TABLE OF CONTENTS

Loans

Equity

Grants

Page written by Ashlyn Brooks. Last reviewed on February 26, 2026. Next review due October 1, 2027.

It’s hard enough securing funding when you have amazing credit. Having a low credit score can make financing a challenge, especially for small businesses. However, it doesn’t have to stop you from getting the working capital you need to keep your business running smoothly. Whether you’re looking to cover day-to-day expenses or fund growth opportunities, there are financing options available, even if your credit isn’t perfect.

Let’s break down what bad credit means, your options for getting a working capital loan, and how Swoop can help.

Anything below 600 could use some attention. But this depends on your financial history as a whole. Bad credit is generally comprised of both a low credit score or a history of missed payments, defaults, or other financial issues that signal risk to lenders. Here are a few financial issues that can contribute:

Keep in mind that for small to mid-sized businesses, credit scores are often a reflection of both the owner’s personal credit and the company’s financial performance. While these issues can make borrowing more difficult, many lenders offer specialized products for businesses in this situation.

Yes, it’s still possible to get a working capital loan with bad credit, but you may have to put in more effort and be flexible on the terms. Many lenders focus on other factors, including your business’s revenue, cash flow, or collateral, rather than solely relying on your credit score.

Let’s discuss some of your options if you do have less than prime credit. Bear in mind that while these options are accessible to businesses with bad credit, they often come with higher interest rates or fees. It’s essential to compare terms and understand the total cost before committing.

You can apply for these loans in the same way you would for a traditional loan. The main goal is to demonstrate your business’s ability to repay despite past financial challenges. Here’s what you’ll need:

No, secured loans aren’t your only option, but they often hold a lower barrier to entry for businesses with bad credit. A secured loan requires collateral, which reduces the lender’s risk and increases your chances of approval.

Let’s look at some common options for you to consider if secured loans aren’t your top choice.

Changes in working capital can directly impact your cash flow and operations. A negative shift( such as an increase in accounts receivable or inventory) can reduce liquidity. But a positive shift can provide the cash needed for day-to-day expenses. Monitoring and managing these changes ensures your business remains stable, even during periods of financial strain.

Let’s look at an example. Take Company A, a small retail business preparing for the holiday season. To meet expected demand, the company significantly increases its inventory, tying up a large portion of its cash in unsold goods. This negative shift in working capital reduces liquidity, making it harder for Company A to pay its suppliers or cover operational expenses.

Now, consider the opposite scenario. After the holiday season, Company A quickly sells through its inventory and collects payments from customers, leading to an increase in cash on hand and a positive shift in working capital. This improved liquidity allows the business to meet its short-term obligations more easily and even consider reinvesting in growth opportunities.

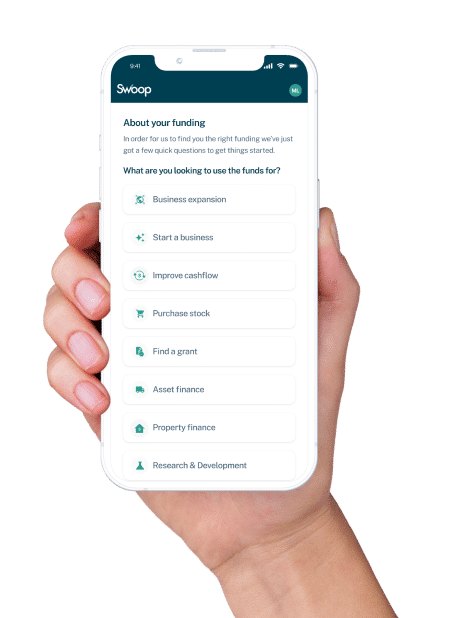

At Swoop we specialize in helping small to medium-sized business owners secure the funding they need to establish or grow their business. Our lenders specialize in looking at applicants holistically, including considering credit scores and past credit usage.

That being said, we’re experienced in helping businesses from all walks of the credit track and are here to present all of the funding options available to you, including business loans, business grants, and more.

Register today to take the next step in your business journey.

Written by

Ashlyn is a personal finance writer with experience in business and consumer taxes, retirement, and financial services to name a few. She has been published in USA Today, Kiplinger and Investopedia.

Swoop promise

At Swoop we want to make it easy for SMEs to understand the sometimes overwhelming world of business finance and insurance. Our goal is simple – to distill complex topics, unravel jargon, offer transparent and impartial information, and empower businesses to make smart financial decisions with confidence.

Find out more about Swoop’s editorial principles by reading our editorial policy.

Related pages

Get your free Bad credit working capital loans quote today

Join the 110,000+ businesses just like yours getting the Swoop newsletter.

Free. No spam. Opt out whenever you like.

Kingfisher Way, Silverlink Business Park, Newcastle upon Tyne, NE28 9NX, UK

View in Google MapsAberystwyth Innovation and Enterprise Campus

Gogerddan Campus

Aberystwyth University

Ceredigion

SY23 3EE

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin, Ireland

View in Google MapsSuite 801, Level 8, 84 Pitt Street, Sydney, NSW 2000, Australia

View in Google Maps43 W 23rd St, New York, NY 10010, United States

View in Google Maps21 Dreyer Street, Cape Town, South Africa, 7708

View in Google Maps

Disclaimer: Swoop Funding LLC (“Swoop”) is a financial technology platform and commercial finance broker, not a lender. Swoop does not provide loans or make credit decisions. We match US-based firms with third-party lenders, equity funds, and grant agencies. All financing is subject to lender credit approval and the specific terms and conditions of the funding provider.

Broker Compensation Disclosure: Swoop provides its platform and matching services to applicants at no direct cost. We receive compensation in the form of a commission or referral fee from the finance providers in our network upon successful placement. This compensation may vary by provider and product. In certain instances, the commission paid to Swoop may influence the interest rate or terms offered by the lender, which can affect the total amount payable under your agreement.

Credit Authorization & FCRA Notice: By submitting an application or registering an account, you provide “written instructions” to Swoop under the Fair Credit Reporting Act (FCRA) to obtain your personal and/or business credit profile from consumer reporting agencies. This information is used solely to evaluate your eligibility for financing and to match you with appropriate lenders in our network.

State-Specific Disclosures:

Florida & Utah: Swoop complies with state commercial financing disclosure laws regarding the transparency of terms for non-real estate secured commercial transactions.

Entity Information: Swoop Funding LLC is a Delaware limited liability company. US Headquarters: 43 W 23rd St, New York, NY 10010, United States. Contact: hello@swoopfunding.com

General Terms: Applicants must be 18 years of age or older. All firms must be registered and operating within the United States. SBA loans are issued by private lenders and guaranteed by the U.S. Small Business Administration; Swoop is not a government agency. Please review our Terms of Use and Privacy Policy for full details.

If you have a complaint, please refer to our Complaints Policy.