available to all VAT registered businesses.

FAQs

InstantVAT releases your VAT refund the moment HMRC verifies your return, so you get the cash in hours, not weeks. For over 85% of businesses HMRC verification is done within three working days, and you’re paid instantly after that. You keep your working capital moving whilst Adsum do the waiting.

No loans, credit checks, or paperwork, just a 2% (+ VAT) transaction fee automatically taken off the refund.

With InstantVAT, you file as usual. Then, the moment HMRC verifies your refund, the money lands in your account. Here’s the process:

- File your VAT return

You or your accountant submit it to HMRC exactly as you do today. - HMRC runs its verification checks

For most businesses this takes less than three working days*. - Get paid the moment HMRC verifies the return

You receive the refund instantly, minus the 2% transaction fee (+ VAT). No credit checks, guarantees, or extra paperwork. - HMRC later sends the refund to Adsum

Because the VAT repayment is redirected to Adsum, your balance is already settled - there’s nothing left for you to do or pay.

*Based on historical data, more than 85 % of refunds clear HMRC’s verification within three working days.

Before Adsum can make your InstantVAT payment, HMRC must verify the refund amount. HMRC runs the following quick checks:

- Quick automated checks: compares your refund against past filings and industry norms, screens for offsets/liabilities, and runs basic data consistency validations.

Deeper reviews (~10% of cases): random or flagged checks where HMRC may ask you for extra info, which can extend the timeline.

Traditional VAT refunds follow HMRC’s full payment process before you see any money, whereas InstantVAT gives you your cash as soon as HMRC verifies your return:

Standard VAT refund:

- HMRC verifies (1–5 working days)

- Checks for outstanding tax (1 day)

- Manual reviews in ~10 % of cases (adds ~30 days)

- BACS payout (3–5 working days)

InstantVAT refund:

- You get paid the moment HMRC marks your return “verified” (minus 2% fee)

- Adsum then does the waiting and collects from HMRC later.

A simple transaction fee of 2% (+ VAT) is deducted from your VAT refund, subject to a £5 minimum. No hidden charges, credit checks, or contracts.

- Minimum fee: £5

- Example: For a £5,000 refund, you’ll receive £4,940 instantly.

Any UK VAT-registered business - sole traders, partnerships, and limited companies alike - can sign up immediately. There are no credit checks, guarantees, or minimum turnover requirements.

Connecting your Government Gateway enables Adsum to:

- Track your submissions in real time: see exactly when HMRC verifies your return so you can be paid instantly.

- Automatically collect your refund: HMRC’s repayment is redirected to Adsum, so you never have to chase the funds or make separate payments.

- Ensure security and accuracy: Adsum only accesses verification statuses and payment instructions - your credentials are encrypted, never viewed by humans, and used solely to streamline your refund.

You can create your InstantVAT account anytime - 24/7 - whenever it suits you. A few things to note:

- Account setup is instant: you’ll have access to your dashboard as soon as you complete the account creation.

- HMRC checks run on working days: if you submit your first return outside UK business hours, HMRC’s verification won’t start until the next business day.

- Payment remains instant once verified: the moment HMRC verifies your refund, you get paid - regardless of the day, month or season.

Pro tip: finish your signup at least 24 hours before submitting a return so your Government Gateway can be fully linked to avoid any setup delays.

Want to get your InstantVAT refunds faster?

Join the 1000+ UK businesses taking advantage of instant VAT refunds today

We have a wide range offunding options

- Accounts receivable financing

- Aircraft financing

- Anytime Fitness

- Anytime business loans

- Apply for a business loan now

- Apply for a self assessment loan

- Asset finance

- Asset-based lending

- Audio visual equipment financing

- Bad credit business loan

- Bakery equipment financing

- Baskin-Robbins

- Black Friday and Christmas rush funding

- Boat financing

- Bobcat financing

- Burger King

- Business car finance

- Business finance brokers explained: how do they work and why should I use one?

- Business loan for marketing

- Business loans

- Business loans for software

- Business loans for women

- Business refinancing and debt consolidation

- Business restructuring

- Business van finance

- Capital allowances on hire purchase (HP): Things to be aware of

- Cash flow loans

- Century 21

- Challenge and opportunity: how to succeed in the 2025 commercial real estate market

- Chem-Dry franchise

- Cinnabon

- Cleaning equipment finance

- Comfort Keepers

- Commercial finance

- Commercial fleet finance

- Commercial fridge finance

- Construction invoice finance

- Convertible Loan

- Corporate finance

- Crane equipment finance

- Dental equipment financing

- Domino’s

- Dump truck financing

- EPOS system

- Ecommerce financing

- Embedded finance

- Equipment appraisals

- Equipment finance brokers

- Equipment finance insurance

- Equipment financing

- Equipment leasing

- Excavator financing

- F45

- Fastsigns

- Finance lease vs. operating lease – what’s the difference?

- Finance leasing explained – what is it?

- Flexible Loans

- Forklift financing

- Franchise finance

- Garage equipment finance

- Getting off to a good start: the Swoop guide to pre-revenue funding

- Green finance

- Gym equipment finance

- Heavy equipment finance

- Heavy equipment leasing

- Home Instead

- How to get a franchise loan

- How to get a startup loan

- Industrial equipment finance

- Innovate UK loans: Funding innovation for British businesses

- Intangible asset finance

- Invoice discounting

- Invoice factoring

- Invoice factoring vs. invoice discounting: What’s the difference?

- Invoice finance

- Islamic business finance

- Jan-Pro

- KFC

- Kumon franchise

- Large business loans

- Limited company loans

- Loan Platform

- Management buyouts

- Manufacturing equipment financing

- Material handling equipment financing

- McDonald’s

- Medical equipment finance

- Medical equipment leasing

- Merchant cash advance

- Mezzanine finance

- Micro Loans

- Middle market loans

- Minuteman Press

- No collateral business loans

- No credit check business loans

- Non-bank business loans

- Novus Glass

- Online business valuation calculator

- Operating leases explained: What are they? How do they work?

- Papa John’s

- Paris baguette

- Payroll loans

- Pirtek

- Pizza Hut

- Plant machinery finance

- Popeyes franchise

- Project finance

- Quick business loans

- Re/Max

- Recruitment invoice finance

- Restaurant equipment leasing

- Revenue based financing

- Revolving credit facility

- SME business loans

- SaaS finance

- Secured business loans

- Secured vs. unsecured business loans – what’s the difference?

- Self-employed business loans

- Seller financing

- Short-term business loans

- Should I avoid business loans that require personal guarantees?

- Signal

- Signarama

- Small business loans

- Snap-on Tools

- Soft asset finance: What you need to know

- Solar equipment financing for businesses

- Startup equipment finance

- Startup loans

- Structured finance

- Supercar finance

- Supply chain finance

- Technology equipment financing

- Term loans

- Tractor financing

- Tractor trailer financing

- Trade finance

- Transworld Business Advisors

- UPS store

- Unsecured business loans

- VAT loans

- VAT loans (Advisor page)

- Vending machine financing

- Visiting Angels

- Wendy’s

- What documents do you need for your funding application? A business owner’s guide

- What does working capital requirement measure?

- Wingstop

- Working capital loans

- £100,000 or less business loan

- £1million business loans

- £250,000 business loan

yet? Register here!

yet? Register here!