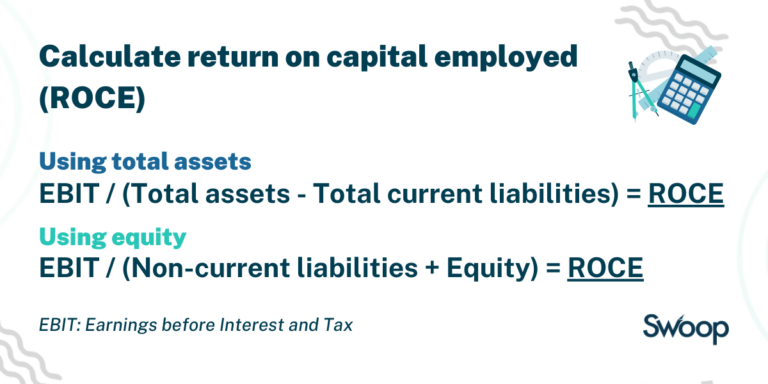

Return on capital employed calculator

To calculate the Return on Capital Employed (ROCE), you’ll need two pieces of information: the operating profit and the capital employed.

Page written by Ian Hawkins. Last reviewed on May 14, 2025. Next review due April 6, 2027.

Ian Hawkins

Head of Content

Ian Hawkins is Head of Content at Swoop. As a freelance business journalist and filmmaker he has reported from Europe, Central and North America and Africa. His films and writing have appeared on BBC World, Reuters and CBS, and he has spoken at conferences on both sides of the Atlantic on subjects including data, cyber security, and entrepreneurialism.

Read this article to me

yet? Register here!

yet? Register here!