A sustainable and prosperous UK economy should mean that businesses thrive across the region – not just in a few cities. That’s why Swoop and the British Business Bank are on a mission to break down barriers to finance for the country’s SMEs. We want to make sure that access to funding is fair for everyone, regardless of gender, ethnicity, or where in the UK they’re located.

What are the Nations and Regions Investment Funds?

The Nations and Regions Investment Funds are a collective £1.6bn investment fund created to drive economic growth and local opportunities for new and growing businesses from across the UK. All sectors can benefit from the business loans and equity finance available, regardless of the economic conditions.

How has the £1.6bn been divided between regions?

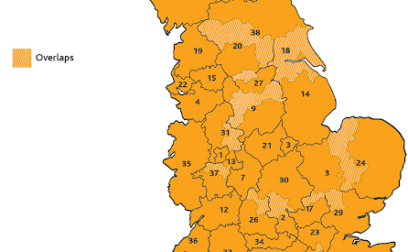

It was announced in the Spending Review 2021 the new £1.6bn pool of SME funding would divided into 6 regional funds, all with varying amounts –

- The Northern Powerhouse Investment Fund will receive £660 million and has expanded to cover the north east of England.

- The Midlands Engine Investment Fund has been allocated £400 million.

- A brand-new South West Investment Fund has been created with £200 million being set aside, building on the success of the Cornwall and Isles of Scilly Investment Fund.

- Scotland is getting a new Investment Fund worth £150 million.

- Wales has a dedicated Investment Fund worith £130 million.

- FInally, Northern Ireland will benefit from a £70 million Investment Fund.

The British Business Bank has the important job of administering these Nations and Regions Investment Funds on behalf of the UK government. The first step was to establish investment funds in areas that their existing regional funding program doesn’t cover. Once this work is completed, follow-on investment funds will be launched in existing areas.

How can my business get funding?

Swoop is excited to be part of this drive to boost growth across the country. As well as helping businesses access these investment funds, Swoop are the experts in all kinds of business funding: from grants to borrowing to equity; if you need capital, Swoop will leave no stone unturned finding the best deal for you.

Find out more about your local fund including details on how to apply or Register with Swoop to discover the full suite of funding options available to your business.

yet? Register here!

yet? Register here!