It’s been a rocky few years for small businesses, but there’s a flicker of hope on the horizon. At the start of 2025, the UK economy recorded growth of 0.7% – the fastest among the G7 nations. After a period of sluggish progress and financial uncertainty, this cautious optimism

is welcome news for businesses up and down the country. However, while the broader

economic picture is improving, the reality on the ground for many small and medium-sized

businesses (SMEs) is more nuanced.

Navigating today’s lending landscape isn’t straightforward. Between evolving funding options, increased scrutiny from lenders, and rising competition, it’s clear that access to finance and working capital isn’t equal across the board. That’s why we here at Swoop Funding set out to understand exactly how small businesses are faring. Using internal data from over 114,000 businesses, we’ve taken a closer look at where funding is growing, who is getting it – and, crucially, who’s being left behind.

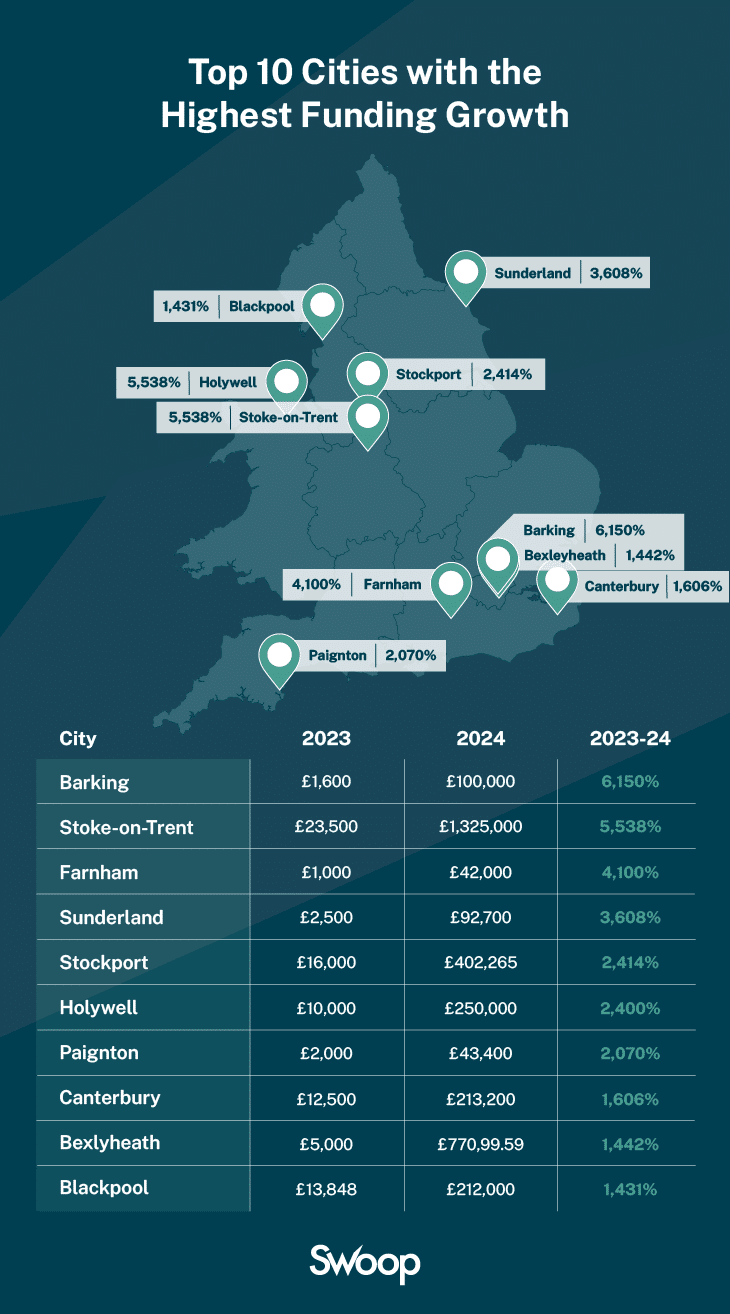

Where is successful funding growing the fastest?

You might expect funding hotspots to line up neatly with the UK’s major economic centres. But our data reveals a surprising trend: it’s the lesser-known locations that are seeing the biggest leaps in successful funding applications. Take Barking, for instance, which has seen a staggering 6,150% increase in successful funding, albeit from a low base. Following closely behind are:

- Stoke-on-Trent – 5,538%

- Farnham – 4,100%

- Sunderland – 3,608%

- Stockport – 2,414%

On the other hand, the more traditional business hubs have actually seen a reduction in investment:

- Manchester – -41%

- London – -31%

- Birmingham – -80%

These figures suggest that smaller cities and towns are beginning to attract more tailored funding opportunities or are better capitalising on local initiatives. While London and Manchester remain huge economic powerhouses, their drop in funding is perhaps signalling a shift towards decentralised support for small businesses.

Start-ups vs. established businesses: who’s getting funded?

When it comes to age, start-ups are soaking up the lion’s share of the capital. Businesses between 0-5 years old have received over £30m in funding – over twice as much than businesses aged 11-15 years (£12.4 million).

Meanwhile, as businesses get older, funding amounts taper off significantly:

- 11-15 years: £12.5 million

- 16-20 years: £4.1 million

- 26-30 years: £1 million

- 36-40 years: £0.6 million

This steep decline in funding with age isn’t necessarily a bad thing. Older businesses often have more established cash flow, stronger credit histories and existing relationships with lenders. But it does highlight how essential early-stage capital is – and just how vital funding is in those formative years for a new business.

Which industries are receiving the most funding?

A deep dive into sector data paints a clear picture of where investment is flowing – and where it’s lagging behind:

- Professional, scientific & technical services – £14.8 million

- Manufacturing – £7.9 million

- Wholesale & retail trade, vehicle repair – £7.5 million

- Administrative and support services – £6.5 million

- Construction – £5.8 million

- Real estate activities – £5.6 million

- Information and communication – £4.95 million

- Accommodation and food service – £4.7 million

- Human health and social work – £4.3 million

- Financial and insurance – £3.6 million

Professional, scientific and technical services are leading the way, with manufacturing and retail following behind – likely boosted by continued post-pandemic retail recovery and a concerted government push on infrastructure to help stimulate growth.

Meanwhile, traditional industries like transport and education – both outside the top 10 – trail behind. The numbers hint at a subtle shift in appetite, with service-based and digital-first businesses increasingly in favour. These figures may shift in various ways due to the impact of tariffs from the U.S. over the coming years.

Where are businesses being rejected?

It’s not all success stories. Our data also shows where funding applications are falling flat – and the numbers are highest in the UK’s biggest cities.

- London – £97.8 million in rejected funding

- Manchester – £10.1 million

- Birmingham – £7.6 million

- Glasgow – £5.7 million

- Leeds – £4.6 million

- Cardiff – £4.5 million

These high rejection rates may reflect the sheer volume of applications in densely populated areas, but they also suggest a mismatch between the funding sought and what lenders are willing to offer. Businesses in these areas may need more support identifying the right type of finance – or strengthening their applications to improve their chances of approval.

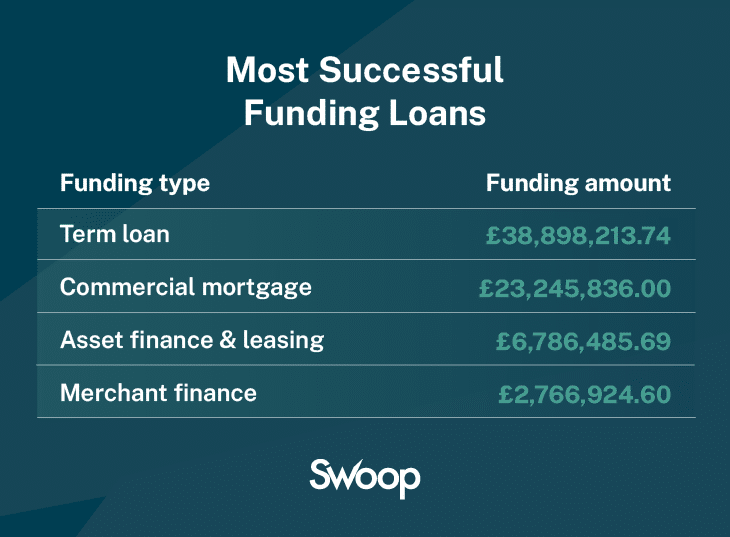

What types of funding are being accepted?

When we break it down by funding type, we see a few patterns emerging. Term loans and commercial mortgages dominate the market, accounting for some £62 million of accepted funding. It’s quite a dip down then to asset finance and leasing (£6.8m) and venture capital (£3.5m). Startup loans bring up the rear – with a mere £25,000 of funding given the thumbs up.

Delving into the best-funded sectors by region, London remains the funding frontrunner in many sectors, but other cities are punching above their weight in specific industries. Here’s how wholesale and retail funding breaks down:

- London – £1.3 million

- Preston – £0.28 million

- Holywell – £0.25 million

Whereas there’s a different picture in real estate activities:

- Wadebridge – £2 million

- London – £1.2 million

- Horsham – £0.5 million

While London leads, many other cities show strong momentum – Stoke-on-Trent in finance, Longhope in manufacturing, Solihull far ahead of the pack in accommodation and food service. This regional spread is encouraging and suggests a slow but steady levelling of the funding playing field.

These findings offer a valuable window into the real-world funding experiences of UK SMEs. While the economy is gaining strength, small businesses are still navigating uneven terrain when it comes to securing finance. That’s why understanding where the gaps are – and how to close them – is so important.

At Swoop, we believe that no business should miss out on funding due to a lack of guidance or support. Our platform is designed to connect businesses with the right funding for their specific needs, whether they’re just starting out or scaling up.

Five top tips to improve your funding journey

- Know what you’re asking for

Tailor your application to the right funding product. Term loans aren’t one-size-fits-all – explore alternatives like asset finance, invoice finance or equity if they suit your needs better. - Get application-ready

Lenders want to see a clear, confident business plan, realistic projections and a solid track record (however short) when considering financing. Need help? Our SME finance guide is a great starting point. - Strengthen your financial story

Good credit, tidy accounts and timely tax filings go a long way. For start-ups without trading history, personal credit may play a key role – so try to keep that squeaky clean too. - Be strategic with timing

Avoid applying during seasonal downturns or periods of cash flow strain. Instead, build up a track record and approach lenders when your books look strong. - Use a platform that does the hard work

Navigating lenders manually is tough – we get it. That’s why Swoop exists: to do the heavy lifting and bring tailored opportunities to your inbox.

Our methodology

The report is the result of a comprehensive internal analysis conducted by Swoop Funding. The data was taken from over 114,000 UK businesses.

Swoop requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

*UK to have third-strongest G7 growth in 2025, IMF forecasts

yet? Register here!

yet? Register here!